Key Points

- The Private Equity industry has seen explosive AUM growth over the last 10 years.

- Private Equity leaders have compounded client capital in strong & weak markets.

- Private markets are more rational than public markets and offer a smoother ride.

“We are fortunate to be able to deploy a significant amount of dry powder with asset prices more dislocated and while capital is quite scarce”. KKR Management on the November 1, 2022 quarterly earnings call.

The Alternative Asset Management Business Has Grown Rapidly

A key mega trend our team is excited about is the migration of assets to alternative asset managers. Within the asset management industry, the alternatives category is growing fast and with significant room to expand. The “smart money,” which includes foundations, endowments, pensions, sovereign wealth funds, and insurance companies, have been investing in private markets for decades and between 20-40% of their total portfolios are still invested in this category today. The high-net-worth and private wealth markets have been much slower to adopt the private markets, but meaningful asset growth has begun while still being only roughly 2-4% of a typical HNW portfolio. Although they should, I do not expect the retail market to begin allocating like the smartest institutions. However, from where we sit today, there is still meaningful growth ahead in this channel. A recent Evercore ISI report shows each incremental 1% allocation from the wealth management platforms would mean $100 billion of additional assets to alternative managers. That’s powerful stuff.

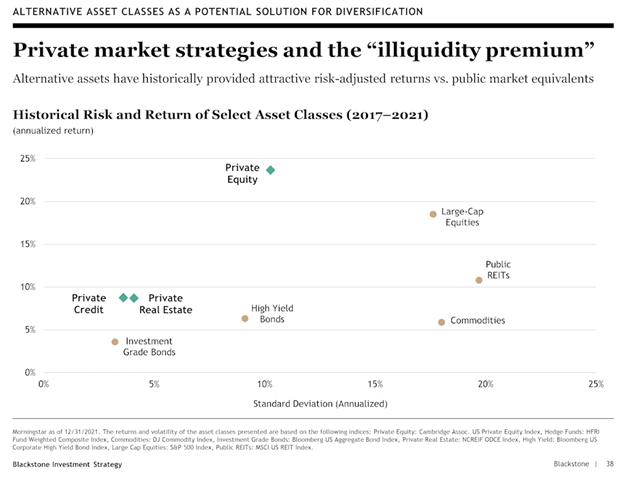

Total funds under management across private markets reached an all-time high of over $10 trillion. Remember, the global equity market is about $111 trillion and the global fixed income market is about $127 trillion. So, the private markets are still a fraction of what the public markets are (data source: sifma.org). The trend is very clear, institutions have continued to increase allocations to private markets at the expense of public markets. Overall, the performance has been better, even with higher fees, the investment strategies are differentiated, and the ride is generally smoother. Here’s a chart from the largest PE firm, Blackstone, that I think will resonate with you. It shows various public and private asset class returns and volatility since 2017 when the Blackstone products were created for the HNW market. Winners are located in the northwest quadrant:

If you have any investments in Blackstone or KKR’s wealth management strategies, you’ve slept a lot better when comparing the daily volatility of equity and bond markets to private markets. The harsh reality is that the public markets have become more of a casino than they ever have. Algo’s and dark pools drive daily volume and short-termism. In addition, “trading” has become rampant. Private investors have the luxury of longer duration, far less volatility in business valuations, the confidence to average down when their investments have been marked lower, and a loathing for panic selling at bargain prices. That’s why private markets have become so important in a portfolio today.

Alternative Asset Managers Have Compounded Capital Strongly

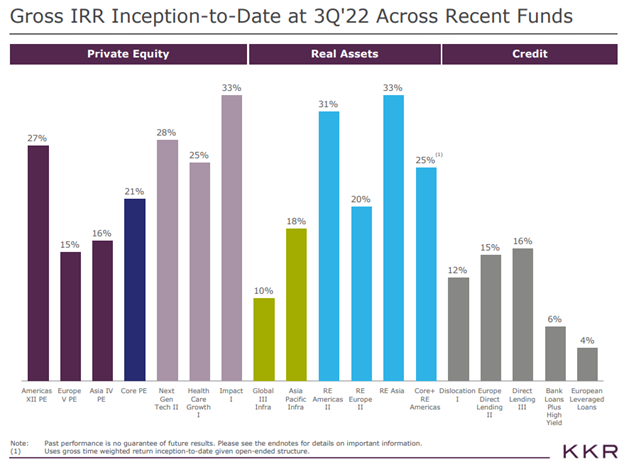

Over the past 20 years, the Yale University Endowment has generated the top total return across all endowments tracked by Pensions & Investments. How did they do it? Smart asset allocation decisions, strong manager selection, and by avoiding short-termism. A key reason for the outperformance is the active decision to lessen their dependence on public securities in favor of adding a significant allocation to private securities. The chart below is a taste of what smart allocators in private markets have offered investors. This slide comes from KKR’s November 1, 2022 earnings presentation.

The best private equity firms simply have an information advantage and they see around corners because they own hundreds of companies and collect real-time data. They have a global opportunity set, the smartest professionals in the industry, and access to large amounts of capital to deploy at opportunistic times. Private Equity stocks are on sale today and the opportunities have never been more robust.

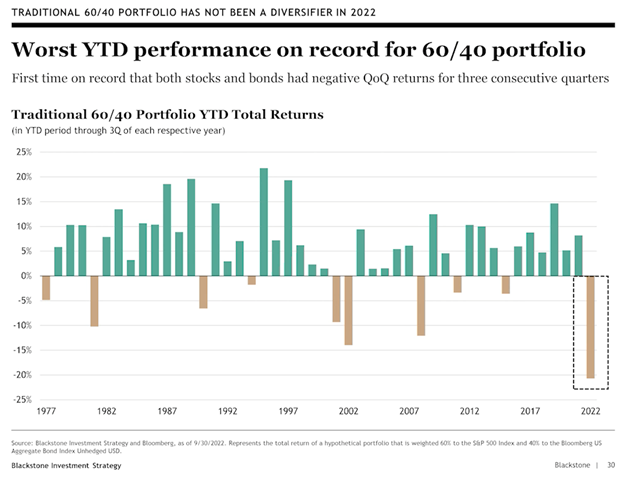

2022 has been a difficult year for public equities and fixed income. The 60/40 portfolio has never had such poor returns. Rates are normalizing after being manipulated by the Federal Reserve for over a decade. The demand for the services these Private Equity firms offer will only go higher.

To illustrate this more clearly, let’s connect a few dots.

- Do you think institutional money and retail investors will want more or less exposure to private market strategies that are holding up meaningfully better in a very tough year? More is the correct answer.

- With inflation set to stay elevated for longer and interest rates normalizing with a much higher cost of capital, do you think it gets harder or easier to generate attractive returns? Harder is the right answer. Remember, these PE firms saw this inflation three years ago and they positioned portfolio’s well in advance of rising prices.

- When the economy slows and markets act irrationally and drive asset values lower, do you think having significant capital ready to deploy at better prices ends with a positive outcome once the dust settles? Yes, is the correct answer.

FYI: Blackstone has $182 billion of dry powder waiting to be deployed. KKR has $113 billion.

Private Markets are More Rational than Public Markets

I’ll go out on a limb and say that sleeping soundly at night, particularly when markets are in turmoil, is something people can appreciate.

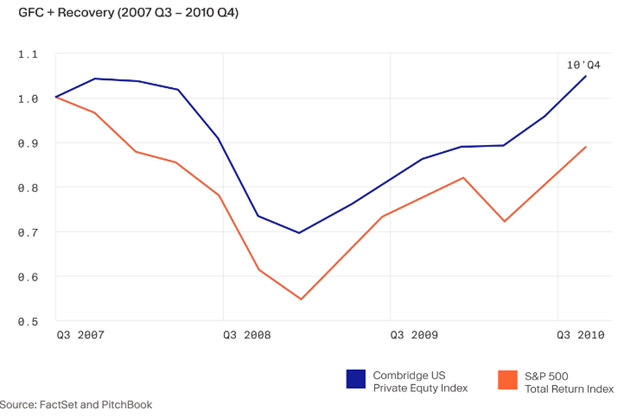

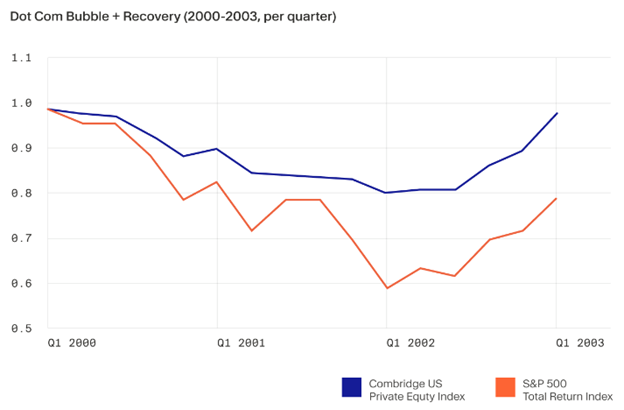

When we see the public markets gyrate with massive swings in both directions, one can only assume the second-by-second prices we see on screens are not always realistic. There are margin calls, forced selling for personal reasons, algo-driven parabolic moves, and mind-bending drawdowns. Actual businesses and their “values” simply do not fluctuate like the public markets indicate. To illustrate this, let’s see how Private Equity performed from peak 2007 into the Financial Crisis, how it recovered into 2011, and through the dotcom bubble and subsequent recovery. PE performed much better than their public market peers because they were not forced to sell, and they got more aggressive with buying assets at distressed prices. Sometimes, not seeing your assets priced every day is a very good idea. It is important to note that the stocks of PE firms struggle mightily because they are stocks in a stock market meltdown. However, their actual businesses & the opportunities they eventually capture generate significant forward returns. That’s what I expect for stocks going forward.

To quote a smart hedge fund manager I know, “the best alternative asset managers plant more seeds when things are scary and harvest more crops when things look great.”

Private Markets are More Rational than Public Markets

I know of no other flywheel that’s more robust or that holds better compounding opportunities than the Private Equity and Real Assets model. I’m not sure where markets will bottom, but I am quite confident in the ability of Blackstone and KKR to drive meaningful shareholder value in the future. Here’s the flywheel in a nutshell:

- Top Private Equity firms employ the smartest investors in the world.

- That offers these firms a major competitive advantage.

- Which drives strong asset flows into the firm.

- More assets drive more investments.

- More investments drive more fee revenue and incentive fee revenue.

- These firms have a history of strong returns for clients.

- This drives even more new assets to the firm.

- More assets drive more fee’s which leads to investors working with fewer firms.

- More money going to fewer PE firms drives a widening competitive advantage.

- Happier customers drive deeper relationships which drives even more asset flows.

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

The Chipotle hypothetical cost averaging example highlights the potential power of holding core positions in industry leading brands and being committed to adding to these positions when the market acts irrationally. Cost averaging leading companies can add significant value to your long-term portfolio even if you do not catch the absolute bottom in the stock. Details on this hypothetical are below.