One of the ultimate strategies for a concentrated position is the zero-cost collar. The scenario presents itself when an investor has a large position, typically due to a job at a publicly traded company that pays a portion of compensation in stock. Over time, the stock becomes a significant component of net worth that may be difficult to exit due to significant tax consequences among other potential issues. The real problem lies in the risk to the downside of this single position. A negative event can result in a spiral down for both the stock and the investor’s net worth, unraveling years of hard work.

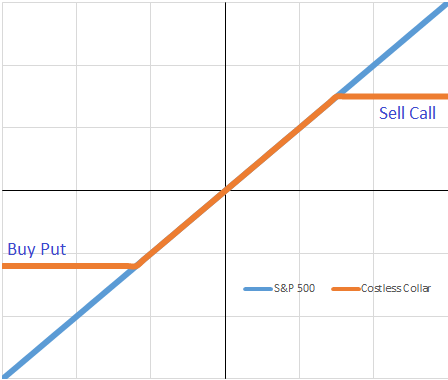

While there are a number of approaches to diversify around the position and look to mitigate the effect of a concentrated position, one of the best tools is the costless collar, also known as a zero-cost collar. A costless collar is an options strategy that “collars” the stock through the purchase of a Put below the current market value of the stock while selling a Call above the current market value. The Put serves as tail-risk insurance for the underlying security as it provides the right to the owner to sell the security at the agreed upon “strike” price of the contract. The investor is protected from a major negative scenario where the stock takes a material hit in value due to this Put. Like all insurance, a premium must be paid and a Put is no different. That is where the Call comes in. The investor can collect the premium necessary for the Put by selling the Call. While the Call allows the Collar to be “costless” the Call itself comes at the cost of the stock getting “called” away given a decent move to the upside. The risk of losing the premium on the Put is traded for the risk of capping upside returns.

Example of a Costless Collar (AKA Zero-cost Collar)

Investor is protected by the put as illustrated by the parallel orange line on the left

in return for limiting upside illustrated by the parallel orange line on the right

Now there is an art to selecting how wide the collar should be set as well as how long the position should be held. Option markets provide a ton of flexibility at the cost of complexity (note the trend of there always being a trade-off in the markets. There are no free rides!). But prior to discussing the merits behind differing Collar widths and timing, it would be prudent to discuss one of the largest concentrated positions in the market.

The S&P 500 is up over 250% since the market bottomed in 2009. The US equity markets generally is one of the largest, if not the largest, position in most US based investor portfolios – and this has paid off nicely over the last 10 years. With a number of potential headwinds in the market (e.g., increasing yields due to Fed tightening policy and trade wars to name two), it may be prudent to place some level of a hedge within the equity portion of one’s portfolio. Within a larger taxable account, it may be most efficient to work directly with options given a strong knowledge of the product. Within qualified accounts and smaller taxable accounts it may be most efficient to use an existing strategy that utilizes either collars or alternative approaches to hedging out a portion of the downside.

There are two major decisions to be made when placing a costless collar:

- How narrow or wide the collar should be and;

- Over what duration should the collar be placed.

In deciding the width of the collar one should start with what level of protection makes sense. The smart aleck would state “full protection” which is why the next consideration is how much participation on the upside the investor is willing to sacrifice for their downside level of protection. Ultimately, it is important to remember that the whole reason for the collar is to protect on the downside and that is why it is the first consideration in the equation. What the investor can handle losing within the concentrated position without having to materially change lifestyle or retirement plans is a good place to start. A few years ago we conducted several advisory surveys and found the most attractive levels were for 10% – 15% protection down for around the same participation up over a year period.

Examples of Collar Widths for a Costless Collar

Duration plays a significant role as well. Options are term dated resulting in a need to roll the position if one wants to maintain a hedged exposure. The duration needs to be matched with the width of the collar. For example, attempting to set a collar 10% wide over a one month period would be difficult as the Puts necessary to purchase will most likely be significantly more expensive than the equivalent Calls which would result in having to sell Calls significantly lower. Additionally, given the low absolute value of the options, it would be more difficult to include the transaction costs into the pricing. So typically, when a shorter term collar, such as one month, is placed, the collar is much tighter around the current price. This in turn can lead to whipsaws – an event where the investor exits their position by exercising the put only to see the underlying security pop back up in value. Very long durations pose their own issues in terms of liquidity and again, how wide to set that collar given the time frame.

Generally, in single stock securities, the sweet spot from a pricing perspective will mostly be in the 3 – 9 month range with a 10% – 15% collar the typical range. Though inputs, such as how volatile the stock is as well as the investor’s risk appetite, should be taken into consideration when structuring the trade.

In regards hedging the market generally, the S&P 500 has one of the most active and liquid option markets in the world and is therefore a good candidate in placing a collar strategy. In a qualified account it may be prudent, especially given the complexity of options, both from a product standpoint as well as a portfolio implementation standpoint, to simply place a position into an existing managed collar strategy in the marketplace. Shorter term strategies will provide more protection from a significant one time drop in the market though will have more risk from whipsaws and will most likely leave more on the table in a strong up-trending market. Longer term strategies may actually provide more protection from a longer slumping market while also being able to capture a larger portion of market upside.

In summary, collars provide a defined, hedged exposure to the market. Given recent market gyrations, Fed tightening and potential trade wars, it may be prudent to consider hedging a portion of your market exposure.

The post Is It Time for a Costless Collar on the Market? appeared first on Exceed Investments.

The post Is It Time for a Costless Collar on the Market? appeared first on Catalyst Defined Outcome Blog.