Company Description

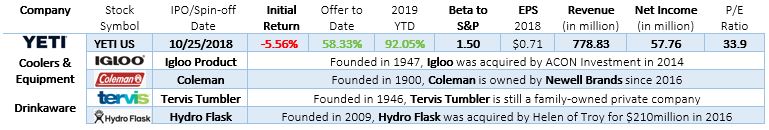

Founded in 2006 in Austin Texas, YETI is a private equity-backed outdoor equipment designer, marketer, retailer and distributor. The company offers coolers & equipment, drinkware along with other outdoor accessories. As of September 2019, Cortec Group still owns ca. 46.2% of YETI.

Business Model

YETI operates in the retail sector and generates revenue from sales. Coolers & Equipment and Drinkware are the two primary product categories that contribute to the net sales.

IPO History

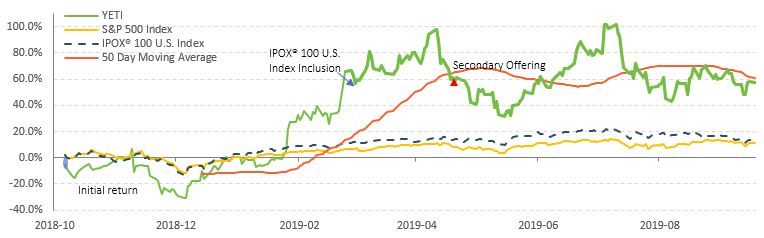

On 10/25/2018, YETI began trading on NYSE. BofA Merrill Lynch, Morgan Stanley and Jefferies were the lead book running managers for the deal. The share was priced at $18.0 per share, below the expected range of $19 to $21 per share. The company sold 16 million shares, 20% less than expected and with an additional 15% over-allotment option exercised in part, YETI was valued at approximately $1.5 billion at offer. Close to 85% of shares were offered by selling stockholders. The stock opened at $16.75/share and recovered to finish the first day at $17. YETI was included in the IPOX® 100 U.S. Portfolio on 03/15/2019 and currently weighs approximately 0.17% of the portfolio.

Historical Performance

Growth Outlook

Industry Comparison