Company Description

Twilio

Founded in 2008 and headquartered in San Francisco, Twilio develops and provides a cloud-based communication platform that enables developers to integrate voice, messaging and video capabilities into their software applications via Application Programming Interfaces (APIs).

Business Model

Twilio generates revenue from usage-based fees from customers using the software products that they have incorporated into their software applications. The company also earns monthly flat fees from certain fee-based products including telephone numbers and customer support.

IPO History

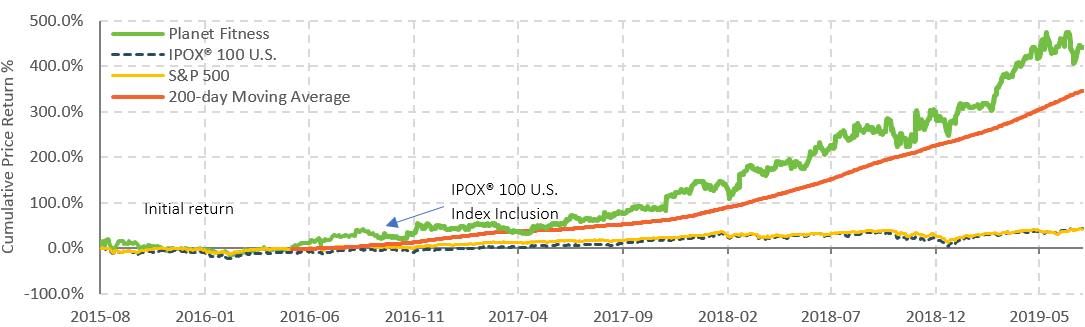

On 6/23/2016, Twilio began trading on NYSE led by Goldman Sachs and J.P. Morgan. The cloud communication company was priced at $15.00 per share, above the proposed range of $12.00 to $14.00/share. Twilio sold 10.0 million shares and with a 15% over-allotment option fully exercised, the company was valued at $1.23 billion at offer. The stock opened at $23.99/share, a 59.93% pop, and continued to climb to close the first day with a 91.93% initial return. Twilio was included in the IPOX® 100 U.S. Portfolio on 6/16/2017 and currently weighs approximately 1.23% of the portfolio. On 2/1/2019, Twilio acquired email API platform SendGrid (SEND US), another IPOX® 100 U.S. Portfolio holding in 2019

Historical Performance

Growth Outlook

Industry Comparison

[table id=11 /]