[vc_row][vc_column][td_block_text_with_title custom_title=”Company Description” tdc_css=””]

Match Group

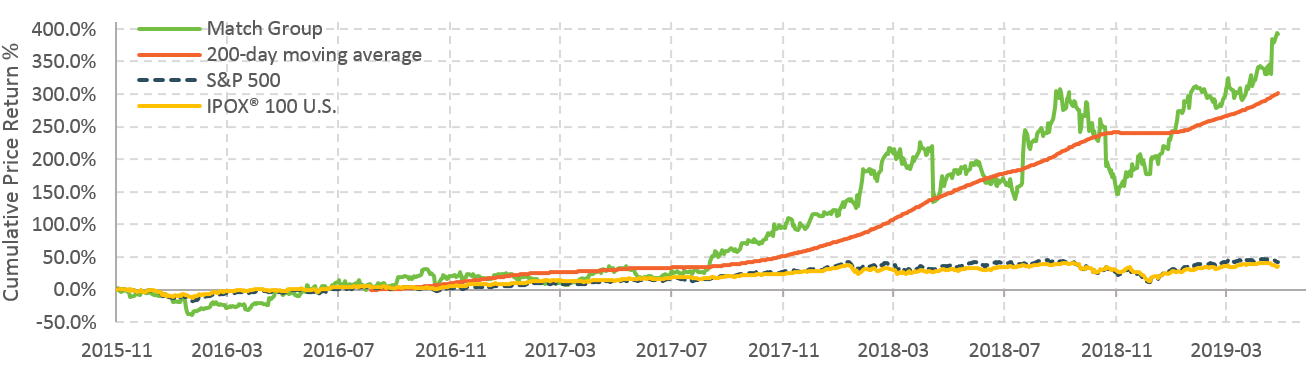

Incorporated in 2009, Dallas, Texas-based Match Group is a worldwide leading provider of dating products with a diverse portfolio of brands including Tinder, Match, and OkCupid. Match Group is a wholly owned subsidiary of IAC/InterActiveCorp. In addition to the dating business, Match Group once operated in the education service industry through its ownership of The Princeton Review. The Group sold Princeton Review to Korean education technology company ST Unitas in 2017.[/td_block_text_with_title][td_block_text_with_title custom_title=”Business Model” tdc_css=””]Match Group derives revenue from recurring subscriptions, non-recurring fees, and online advertising. [/td_block_text_with_title][td_block_text_with_title custom_title=”IPO History” tdc_css=””]On 11/19/2015, the same day as Square’s debut, Match Group launched on Nasdaq led by J.P Morgan, Allen & Company, and BofA Merrill Lynch. The stock was priced at $12.00 per share, the low-end of indicative price range of $12.00 – $14.00/share. With a full subscription of 33.33 million offered shares and the 15% over-allotment option fully exercised, the company was valued at $2.98 billion at offer. Match opened at $13.50/share, a 12.5% jump from its offer price, and extended its gain on first day of trading to $14.74/share with a 22.83% initial return. Match Group was included in the IPOX® 100 U.S. Portfolio on 12/14/2015 and currently weighs approximately 1.2% of the portfolio.[/td_block_text_with_title][td_block_text_with_title custom_title=”Historical Performance” tdc_css=””] [/td_block_text_with_title][td_block_text_with_title custom_title=”Growth Outlook” tdc_css=””]

[/td_block_text_with_title][td_block_text_with_title custom_title=”Growth Outlook” tdc_css=””] [/td_block_text_with_title][td_block_text_with_title custom_title=”Industry Comparison” tdc_css=””][/td_block_text_with_title][vc_row_inner el_class=”tablescroll”][vc_column_inner el_class=”tablescroll”][vc_column_text el_id=”tablescroll”][table id=2 /][/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space][/vc_column][/vc_row]

[/td_block_text_with_title][td_block_text_with_title custom_title=”Industry Comparison” tdc_css=””][/td_block_text_with_title][vc_row_inner el_class=”tablescroll”][vc_column_inner el_class=”tablescroll”][vc_column_text el_id=”tablescroll”][table id=2 /][/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space][/vc_column][/vc_row]