[vc_row][vc_column][td_block_text_with_title custom_title=”Company Description” tdc_css=””]

Keysight Technologies, Inc

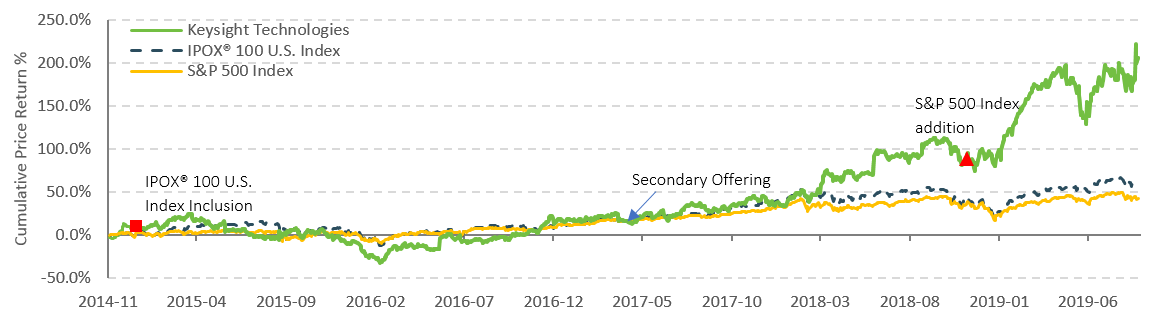

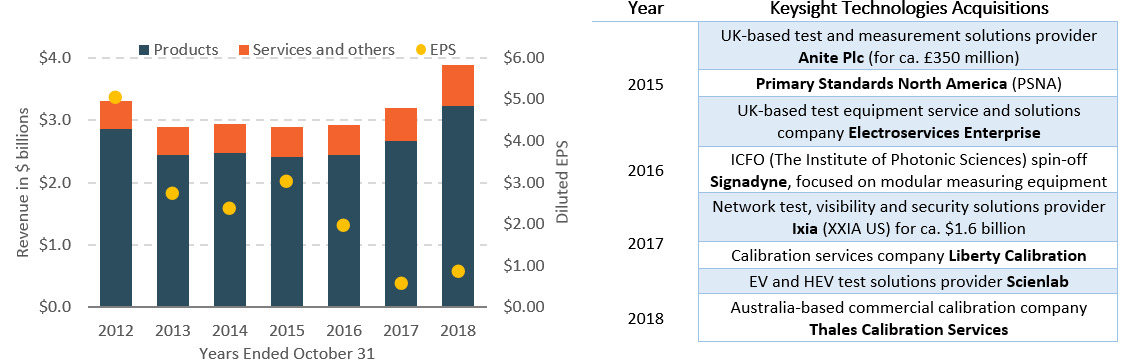

Traced back to 1939 when Hewlett-Packard (HP) was first founded, Keysight Technologies, Inc is an electronic measurement company, headquartered in Santa Rosa, North California. Keysight was the former electronic measurement business of Agilent Technologies, a HP spin-off in 1999. The company provides electronic measurement instruments and systems, related software and software design tools and customer supports and services to the communications, aerospace and defense and industrial, computer and semiconductor test markets.[/td_block_text_with_title][td_block_text_with_title custom_title=”Business Model” tdc_css=””]Keysight Technologies generates the majority of revenue from the measurement solutions business, which provides products and related software . The company also generates a small portion from its customer support and services business, which offers repair, calibration, parts-for-sale and resell refurbished used equipment.[/td_block_text_with_title][td_block_text_with_title custom_title=”Spin-Off History” tdc_css=””]On 11/3/2014, Keysight Technologies began trading on NYSE followed by its completed separation from Agilent Technologies (NYSE: A) on 11/1/2014. The stock closed the first day of trading at $31.15, with approximately 167 million shares distributed, Keysight was valued at ca. $5.2 billion. Keysight Technologies was included in the IPOX® 100 U.S. Portfolio on 12/19/2014 and currently weighs approximately 1.10%.[/td_block_text_with_title][td_block_text_with_title custom_title=”Historical Performance” tdc_css=””] [/td_block_text_with_title][td_block_text_with_title custom_title=”Growth Outlook” tdc_css=””]

[/td_block_text_with_title][td_block_text_with_title custom_title=”Growth Outlook” tdc_css=””] [/td_block_text_with_title][td_block_text_with_title custom_title=”Industry Comparison”][/td_block_text_with_title][vc_row_inner el_class=”tablescroll”][vc_column_inner el_class=”tablescroll”][vc_column_text el_id=”tablescroll”][table id=17 /][/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space][/vc_column][/vc_row]

[/td_block_text_with_title][td_block_text_with_title custom_title=”Industry Comparison”][/td_block_text_with_title][vc_row_inner el_class=”tablescroll”][vc_column_inner el_class=”tablescroll”][vc_column_text el_id=”tablescroll”][table id=17 /][/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space][/vc_column][/vc_row]