[vc_row][vc_column][td_block_text_with_title custom_title=”Company Description” tdc_css=””]

Guardant

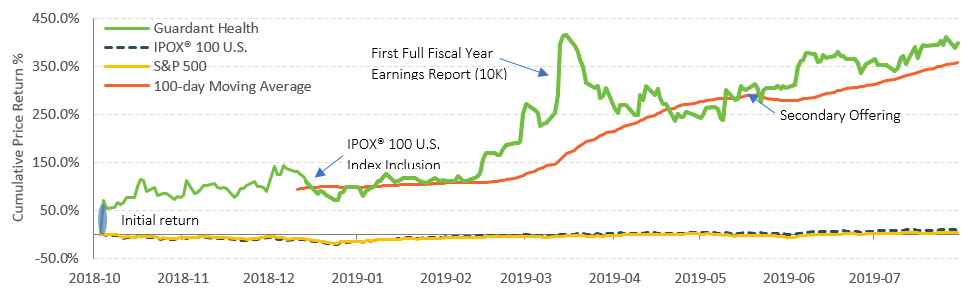

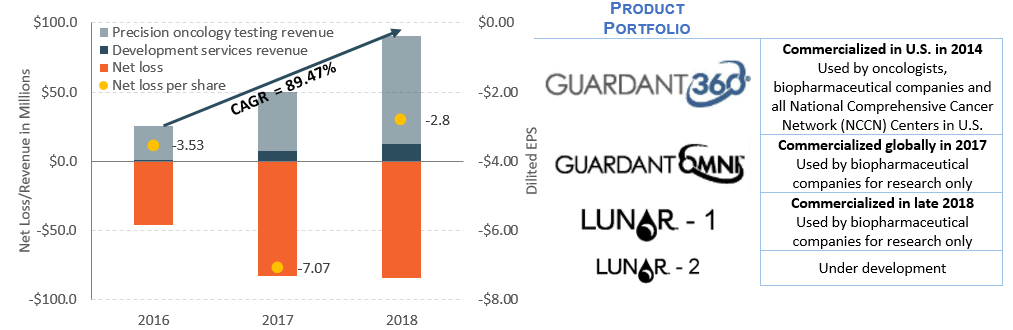

Founded in 2011, Guardant Health is a Redwood City, CA-based precision oncology company. The company provides blood tests (or liquid biopsy) for recurrence and early detection for cancer diagnosis and treatment (cancer continuum of care).[/td_block_text_with_title][td_block_text_with_title custom_title=”Business Model” tdc_css=””]Guardant Health generates revenue from (i) precision oncology testing (the sales of tests) and (ii) development services (collaboration arrangement with biopharmaceutical companies and large medical institutions in companion diagnostic development and regulatory approval services, clinical trial referrals and liquid biopsy testing development and support).[/td_block_text_with_title][td_block_text_with_title custom_title=”IPO History” tdc_css=””]On 10/04/2018, Guardant Health launched on Nasdaq led by J.P. Morgan and BofA Merrill Lynch. The precision oncology company sold 12.5 million shares with a 15% over-allotment option fully exercised. Guardant Health raised $273.125 million after pricing at $19.00 per share, above its expected range of $15.00 – $17.00/share and was valued at $1.62 billion at offer. The shares opened 46.05% higher at $27.75/share and close the first day with a 69.47% initial return. Guardant Health was included in the IPOX® 100 U.S. Portfolio on 12/21/2018 and currently weighs approximately 0.5% of the portfolio. [/td_block_text_with_title][td_block_text_with_title custom_title=”Historical Performance” tdc_css=””] [/td_block_text_with_title][td_block_text_with_title custom_title=”Growth Outlook” tdc_css=””]

[/td_block_text_with_title][td_block_text_with_title custom_title=”Growth Outlook” tdc_css=””] [/td_block_text_with_title][td_block_text_with_title custom_title=”Industry Comparison” tdc_css=””][/td_block_text_with_title][vc_row_inner el_class=”tablescroll”][vc_column_inner el_class=”tablescroll”][vc_column_text el_id=”tablescroll”][table id=13 /][/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space][/vc_column][/vc_row]

[/td_block_text_with_title][td_block_text_with_title custom_title=”Industry Comparison” tdc_css=””][/td_block_text_with_title][vc_row_inner el_class=”tablescroll”][vc_column_inner el_class=”tablescroll”][vc_column_text el_id=”tablescroll”][table id=13 /][/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space][/vc_column][/vc_row]