Company Description

Everbridge

Incorporated in 2008 under the name 3n Global, Everbridge is a Burlington, MA-based software company. The company provides critical event management (CEM) and enterprise safety solutions. Everbridge offers a SaaS-based platform that enables rapid delivery of Mass Notification, Incident Management, IT Alerting, Safety Connection, Community Engagement, Secure Messaging and Internet of Things.

Business Model

Everbridge generates revenue primarily from the sale of its critical communications applications on a subscription basis. The company also recognize revenues from set-up fees and professional services such as on-site project management, consultation, creation of client-specific message and scenarios, development of ad-hoc report templates and on-site emergency and incident management reviews.

IPO History

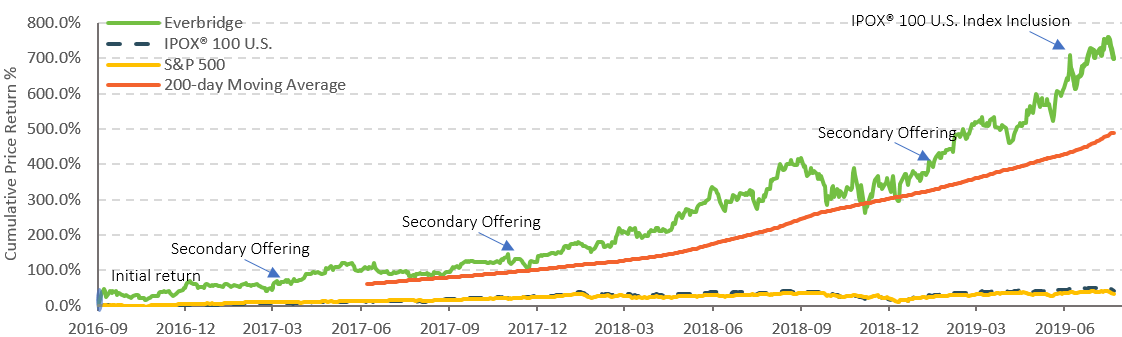

On 9/16/2016, Everbridge debuted on Nasdaq led by Credit Suisse and BofA Merrill Lynch. The software company offered 6.25 million new shares and the selling stockholders offered 1.25 million shares. Everbridge priced at $12.00 per share, midpoint of the expected range of $11.0 – $13.0/share and was valued at $323 million at offer. The shares opened at a lukewarm $12.30/share but closed the first day with a 27.03% initial return. Everbridge was included in the IPOX® 100 U.S. Portfolio on 6/21/2019 and currently weighs approximately 0.2% of the portfolio.

Historical Performance

Growth Outlook

Industry Comparison

[table id=14 /]