[vc_row][vc_column][td_block_text_with_title custom_title=”Company Description” tdc_css=””]

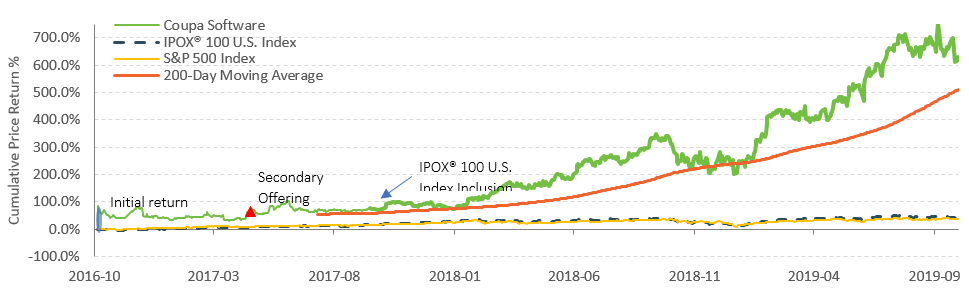

Founded in 2006 and headquartered in San Mateo, CA, Coupa Software provides a cloud-based spend management platform for businesses. The platform consists of procurement, invoicing, expense management and other supporting modules that help companies to manage spend.[/td_block_text_with_title][td_block_text_with_title custom_title=”Business Model” tdc_css=””]Coupa Software, follows most of the Software-as-a-Service (SaaS) business model, generates the majority of revenue from the subscription to the spend management platform. The company also derives professional services revenues from implementation and configuration services.[/td_block_text_with_title][td_block_text_with_title custom_title=”IPO History” tdc_css=””]On 10/6/2016, Coupa went public on Nasdaq led by Morgan Stanley, J.P. Morgan, Barclays, and RBC. The IPO was priced at $18.00 per share, high-end of the raised range. With a full subscription of 7.4 million increased offered shares and 15% overallotment option fully exercised, the company was valued at ca. $886 million. The stock opened at $35.00/share, a 94.4% jump, but closed the first day down at $33.28/share.[/td_block_text_with_title][td_block_text_with_title custom_title=”Historical Performance” tdc_css=””] [/td_block_text_with_title][td_block_text_with_title custom_title=”Growth Outlook” tdc_css=””]

[/td_block_text_with_title][td_block_text_with_title custom_title=”Growth Outlook” tdc_css=””] [/td_block_text_with_title][td_block_text_with_title custom_title=”Industry Comparison”][/td_block_text_with_title][vc_row_inner el_class=”tablescroll”][vc_column_inner el_class=”tablescroll”][vc_column_text el_id=”tablescroll”][table id=22 /][/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space][/vc_column][/vc_row]

[/td_block_text_with_title][td_block_text_with_title custom_title=”Industry Comparison”][/td_block_text_with_title][vc_row_inner el_class=”tablescroll”][vc_column_inner el_class=”tablescroll”][vc_column_text el_id=”tablescroll”][table id=22 /][/vc_column_text][/vc_column_inner][/vc_row_inner][vc_empty_space][/vc_column][/vc_row]