Company Description

Founded and commenced operation in 2012, Carvana was a subsidiary of DriveTime Automotive Group until its subsequent Spinoff in 2014. The Phoenix, Arizona-based company provides an eCommerce platform for buying used cars. Carvana purchases, reconditions then sells and delivers the vehicles. The company also offers vehicle pick-up option from vending machines which provides a unique experience.

Business Model

Carvana generates the majority of revenue from used vehicle sales. Revenue on retail units sold include a) the sale of the vehicle, b) gains from financing offerings, c) sales commissions on vehicle service contracts (VSCs) providing insurances, and d) wholesale sales (at auction) of vehicles acquired from customers as trade-ins.

Spin-Off History

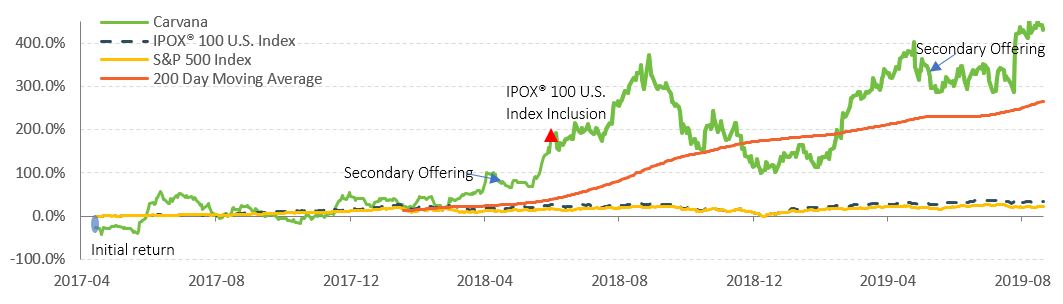

On 4/28/2017, Carvana debuted on NYSE led by Wells Fargo, BofA Merrill Lynch, Citigroup and Deutsche Bank. The used cars eCommerce company raised $225.0 million as it sold 15.0 million shares at an IPO price of $15.0 per share, mid of its expected range. Carvana was valued at ca. $1.98 billion at offer. The shares opened 10% down and continued to fall short. The stock closed its first day at $11.10/share. Carvana was included in the IPOX® 100 U.S. Portfolio on 06/15/2018 and currently weighs approximately 0.6% of the portfolio.

Historical Performance

Growth Outlook

Industry Comparison

[table id=18 /]

Other Major Competition

Traditional franchised dealerships, Independent dealerships, Offline membership-based (Costco Auto Program), Automobile manufacturers. Other online car retailers (Vroom, Shift, Kelly Blue Book/KBB.com, TrueCar.com (TRUE US) etc.)