Company Description

Americold

Americold is the world’s largest owner and operator of temperature-controlled warehouses. Americold has a global portfolio of warehouses in the United States, Australia, New Zealand, Argentina and Canada. The company operated in the industry since 1910 and is affiliated with Yucaipa, Fortress Investment Group, Goldman Sachs Group and Charm Progress after the acquisition of Versacold’s portfolio in 2010.

Business Model

Americold generates on revenue through 1a) rent and storage fees collected from temperature-controlled warehouse storage provided, 1b) related handling and other warehouse value-added services, 2) third-party management services and 3) transportation services (consolidation, freight under management, dedicated transportation).

IPO History

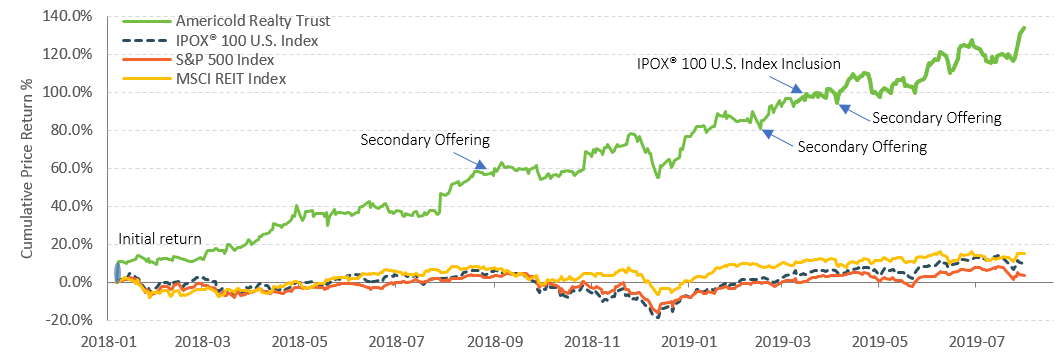

On 01/19/2018, Americold Realty Trust made its REIT offering on NYSE led by BofA Merrill Lynch, J.P. Morgan and RBC Capital Markets. It was the first and only publicly traded REIT focused on the cold-storage segment. The common share was priced at $16.00 per share, top of its expected range of $14 to $16 per share. With a full subscription of 45,300,000 shares offered by both the trust and selling shareholders, and an additional 15% over-allotment option fully exercised, Americold was valued at close to $2.3 billion at offer. The stock opened at $17.50/share and closed the first day higher at $17.77. Americold Realty Trust was included in the IPOX® 100 U.S. Portfolio on 03/15/2019 and currently weighs approximately 0.4% of the portfolio.

Historical Performance

Growth Outlook

Industry Comparison

[table id=15 /]