Company Description

Altice

Altice USA is a communications and media company. Altice provides pay television, broadband, telephony and advertising services to both residential and business customers through two acquired businesses: Optimum (Cablevision) and Suddenlink (Cequal). Altice USA is the U.S. unit of Altice N.V.

Business Model

Altice USA derives revenue primarily through monthly charges to residential, large enterprise and SMB customers of pay television, broadband, and telephony services. The company also generates revenue from the sale of advertising time and other add-on services.

IPO History

On 06/22/2017, the company completed its IPO on NYSE led by banks including J.P. Morgan, Morgan Stanley, Citigroup and Goldman Sachs. The share was priced at $30.00 per share, close to the higher end of the expected range of $27 to $31 per share. With a full subscription of 63,943,029 shares offered and an additional 12.17% over-allotment option fully exercised, Altice USA was valued at $22.11 billion at offer. Altice USA opened at $31.60/share, a 5.33% pop and climbed to close the first day with a 9.03% initial return. It was the second largest U.S. IPO in 2017. Altice USA was included in the IPOX® 100 U.S. Portfolio on 03/16/2018 and currently weighs approximately 1.56% of the portfolio.

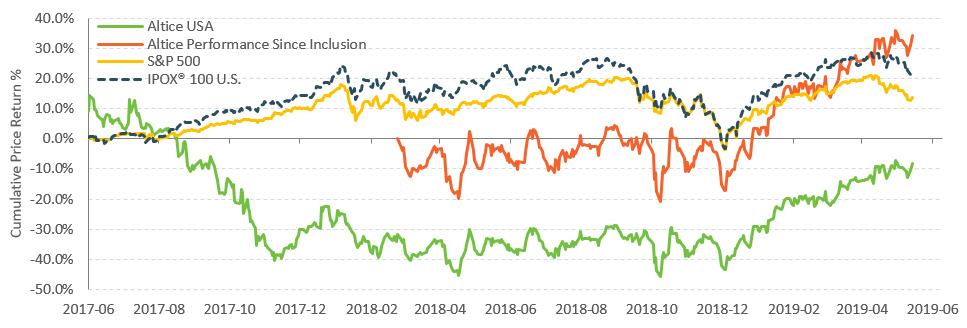

Historical Performance

Growth Outlook

Industry Comparison

[table id=4 /]