Investors are slowly waking up to the realization that “stagflation” is a problem. For years, the term “stagflation” has been thrown around and dismissed like a sighting of “Bigfoot.” However, rising inflationary pressures are now colliding with slowing economic growth. This collision presents a challenge for Central Bankers and their monetary policy experiments.

Let’s start with a definition of “stagflation.”

“Stagflation is characterized by slow economic growth and relatively high unemployment—or economic stagnation—which is at the same time accompanied by rising prices (i.e. inflation). Stagflation can be alternatively defined as a period of inflation combined with a decline in the gross domestic product (GDP).” – Investopedia

As stated, many believe stagflation is impossible due to the economic theories that dominate academic and policy-making circles. The construction of the economic models ruled out the possibility that you could have slow economic growth and high inflation simultaneously. To wit:

“In particular, the economic theory of the Phillips Curve, which developed in the context of Keynesian economics, portrayed macroeconomic policy as a trade-off between unemployment and inflation.

As a result of the Great Depression and the ascendance of Keynesian economics in the 20th century, economists became preoccupied with the dangers of deflation and argued that most policies designed to lower inflation tend to make it tougher for the unemployed, and policies designed to ease unemployment raise inflation.” – Investopedia

The problem with economic “theories” is they rarely properly account for individuals’ behaviors. Stagflation is an excellent example of how real-world economic data often diverts from widely accepted economic theories and policy prescriptions.

So, are we witnessing what many economists deemed impossible?

Inflation Is It Transient, Or Not?

Inflation is a problem resulting from an economic imbalance between supply and demand.

Following the “economic shutdown,” the Government created a massive amount of artificial demand by sending checks directly to households. However, because of the shutdown, production and manufacturing facilities could not meet the surge in demand. So naturally, the inevitable result was higher prices for the number of goods and services available to meet overwhelming demand.

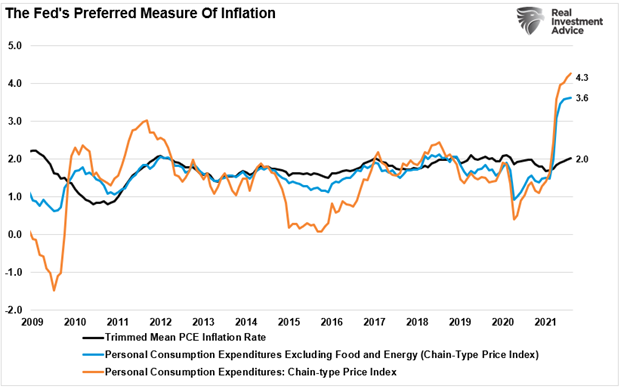

As shown below, the surge in inflationary pressures is not surprising. However, the question is whether the current inflationary spike is transient or persistent?

There are two problems surfacing that suggest inflation may be less transient than previously believed.

- The supply chain disruptions are not resolving themselves, but worsening; and,

- Incomes are not keeping up with inflation.

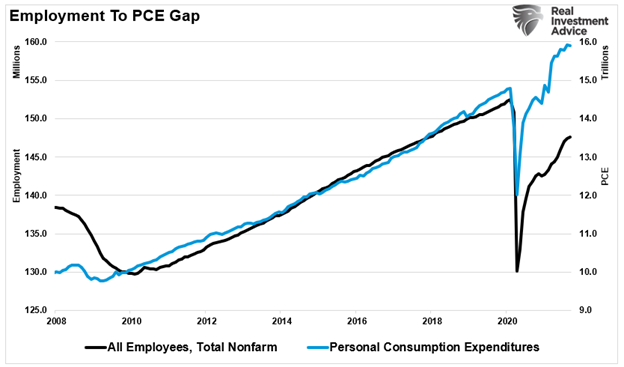

Furthermore, as noted in the definition of “stagflation” above, employment is not recovering to a level to support an economy devoid of fiscal stimulus. As shown below, the gap between the stimulus-driven PCE (Personal Consumption Expenditures) and the jobs to keep consumption at those levels is significant.

Such is problematic economically speaking.

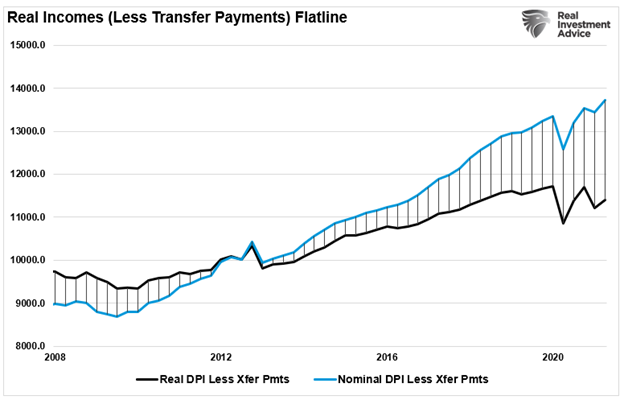

When consumers experience higher costs without a commensurate increase in incomes, consumption will fall. Given that consumption comprises nearly 70% of U.S. economic growth, the problem becomes readily apparent.

“Stagflation” Is Now A Thing

With this foundation, it is easy to understand “stagflation” has now manifested itself. Atlanta Fed President Raphael Bostic recently admitted the same:

“It is becoming increasingly clear that the feature of this episode that has animated price pressures, mainly the intense and widespread supply chain disruptions, will not be brief. Data from multiple sources point to these lasting longer than most initially thought. By this definition, then, the forces are not transitory.”

Inflationary pressures are antagonistic, thereby slowing economic growth. Goldman Sachs recently slashed 2022 economic prospects over continuing supply chain disruptions, lack of fiscal policy, and higher inflationary pressures.

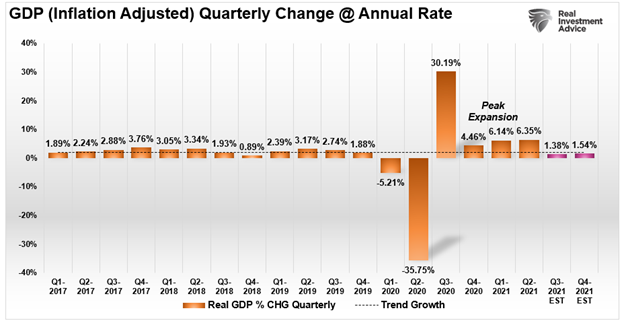

“A little over a month ago, Goldman surprised Wall Street when it slashed its Q3 GDP forecast to just 5.5% from 9.5%. That was a move the bank’s chief economist Jan Hatzius said reflected “hits to both consumer spending and production.” Then last weekend, confirming the stagflationary direction of the US economy, Goldman once again cut its Q3 and Q4 GDP forecasts again, from 5.5% to 4.5% and from 6.5% to 5.0%, respectively.” – Zerohedge

While the IMF, Goldman, and many other Wall Street banks are slashing economic growth estimates, they remain on the high end of what reality will likely be. With inflationary pressures surging, without wages compensating, economic growth will continue to weaken as stagflation weighs on the average family.

That is why we agree with Bostic’s conclusion:

“The real danger is that the longer the supply bottlenecks and attendant price pressures last, the more likely they will shape the expectations of consumers and businesspeople, shifting their views on pricing and wages in particular,”

If inflationary pressures remain, as Bostic suggests, such will subtract from economic growth in the future, indicating a sub-2% growth rate in 2022.

Then there is the actual labor problem.

The Labor Conundrum

Inflation is not a “bad” thing when combined with strong employment rates and wage growth which supports much higher levels of economic activity. But therein lies the problem in the current economy.

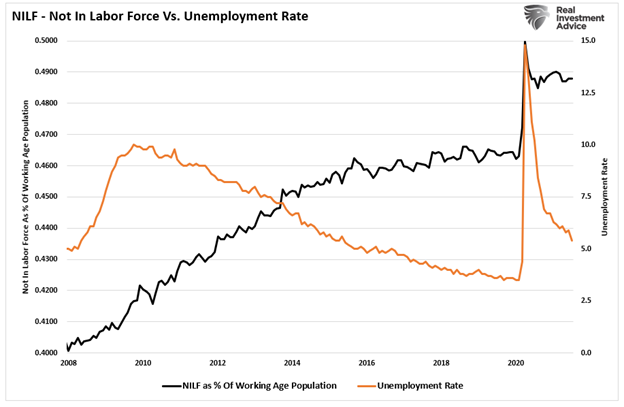

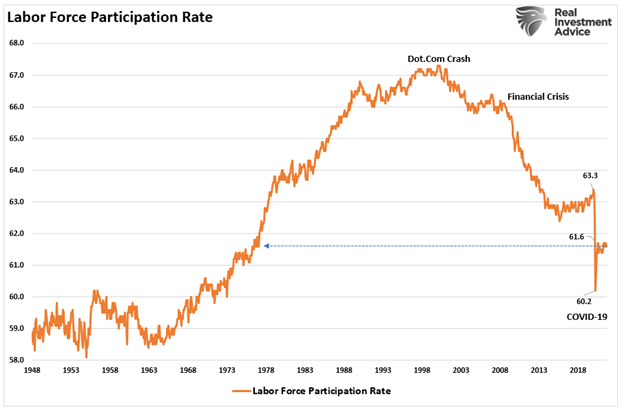

The official employment measures suggest we are nearly back to full employment. Yet, the participation rate in the economy remains deeply depressed. Such explains why real incomes remain stagnant, and a rising share of Americans are dependent on some form of governmental support.

The problem of participation also shows up in the rising levels of income and wealth inequality in the U.S. Since the turn of the century, the top 10% of income earners have accumulated a significant share of overall wealth. In comparison, the bottom 50% continue to struggle.

The labor force participation rate continues to decline after each recession, as companies opt to replace employees with technology to increase profits and reduce costs.

While the “official” rate suggests the U.S. is near full unemployment, the labor force participation rate argues otherwise.

If the definition of “stagflation” is a period of high inflationary pressures, coupled with high “real” unemployment and slowing economic growth – I would argue we have achieved that definition.

The question is whether or not it is sustainable?

Stagflation Now, Deflation Later

While the factors creating stagflation currently are problematic, they are likely transient.

Eventually, the supply chain disruptions will get resolved. Supply will increase, and demand will decline as needs get met. Furthermore, the overarching deflationary thesis remains.

- A decline in organic savings that depletes productive investments

- An aging demographic that is top-heavy and drawing on social benefits at an advancing rate.

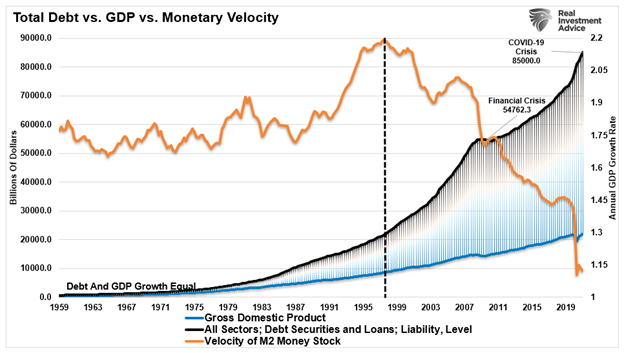

- A heavily indebted economy with debt/GDP ratios above 100%.

- The decline in exports continues due to a weak global economic environment.

- Slowing domestic economic growth rates.

- An underemployed younger demographic.

- An inelastic supply-demand curve

- Weak industrial production

- Dependence on productivity increases to offset reduced employment

Furthermore, given deflationary pressures due to weak wage growth, automation, and mounting debts, it is unlikely inflation can rise much before it triggers an economic contraction. Moreover, since interest rates adjust for inflation, a rise in inflationary pressures is a “double whammy” on consumption.

The debt problem remains a massive risk to monetary and fiscal policy. If rates rise, the negative impact on an indebted economy quickly depresses activity. But, more importantly, the decline in monetary velocity clearly shows that deflation remains a persistent threat.

Whether it’s “stagflation” or “deflation,” the problem for the Fed is that monetary policy has little effect on either one.