When I got into this business in 1993, the idea that a public company could be worth more than $1 trillion was not even a consideration. In the history of public markets leading up to that time, the prevailing feeling was that since it never happened before, why should it happen in the future? The reality though, in a truly global marketplace, anything’s possible. Understanding this simple concept allowed me to begin thinking about the characteristics that a company needs to have to hit this milestone market cap level. A company with one product, serving one target market in one country has absolutely no shot at being included in the $1 trillion club. This doesn’t mean it can’t be a great investment, it just can’t get into this club.

Since there are just two companies on the planet that have a $1 trillion market cap at the time of this writing (Apple & Microsoft), it’s fair to say that there could be significant investment returns possible if someone can identify the primary characteristics needed to reach the $1 trillion mark. It’s fair to say that companies with as many of the following characteristics as possible should offer investors a decent risk/return experience over time.

Mega-Brand status = $1 trillion+ in market cap:

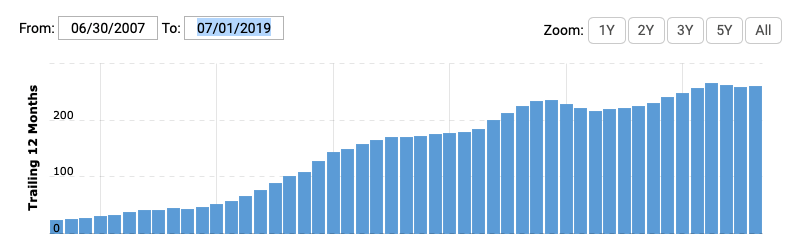

- High demand product/service(s) that resonate and become vital for everyday life. Every company needs their “iPhone” moment to reach Mega-Brand status. A company or consumer must need the product or service(s), whether perceived or real. Computer’s all over the world require Microsoft’s operating system and many of the programs inside the Office suite. Apple products are being consumed by consumer’s around the world. Amazon customers shop online daily all over the world. From Apple’s perspective in the chart below, here’s what happened to Apple stock from the first iPhone launch on June 29, 2007 to today (October 21, 2019): 1500% vs 156% for the S&P 500, that’s about a 10x return versus “the market”.

Is this a coincidence? I don’t think so.

Source: Stockcharts.com

Sales growth ultimately drives market cap growth. Clearly there are many factors driving corporate value creation, but my research indicates, consistent revenue growth with a long runway offers the best chance at sustainable and significant market cap gains. In the chart below, here’s Apple’s revenue trajectory since launching the iPhone in mid-2007. Do you see a correlation with the stock price ascent?

Source: Macrotrends.net

- Global opportunities.

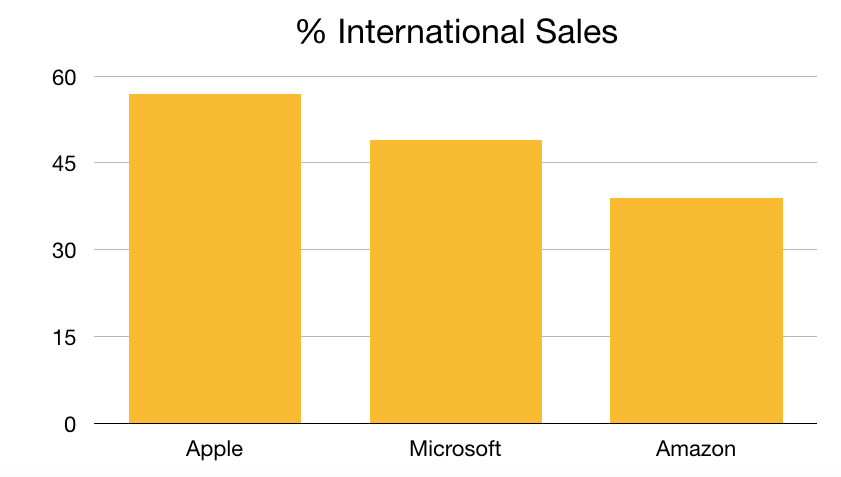

To reach the $1 trillion market cap milestone, a company must also sell its products/services around the world. The bigger the addressable market, the bigger the potential opportunity to monetize. I like to look for brands that are early in the global expansion lifecycle, so I know there’s a long runway for growth ahead. The global opportunities angle is likely the most important of all the factors discussed in this paper. For those that say Apple, Microsoft, and Amazon’s opportunities are dwindling, let’s see what percent of their current total revenue is outside the U.S. to see if we’ve reached the revenue saturation point yet.

Data source: Bespoke.com

Given the above data, I would not say these great brands have exhausted all their international or domestic opportunities.

- Demographic dominance.

To reach the nirvana of Mega-brand status, a brand needs to resonate with as many demographic groups as possible. Nike is a beloved brand from kids to the elderly, here and abroad. That’s what we want. Apple iPhone users hold the same status with global consumers. Lululemon is quickly becoming a demographically diverse apparel maker.

- Significant brand love.

Is the iPhone the most superior product in the smartphone universe? Some may believe it is, but the reality is Apple’s real strength is marketing, design, user interface, and its closed network. All these factors roll into a brand love score that’s tough to beat. The iPhone 11 just launched and people are still lining up around the block to be the first to analyze and purchase this $1,100 vanity phone. That kind of brand love is rare. Amazon Prime is another example of a network effect that offers pricing power. In a world where innovation never sleeps, the key to continued success cannot be from a technological advantage alone, high brand love is the X-factor that keeps a customer taking additional bites of the apple even when there is likely a better product available.

- Multiple category killers.

Apple would not be a trillion company if they were a one product brand. First it was the Mac, then the iPod, then the iPhone, then the iPad, then the Apple Watch, then the Earbuds, and Apple TV and iTunes service. The more follow-on product successes a company has, the more the compounding effect can enhance the market cap of the business. Build a network surrounding all the products that need replacing and add high brand loyalty and you have a company that should significantly outperform the market over time.

Bottom line:

No one knows if the world will ever see another company reach the $1 trillion market cap level. What I know, there are a handful of characteristics that offer a company the “opportunity” to reach this spectacular milestone. As I analyze the brands index names for investment, the above checklist items are some of the most important factors I inspect to decide if an investment is warranted. Brand relevancy, superior products, global opportunities, demographic diversity, high brand love, and multiple product/revenue opportunities are the key to reaching the $1 trillion club. I look forward to sharing more information about other potential members of this astute club in future blog posts.

DISCLOSURE:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.