Key Summary:

- March’s Inflation report highlights the last mile of inflation will be tougher to solve for.

- Consumer behavior has changed since the pandemic, we expect these trends to persist.

- With equity markets a bit volatile under the surface of the index, opportunities abound.

Very Important thesis: If equities generate roughly ~10% a year over time, leading brands, high quality franchises, serving the dominant driver of the economy, in theory, should compound at 13%+ over time. We have significant proof on this topic. The world’s most dominant brands could not be a timelier investment for today’s higher inflation world.

March Inflation Report Across Important Components:

I’m sure you and your family have been feeling the increased pressure of inflation across much of the important components of your monthly spending. For high income families, the pinch is barely noticeable. For the middle class and lower income consumers, which make up about 2/3 of the total population, persistent inflation will continue to put pressure on families. Consumers are incredibly resilient, however. Our resilience, though, will come at a cost across part of corporate America’s earnings. Not every company is thriving today because not every company has a solid balance sheet, superior brand loyalty, and differentiated products and services. Our belief continues to be less companies in the portfolio is better than more. Stock selection should be used with a scalpel, not a shovel. If your portfolio holds thousands of stocks today via more index type exposure, you may want to consider trimming this down and allocating in more of a narrow, thematic way.

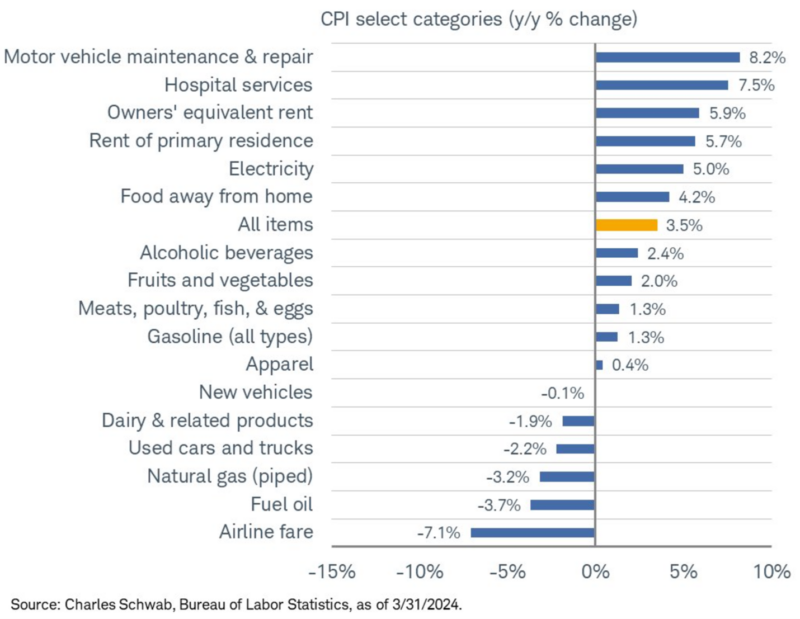

Below, I show a terrific summary of March’s inflation report via important components that make up the total CPI number. One datapoint does not make a series but generally, we know with certainty where the persistent inflation lives and how consumers are spending around these areas. That helps us understand what great brands to own and which ones to avoid for now.

We have seen rolling corrections and even recessions across different parts of the economy. Largely, the consumer has stayed strong, and spending has been stable. This spending, however, has not been broad-based. We expect this to continue for at least another year as inflation and rates chop around while staying higher for longer.

Consumer Behavior Has Changed. It Should Persist.

Looking at the graph above, there are clearly enough spending headwinds present for the masses to warrant shifts in a portfolio. Higher costs will reinforce one key behavior shift that’s been present since 2020: trading down and saving money wherever possible is very important for consumers. Thank heavens wages and income have also been rising generally, but consumers are fiercely looking for bargains across key spending categories. This behavior will continue to benefit brands that offer real value across categories including retail and e-commerce (Amazon primarily), warehouse shopping (Costco, Walmart), and discount apparel (TJX, Ross Stores, Burlington, etc). While new vehicle prices have come down slightly, overall, they are still quite high and finance rates are at multi-year highs. This will likely cause more trade-down activity for consumers that want or need an auto.

In addition, consumers are keeping their auto’s longer which should allow the auto repair and parts segment to remain a solid business. This favors great brands like O’Reilly Automotive and Autozone. This category has also experienced cost inflation which should allow the margins for these businesses to stay higher for longer. For many consumers, the lesser of two evils will be to pay for the older car maintenance versus spending more on a new or used car that requires higher finance rates.

Another area of persistent inflation is the services part of the economy. Core Services, ex-shelter was +5% YOY. If you have taken a vacation, stayed at a hotel, gone to a concert or sporting event, for example, you have felt this cost pressure. Consumers love experiences, though. Yes, perhaps the caliber of vacation will catch a downgrade, but we will continue to spend on our most favored experiences while cutting back in other less important areas. That remains why our team continues to avoid the middle ground of consumer spending categories. If the spending category is not a need or a high favorite of the typical consumer, we generally are absent or underweight exposures there.

Volatility is the Friend of the Long-Term Investor.

Macro datapoints create uncertainty and noise. This causes short-term volatility. When prices fall because volatility is rising, wonderful opportunities get created. We are seeing this now in markets. At the index level, stocks appear calm. Underneath the surface, the average stock in the Nasdaq index has already experienced a peak to trough decline of 28% (Source: Schwab and Liz Ann Sonders, CIO). Our team loves to buy great franchises on sale and you should expect that from every manager you trust with client assets.

Between the strong wealth effect, job security, rising incomes, the X-factor of >$45 trillion in wealth transferring from older generations to younger ones, the consumer spending theme is alive and well. One must understand, though, how and where consumers are spending. Then one must know which brands are the most relevant in these categories. Once you know that, great stock picking can begin.

Disclosure: The above data is for illustrative purposes only. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.[/vc_column_text][/vc_column][/vc_row]