Key Points

- Over the long-term, Tech and Consumer Discretionary are two sectors to anchor to.

- 2022 was a major “reset year” for stocks in general and tech & consumer in particular.

- In 2023 – tech and consumer are winning again, but there’s still plenty of opportunities.

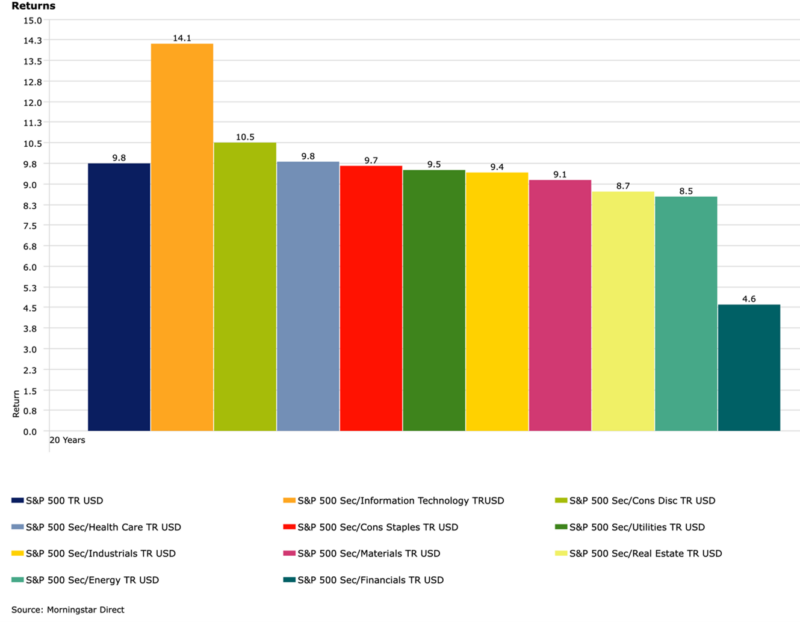

20 Years of Annualized Returns: Tech & Consumer Discretionary Outperform the S&P 500.

We know intuitively, buying great merchandise on sale is something consumers love. Ironically, in the investment business, when great stocks go on sale, investors tend to freeze or sell. That’s a mistake. Using short-term price direction as the mechanism to help make long-term investment decisions will often lead an investor astray. In this business, most funds, ETF’s or strategies tend to be anchored to a single or a few “style factors” or characteristics. Sometimes, the market favors strong top-line sales or high R&D spend, other times, the value factor is where returns are coming from. The important part of this story though: style factors go in and out of favor and the best opportunities come from understanding which factors, sectors, or thematics tend to work the best over longer periods of time. Once you understand this, 1) making sure you own the persistent winners is important and 2) being committed to adding to the LT winners when they experience the normal periods of underperformance offers a wonderful one-two punch to your long-term goal achievement plans. With that in mind, I thought I would investigate sector performance, short and long-term, to see if there’s any opportunities to seize.

20 years of data is a sufficient time frame, I think you would agree. For long-term investors, this is how the sector movie ends: Technology and Consumer Discretionary are the two key sector leaders over time. This shouldn’t be a surprise given these two sectors are key drivers of the global economy. Additionally, because of a recent sector shift by Index providers, a new sector, Communications Services has emerged. Many important tech & discretionary brands have been moved to the new Comm Services sector so I suspect this will also outperform over the long-term, particularly through names like: Meta (Facebook), Google, Netflix, Live Nation, and many more. Nothing happens every year but often, these two or three sectors and the high-quality brands that live here, should continue to perform well on an absolute and relative basis. Our research tells us most portfolios hold sufficient tech but not enough consumer exposure. Regardless, here’s the 20-year look across sectors.

20 Year Sector Returns:

Technology:

The tech sector performed very well versus all other sectors annualizing at ~14.1% over 20 years. This performance was generated by a handful of leading brands, however. Microsoft annualized at 16.5%, Apple at 38.2%, and Nvidia at 29.9% (source: YCharts). Important: the tech sector performed very poorly after the market peaked in March 2000. Some companies never recovered, but the leaders eventually began leading again. Those who understand buying great businesses on sale is smart and logical, got a chance to significantly beef-up their exposure to tech on mega-sale between 200-2003. When you know how the movie ends, you take advantage and buy more when the market acts irrationally.

Consumer Discretionary:

Not surprisingly, consumer stocks serving a strong consumer nation, also performed well annualizing at 10.5% over 20 years. A peek inside the index shows us again, a handful of great brands drove an even bigger portion of the gains in the sector. Stock selection really matters in consumer-land.

Amazon annualized at 23.4% over 20 years, Tractor Supply at 29.3%, Deckers Outdoors (owners of UGG and Hoka Shoes) at 31%, Booking Holdings at 26%, O’Reilly Automotive at 22.6%, and Dicks Sporting Goods at 17.1% per year.

My point is simple: When you know something has a history of performing well, 1) make sure you have an allocation to it for the long-term, and 2) when it experiences a period of underperformance, make sure you add to it while its down and so your speed to recovery is accelerated because of smart cost averaging strategies.

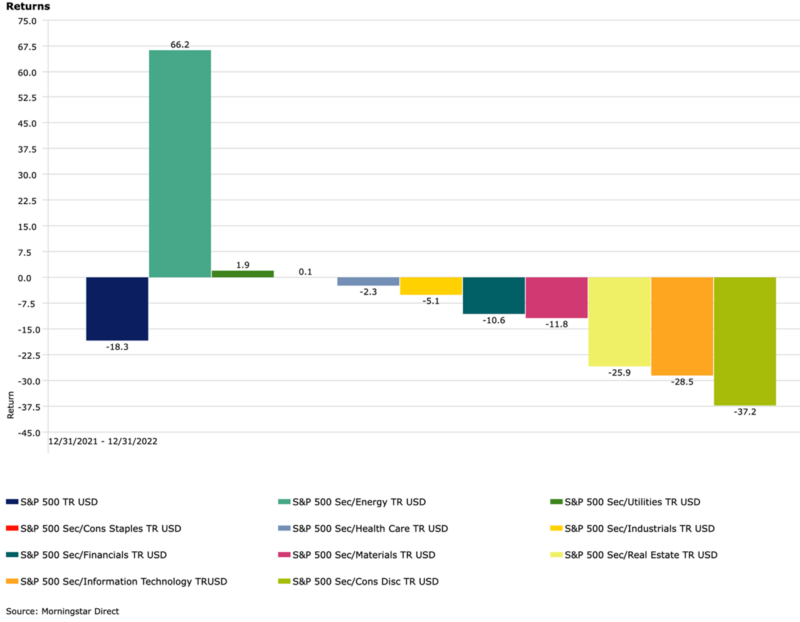

2022: The Great Re-set Year for Tech & Consumer Discretionary.

As you know, 2022 was a tough year for almost every asset class and style-factor. The growth and quality factors across equity-land performed particularly poorly. Why? Because interest rates went straight up for the entire year and multiples for growth stocks and sectors went down rapidly. That caused a ton of disruption across equities and fixed income. Ironically, business fundamentals were largely strong across the board, but the market did not care until late October. Many of the drawdowns in great businesses where irrational & illogical, and the opportunity created by buying more, was never in doubt. Over longer periods, the fundamentals always drive the bus. Here’s how 2022 looked at the sector level. Tech & Consumer Discretionary were the worst performers & Energy was the best performer. Great brands went on sale.

2022 Sector Performance:

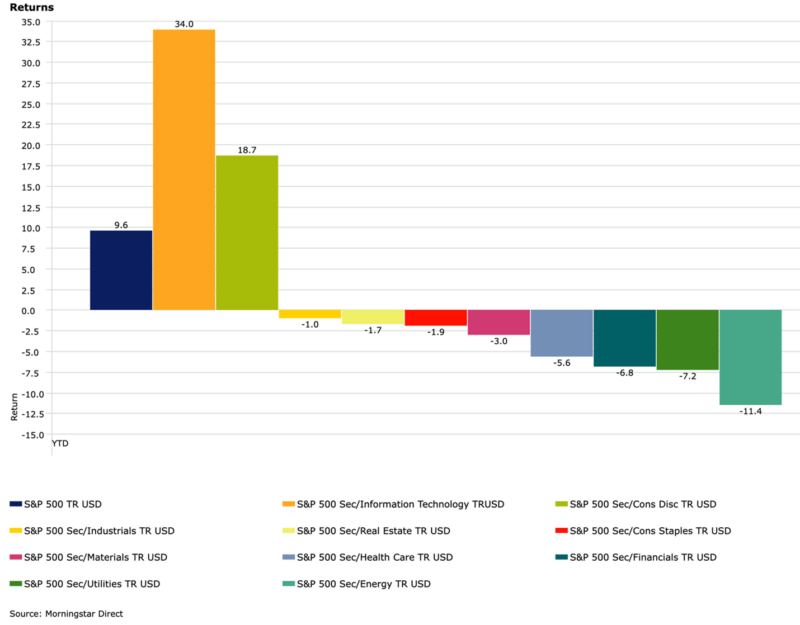

2023: A Mean Reversion via Tech & Consumer Discretionary Leadership.

Markets generally bottomed in mid-October last year and have largely trended higher into the recent month-end. You would never know it when you talk to investors, however. Massive amounts of money continue to go into money market funds, currently >$8 trillion. Only until recently and because of the AI FOMO, have investors decided to buy technology stocks. YTD, Technology and Consumer Discretionary are back on top and are the only sectors with positive returns thus far in 2023. Remember, many of the greatest brands live in the tech and consumer sectors so a brands-dedicated portfolio, by definition, will largely be anchored by tech and consumer stocks. Today’s market is incredibly bifurcated, though. The bulk of returns are coming from just a handful of great brands. As we started this year, the consensus thinking was for a continuing weak market into mid-year followed by a strong recovery. To date, the exact opposite is what has occurred. Consensus got it wrong again.

2023 Sector Returns Through 5/31/2023:

SUMMARY:

- Over most periods since index creation in late 1989, tech and consumer discretionary stocks have tended to be outperformers.

- Now you know how the movie ends. Now you know the answers to the test in advance.

- When these important sectors go on sale, investors should begin adding more exposure.

- Adding exposure to great brands and sectors on sale while they are experiencing temporary underperformance has historically been a very smart decision. Even after the current recovery, there are some very important, very dominant brands on sale.

Stay anchored to these two sectors for the long-term.

It’s not too late to pounce.

Buy/add on dips.

BRANDS MATTER

Disclosure:

The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.