Key Points

- A balanced portfolio holding companies that play offense & defense is key.

- In the new economic regime, certain style factors make the most sense.

- Top “offense-oriented” brands grow despite short-term economic slowing.

Balance in a portfolio can help offer a smoother ride to investors.

For Part 2 of the portfolio creation topic, I wanted to shift to offense. There’s thoughtful, steady growth while paying attention to costs and maintaining high operational efficiency and there’s growth at all-cost. When rates were at zero and access to capital was plentiful, the “growth-at-all-cost” companies performed exceptionally well. In today’s new regime of higher base rates cost of capital, and inflation, those companies are not where one should be focused, in our opinion. This week let’s focus on the “grow through a slowdown while running the business prudently” group of offense-minded brands.

As the Fed’s aggressive actions begin to take effect across markets and the economy, it’s important to remember that brands highly focused on offense tend to be growth-oriented businesses which also tend to be higher beta (more volatile than defensives generally) and could struggle in a slowdown as end-markets slow and revenue growth eases a bit. Secular growth, or mega-trends as we call them, tend to be more stable and long-lived and can sometimes be less sensitive to shorter-term slowdowns than other cyclical growth opportunities.

Remember, to oversimplify, this is generally what investors want when they make the decision to invest their capital for long-term growth. Knowing these end-goals helps build the most appropriate portfolio for investors:

- Achieve attractive returns.

- Have as smooth a ride along the way as possible.

- Reach their target goal on time and intact.

How they accomplish these three goals is where the magic happens. In many cases, it’s BALANCE that helps them experience a smooth ride. When the economy slows, the best companies and brands make important decisions about where to cut costs while also continuing to grow and take market share. In fact, the best brands tend to take market share in difficult periods because they think long-term, and they have strong balance sheets that enable them to spend through slowdowns.

Important style factors for the new investment regime.

Reminder: style factors describe the characteristics of a business. Most of the time, we tend to be overweight the “quality” style factor partly because it tends to outperform long-term and partly because top brands tend to be high quality companies relative to the stock universe.

From an offense and “prudent growth” perspective, there are a handful of metrics that we believe are important to focus on today. If you are a business owner, you will instantly appreciate the importance of these metrics: high free cash flow, high free cash flow growth, high return on invested capital (ROIC), fairly stable revenue growth over time, a steady reduction in the number of shares outstanding if possible, strong balance sheet, better margins than industry peers, reasonable valuations relative to the growth opportunities in front of them, high interest expense coverage so you can service debt easily, margin expansion possibilities, and positive EPS and revenue revisions. If you want to know why market returns tend to come from only a handful of companies, look no further than the rigid list of strong metrics I have listed above. Should anyone be surprised that the bulk of long-term market returns come from a much smaller number of companies that have superior business models, managements, and global opportunities?

Quality, Stable Offense via Growth Brands

Generally, the companies that can continue to growth their revenue and free cash flow across multiple demographic groups, geographies, economic environments, and through new product innovations, tend to generate strong investment returns for shareholders. These are also the brands that tend to join the $trillion-dollar-club over time. Sometimes, these companies are called “compounders”, we call them Mega-Brands. Using real-time corporate data, here’s a few Mega Brands that seem well-positioned today, rank highly across the factors cited above, and should show some stability in an economic slowdown:

Visa (V) & Mastercard(V): “Everywhere You Want to Be”.

The use of cash has been slowing falling all over the world. In emerging market economies, the trend of using cash over cards is more prevalent still, given a large segment of the emerging consumer population does not have a traditional bank account. However, there are tons of fin-tech brands building unique value propositions to help these consumers enter the “swipe over cash” thematic. Yet, two mega brands still dominate the payment processing industry, and they are wonderfully profitable businesses. Collectively, Visa and Mastercard process almost 85% of payment transaction in the U.S., the world’s largest economy. As the economy slows and consumers make choices where and how to spend, having less exposure to consumer credit issues is ideal. Unlike American Express, CapitalOne and others, Visa & Mastercard have very little credit risk embedded in their businesses.

Consider them the owner and partners in a vast global toll-road where every visitor must pay the toll. Roughly 70% of every revenue dollar falls directly to the free-cash-flow line of Visa/Mastercard. They score in the 99 & 100th percentile for high margins and in the top decile for free cash flow metrics & operating efficiencies. They are aggressive buyers of their own stock when the stocks underperform, as they did through Covid when cross-border travel was virtually shut-down. Being more aggressive with new buying when stocks are low is exactly the kind of behavior that tends to reward companies and investors over the long-term.

Fun fact: V/MA stock has handily outperformed the S&P 500 Index over the last 1, 5, 10 years and since both went public. Over the last 3 years, with Covid restrictions and cross-border travel issues present, the stocks have underperformed. In our opinion, both companies are undervalued and will beat expectations over the next 12 months as global travel normalizes and higher average inflation keeps average transaction value elevated.

Tesla: TSLA

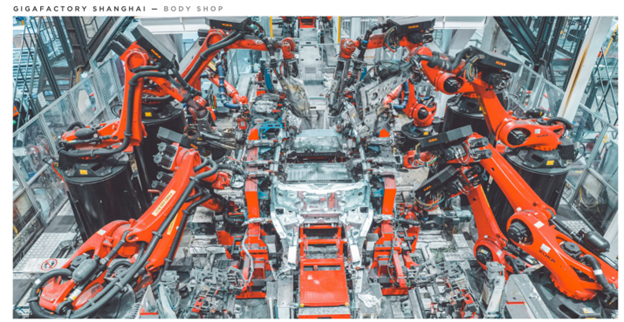

Achieving scale is the key to maximizing efficiencies. Tesla has a huge lead over peers, and we think it’s sustainable for many years to come. As automation and robotics drive productivity and manufacturing gains, Tesla will continue to grow much faster than most companies, regardless of industry. Yes, Tesla could be the most polarizing brand ever created and the stock is neither cheap nor stable from day to day. Additionally, if we enter a true recession, their growth could slow a bit but it will rip right back once consumers feel better about the economy.

Aside from the love or hate of Tesla, hiding in plain sight is a massive secular growth trend that is still in its infancy: the electrification of everything, starting with vehicles.

To be clear, the major opportunity for Tesla shareholders was going from small production to major production.

That stage for Tesla is largely complete but when you look at the small overall EV adoption curve and its growth trajectory while combining Tesla’s manufacturing lead and its strong brand as THE innovator in the space, there’s more growth for the company and stock in my opinion. I have little doubt that Tesla will once again be part of the $trillion club. The global opportunity is simply too large and attractive. Oddly, the stock is still under-owned institutionally, yet it has some of the most robust growth metrics relative to other companies who play offense. Here’s a quick glance at Tesla’s metrics at fiscal-end 2017 versus fiscal-end 2022:

- $11.8B in annual revenue.

- $3.4B in total cash.

- Model 3 deliveries were just beginning.

- There was no Model Y yet.

- 1128 supercharging locations globally.

- Automotive gross margins: 18.9%.

Here’s how fiscal 2022 ended for Tesla:

- $81.4B in annual revenue.

- $22.2B in cash with no debt – a monster achievement for any car company.

- $7.56B in free cash flow generated.

- Model 3 and Model Y scaled production has occurred.

- ~4200 supercharging locations globally.

- Automotive gross margins: 25.9% – the best in the industry.

Tesla stock can be a wild ride at times given how polarizing Elon Musk is and how noisy the earnings releases can be quarter-to-quarter but keep your eye on the prize: global EV adoption. Volatile stocks like this should be sized accordingly in a portfolio but TSLA surely added some value to a portfolio as they reached global scale.

A $10,000 investment in July 2010 would be worth $1.26 million today versus ~$51k in the S&P 500.

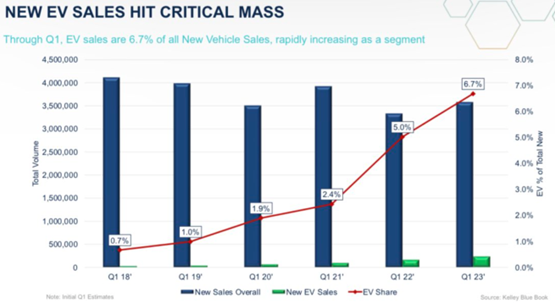

EV Sales are still small but growing rapidly.

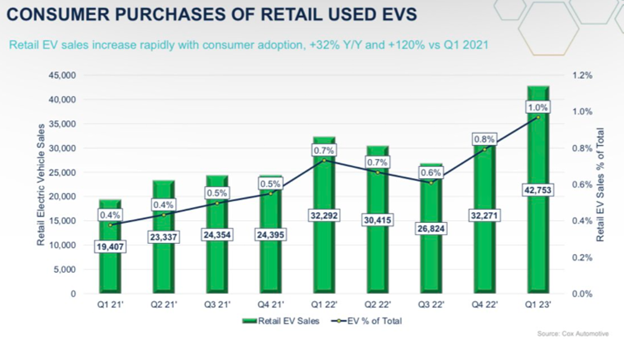

Retail buying of used EV’s will grow even faster and Tesla has the most to gain as trailblazer!

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

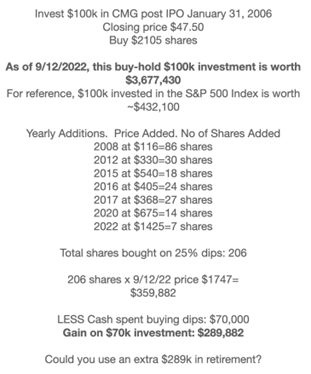

The Chipotle hypothetical cost averaging example highlights the potential power of holding core positions in industry leading brands and being committed to adding to these positions when the market acts irrationally. Cost averaging leading companies can add significant value to your long-term portfolio even if you do not catch the absolute bottom in the stock. Details on this hypothetical are below.