Key Points

- Nike is still the undisputed global footwear champion, but growth is slow.

- Niche footwear brands are taking market share from the largest brands.

- Growth at Hoka has been extraordinary, there’s a lot of low-lying fruit to capture.

The global sneaker market is roughly $152.4 billion as of 2022

Let’s talk athleisure because it’s a powerful secular growth theme and there’s some absolutely dominant brands in the category. We can’t talk about sneakers and footwear without leading with Nike. Nike is one of the most recognized and loved brands around the world. Once called Blue Ribbon Sports, Nike was founded by Bill Bowerman and Phil Knight in 1964. Nike is one of the great corporate stories of all-time. Phil used to sell the new shoes out of his car just to spread the word about the new brand. Back then, Adidas and Puma were the big dogs in the industry and runners where a shoe brands primary target. Today, the athletic footwear industry has morphed into something much larger as consumers tend to own a handful of shoes for different purposes: everyday life, running, cross-training, etc. The message has never changed: brands focused on comfort, durability, a cushioned innersole, attractive colors and designs, and overall great support (toe to heel and lateral for ankle support) have strong growth opportunities. Today, the footwear category has blossomed, and dozens of niche brands are becoming real competitors to the incumbents.

Hoka: Quietly becoming very relevant.

As an investor in iconic and highly relevant brands, I’m always on the lookout for up & comer brands.

Each December, our team gets together to assess all the spending categories while analyzing the brands that seem to be winning, losing, and emerging from a market share perspective. Nike has a very long lead and is a marketing machine, but their size and global scale turns the stock into a steady-eddy brand versus a strong and sustainable growth brand. Our holding in Nike is about the dividend growth opportunity and about a shift towards e-commerce and digital while building a deeper direct relationship with consumers. We still see strong margin expansion opportunities for Nike along with better inroads in Asia and Emerging Markets.

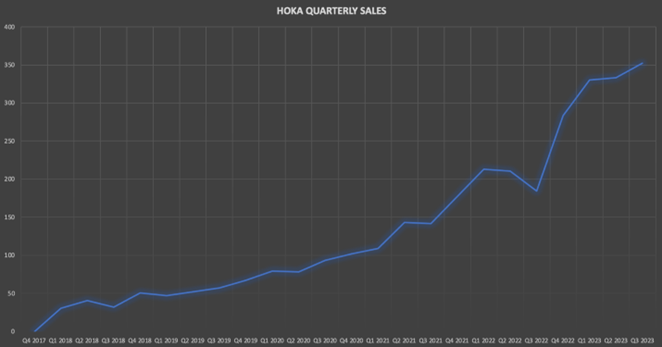

Now let’s talk about our growth pick. Hoka has largely been a niche running shoe brand that has been flying under the radar of most peers and consumers. Acquired by Deckers Outdoors (DECK) in late 2012, Hoka has one of the most impressive growth profiles across the footwear category. What started as a niche running shoe and one with a very peculiar design, has morphed into a much more diverse footwear brand that appeals to kids, adults, and older adults. The international expansion is still in the early innings and brand awareness, while making strong inroads, still has a significant amount of growth ahead. That’s the kind of story that excites us when we are looking for undiscovered brands and strong growth that’s not well understood by the street. My experience with Hoka started with trail running shoes and I have been a loyalist ever since. Now, my wife has 2 pairs, my daughter has one pair (Nike is the coolest after all), and the grandparents all have at least one pair. They are unbelievably comfortable, give you great ankle and arch support and have finally started to expand the color palette which used to be a bit boring. Check the shoes out here: https://www.hoka.com/en/us/

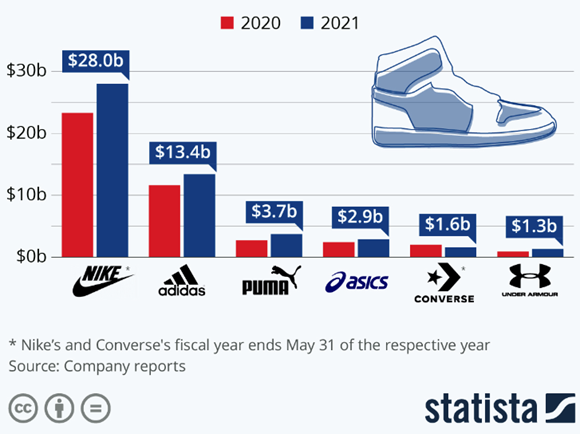

Let’s look the sneaker market share peer group from 30,000 feet. Here’s what market share looks like according to Statista with a 2020/2021 viewpoint.

Nike is 2x larger than Adidas, which seems to be shrinking every day while losing relevance with consumers. After Adidas, the competitors drop off meaningfully in terms of annual revenues to footwear. As you can see, Hoka is not on this list yet, but they will be soon as the brand recently crossed over $1.0 billion in annual sales and still with one quarter to go in fiscal 2023. For the year, Hoka should reach about $1.2-$1.3 billion in sales which is a remarkable accomplishment considering fiscal 2018 sales were $153.5 million for a compound annual growth rate of roughly 50%. Hoka is taking meaningful market share at the lower end of the annual sales peer group and Under Armour, Skechers, Asics, and New Balance are likely feeling the pinch the most. Nike is too big to feel Hoka’s bite for now, but I can guarantee you, what was an easy Nike sale is no longer easy when other brands are becoming more relevant, have a better reputation for solid construction & support, and are at more attractive price points. As consumers feel the pinch from inflation, more trade-downs will occur and Hoka should continue to benefit. Here’s the annual sales trajectory of Hoka between 2018 and Q3 2023. Remarkable quarterly sales and growth from $30 million in Q1 2018 to $352 million in the 3rd quarter of 2023.

At Deckers Outdoors, Hoka is the growth brand, but UGG is remarkably stable.

Deckers is still a small-ish company at roughly $10.5 billion in market cap and $3.6 billion in trailing 12-month sales. The stock has been a stellar performer over the last 20 years with annualized returns of 17.4% versus the S&P 500 at roughly 9.8% annualized. The UGG brand at Deckers has been the growth workhorse but Hoka has taken over and it has fresh legs. The UGG franchise still does about $1.7 – $1.9 billion a year in revenues. Growth is now slower but by no means has growth stalled at this brand making the UGG division a key driver of spending capacity for other initiatives and share buybacks. UGG truly is the gift that keeps on giving.

Sum of the parts:

At $10.6 billion in market cap, DECK trades at about 2.9x sales. For perspective, Nike trades about 3.8x sales and roughly 62% of total sales comes from footwear. If I use a pure peer comp via a fast-growing footwear brand called On Footwear, Hoka, if it were a standalone brand would likely be worth about $7-$8 billion currently. On Footwear trades at 6x sales given they are growing in similar fashion. Investors like pure exposure to themes so typically, the pure play grower in a group trades at a higher multiple than a conglomerate with many brands under one roof. Tesla is a good example of this in the EV space as the pure play at scale option for investors. Currently, the Hoka brand and its annual sales is worth about 62% of the total market cap of Decker’s and it’s still in “beast growth” mode. When you see faltering brands like Skechers with about $7 billion in shoe sales, Asics with almost $3 billion in sales, and serial underperformer, Under Armour at roughly $1.3B in shoe sales, you start to see how much growth potential there is for Hoka.

Our team estimates the Hoka brand being worth roughly the current market cap of the entire Decker’s company making the stock of DECK quite cheap. In our estimation, Hoka will continue to experience outsized growth because its sitting in the sweet spot for footwear growth just crossing $1 billion in sales. We estimate Hoka has another $4 billion in annual sales until it starts to experience the typical growing pains of most footwear brands. Given the current persistent inflation and its effect on consumers, we do not expect growth across consumption categories to always be linear, but we have very high confidence in Hoka’s growth trajectory long-term. That makes the stock of Decker’s, one of our favorites for the next 3+ years given the sum of the parts analysis and the strong growth opportunities within Hoka.

Deckers Management: Exceptionally Strong Capital Allocators

Another reason we love this company, is our confidence in management. They have consistently reduced the share count since 2010 and used strategic buybacks to their advantage. Deckers management does a tremendous job managing the cycles, inventory, and the balance sheet. The current buyback of roughly $1.5 billion amounts to about 14% of the current market cap. They have a track record of smart, accretive buyback decisions and the company has zero debt and about $1.05 billion in cash. With strong and stable gross margins, a stable predictable UGG brand that generates strong cash flows, and a growth brand in Hoka, the stock is highly attractive and significantly undervalued, particularly relative to the peers in athleisure and footwear.

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.