Key Points

- The Connected Fitness category has significant opportunities for growth going forward.

- Peloton has emerged as the technology and content leader across multiple verticals.

- The hub & spoke opportunity for Peloton is greatly under-appreciated.

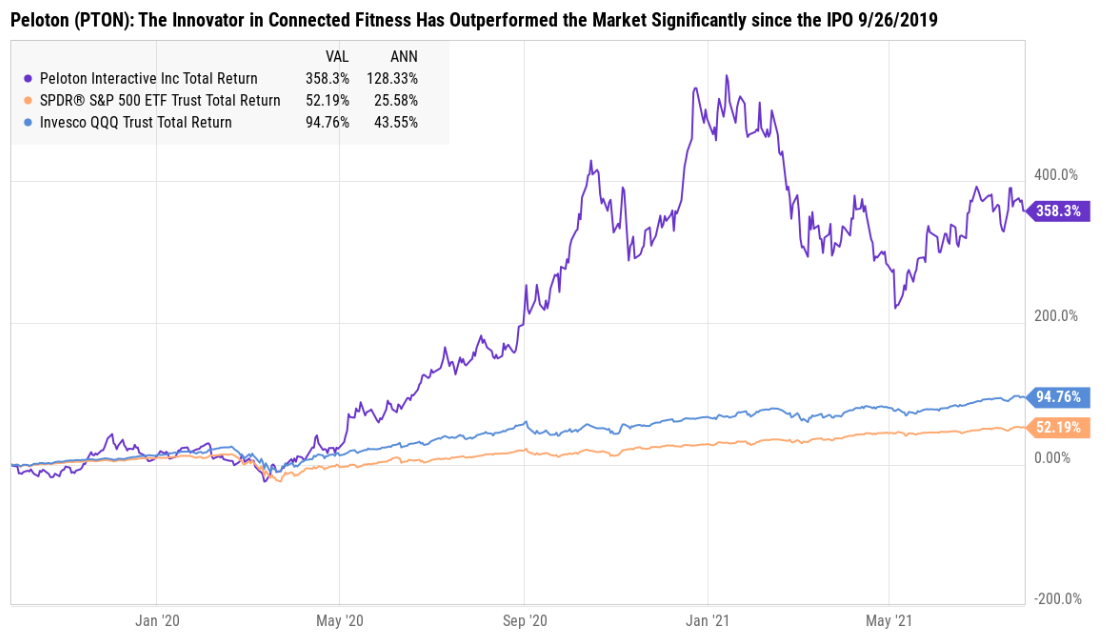

Source: Ycharts. Period assessed: PTON vs S&P 500 and Nasdaq 100 since 9/26/2019 to 8/2/2021

The most relevant brands serving key consumption markets are often top perming stocks. Peloton is a great example since the IPO in September 2019.

Connected Fitness

Big picture, the fitness category is enormous and generally under-stated. As an example, Peloton cites the estimated 180 million global gym member as a starting point for the fitness opportunity. Fitness, though, is much bigger than gym memberships. I’m a fitness junky and I don’t have a gym membership anymore, so the addressable market is really only limited by age and disposable income. I’m a GenX and my generation is the first to have fitness even remotely part of our everyday lives. Millennials and GenZ have wellness integrated into their minds in a much bigger way overall. These consumers also have technology at the center of their lives so it makes sense that a connected fitness focus offers tremendous long-term opportunities for investor’s & consumers.

If the Connected Fitness category has major tailwinds from a secular trend perspective and brand loyalty is at the center of purchase intent, the most relevant brands serving this category should have wonderful opportunities to capture a bigger piece of the total market opportunity.

Peloton sits at the forefront of this opportunity.

Peloton is the leading interactive fitness platform in the world with a loyal community of more than 5.4 million members. The company pioneered connected, technology-enabled fitness, and the streaming of immersive, instructor-led boutique classes for its members anytime, anywhere. The brand’s immersive content is accessible through the Peloton Bike, Peloton Tread, Peloton Bike+, Peloton Tread+, and Peloton App, which allows access to a full slate of fitness classes across disciplines, on any iOS or Android device, Apple TV, Fire TV, Roku TVs, and Chromecast and Android TV.

Peloton is the leading interactive fitness platform in the world with a loyal community of more than 5.4 million members. The company pioneered connected, technology-enabled fitness, and the streaming of immersive, instructor-led boutique classes for its members anytime, anywhere. The brand’s immersive content is accessible through the Peloton Bike, Peloton Tread, Peloton Bike+, Peloton Tread+, and Peloton App, which allows access to a full slate of fitness classes across disciplines, on any iOS or Android device, Apple TV, Fire TV, Roku TVs, and Chromecast and Android TV.

Because of Covid-19, millions of consumers left the gym and began working out at home and in the great outdoors. A funny thing happened over the last 16 months, many people actually enjoyed the experience better, saved money and joined a more robust community. That alone is a powerful moat for the top connected fitness brands as well as having a very sticky customer base that, thus far, has been unwilling to give up their new workout practices. In fact, Peloton management states that the 12-month retention rate for their digital subscribers is currently 92%. Peloton and the Mirror (owned by Lululemon) are on to something very big but I’m not sure the bulk of stock market participants are paying attention. Connected Fitness is not a fad, it’s becoming a lifestyle. Ask the management teams at Nike, Adidas, and Lululemon what happens when wellness and fitness becomes a lifestyle. All of these stocks have been terrific performers over the last 5+ years. And the future still looks very bright.

But this is just the beginning of the opportunities in Connected Fitness, particularly for Peloton.

Connected Fitness: A Wicked Hub & Spoke Opportunity

Think of Peloton as the hub in a bike wheel. The foundation of the wheel is loyal customers. The stronger the loyalty, the more durable the wheel. To keep customers happy, engaged, loyal, and being the best marketing partners in the world, every brand needs a growing flywheel of in-demand products and services that ride the cutting edge of innovation. These are the spokes of the wheel across the Peloton business.

For Peloton and their Connected Fitness opportunity, the spokes hold some very interesting and robust opportunities. From my perspective, the opportunities to build and enhance this one-of-a-kind hub and spoke flywheel make the stock of Peloton look much cheaper than it appears on the surface. To be sure, understanding these opportunities and executing on them will ultimately decide if Peloton can achieve greatness but Peloton certainly has an immense opportunity right now to change the course of fitness forever.

Peloton serves 2 markets generally:

- Direct to consumer (DTC) and

- Business-to-business-to -consumer (B2B2C)

When your business is digital and centered around software and technology, you have a much better opportunity to build direct relationships with your customers and to continuously deliver them new and updated services & experiences. In today’s world, that’s imperative to keep strong customer loyalty and low subscription churn. In addition, Peloton has just scratched the surface with B2B2C opportunities as well. Peloton equipment will eventually be located in corporate fitness centers and across the global travel & leisure sector. When I travel to Hawaii or New York, the Brand-Power will demand hotels and even Airbnb’s have these high-demand fitness products so we can log-in and not miss our classes & store our data.

The revenue opportunities are robust and come from a diverse set of services and products. Here are the spokes of the Peloton wheel as I see them:

- Hardware – bikes, treads, watches, and other new fitness products that focus on core strength & cardio. With their acquisition of Precor, they have the manufacturing & design capabilities to create an entire suite of fitness products.

- Software – one digital app that drives all our experiences and keeps track of all our health data. Imagine the possibilities to link our current health metrics to build a profile score that we could use to get discounts on our managed healthcare. Stay in good health standing=keep your discounts. How’s that for real-time motivation. Smart device innovation is everywhere.

- Apparel & merchandise – the Peloton brand means something today. When people have the freedom to express themselves, the brand message spreads and the userbase expands. The opportunity here is with general apparel as well as with sport-specific apparel and add-ons. Bike shoes, jump ropes, hats, water bottles, sweat clothes, foam rollers, dumbbells, mats, etc. There’s so much opportunity here for wonderful marketing.

- General nutrition and activity-specific nutrition – imagine an app that asked you some questions and pulled in your ongoing fitness data then delivered a potential opportunity for a nutritional supplement. Why not do a JV with a sport-nutrition brand like Nuun and offer a Peloton tab for your water bottle? The opportunities here are endless.

- Community connections – Peloton has a like-minded, captive community. These are people that have lots in common and when you have something in common you tend to want to connect. There are social commerce opportunities through a Peloton Marketplace, dating opportunities to connect with that future potential mate, etc.

- Lifestyle club memberships – a like-minded community could be connected to a marketplace of like-minded merchants and brands. Imagine having an instant connection to all of the important wellness and fitness brands inside the Peloton app complete with discounts and buy-now-pay-later options.

- If I just purchased a Peloton bike, why shouldn’t I be able to browse and buy some non-Peloton connected merchandise too? Things like Shimano shoes, a Nike jump-rope, a Garmin Fenix6 smart-watch, could be cool.

Summary:

Summary:

- Connected Fitness is early in days and enormous in size, which makes it very investable.

- Peloton has an early lead and it’s significant. This is their game to lose.

- Think of Peloton like Shopify or Amazon Prime, they build a core business and then connect their members to an ever-growing roster of important products and services that keep them engaged, loyal spending more inside the network every year. The compounding effect can be incredibly profitable for the business and for investors.

Disclosure:

This information and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.