Executive Summary:

Quantitative investment researchers often seek uniquely optimal parameterizations of their strategies amongst a broad “robust” region of parameter choices. However, this ignores a critically important feature of investing – “diversification.” By diversifying across many equally legitimate parameter choices – an ensemble – investors may be able to preserve expected performance with a higher degree of stability.

We examined this concept under the microscope using “dual momentum” – and in particular “global equity momentum” – as our case study. Our objectives were twofold:

- To verify the strength and robustness of the dual momentum concept and specifically the global equity momentum strategy; and

- To describe how to use ensemble methods to preserve expected performance, while minimizing the probability of adverse outcomes.

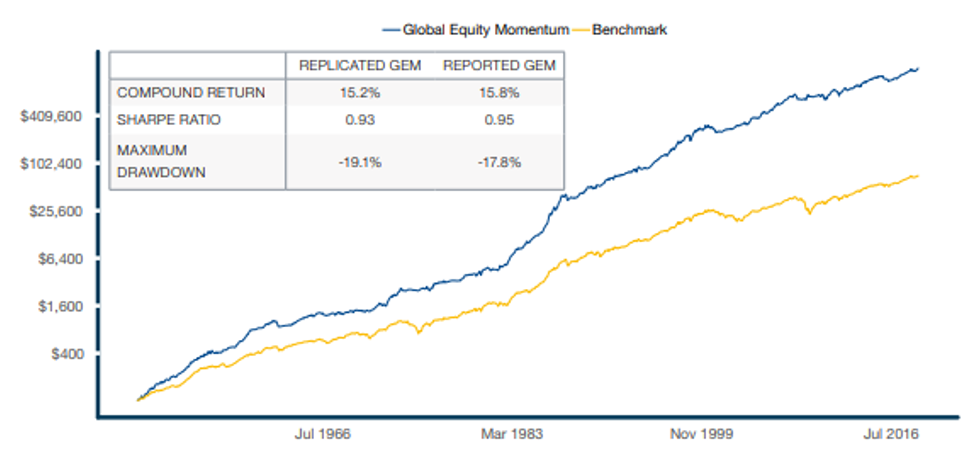

GEM has produced attractive absolute and risk-adjusted performance since 1950, both in- and out-of-sample. We replicated the original research using close data proxies. Figure 1 shows that our results tracked the author’s results very closely despite minor differences in how we constructed our index of foreign stocks.

Figure 1. Performance of Global Equity Momentum, 1950 – September 2018. HYPOTHETICAL AND SIMULATED RESULTS.

Source: Analysis by ReSolve Asset Management. Data from MSCI, Standard and Poor’s, Barclays, Russell Investments. Benchmark consists of 45% S&P 500, 28% foreign stocks and 27% bond aggregate consistent with original article. All performance is gross of taxes and transaction costs.

Click here to download the full report. https://investresolve.com/inc/uploads/pdf/global-equity-momentum-executive-summary.pdf