Climate extremists have a well deserved reputation for a simplistic approach to solving the complex problem of curbing CO2 emissions without impoverishing us all. However, poorly informed objectives doesn’t mean they have a co-ordinated approach. The growth in solar and wind power is setting environmental extremists against one another.

Take New Jersey, a state whose politics have lurched expensively left in recent years. Governor Phil Murphy and the Democrat legislature are pursuing an ambitious plan to develop offshore windpower. Danish firm Orsted plans enough wind turbines to power a million NJ homes. The project was expected to cost $1.6BN four years ago, but last week the company won approval from NJ to keep tax credits from the Inflation Reduction Act that were originally intended to benefit electricity customers.

The bailout will surprise few. But NJ Democrats probably weren’t expecting to face growing opposition to hundreds of offshore wind turbines from environmentalists. Nonetheless, ProtectOurCoastNJ is showing rare intellectual deftness in opposing “the industrialization of the oceans” while also arguing in favor of efforts to reduce global greenhouse gases. They offer a coherent view that is uncommon among their peers.

There are many arguments against windpower. It’s not renewable because the turbines have a useful life of around twenty years. They’re made of steel and concrete, whose manufacture relies on fossil fuels. The worn out blades typically end up in special landfills. Wind is intermittent, although offshore wind produces power more reliably than onshore. Increased penetration of weather-dependent electricity on a grid raises the need for reliable back-up, often from natural gas power plants. Therefore, renewables raise prices, a wholly understandable result that advocates should embrace as worth the cost. Instead, they claim the opposite, ignoring the examples of Germany which ranks among the world’s priciest electricity. And California, which vies for this title and goes one better with unreliability to boot.

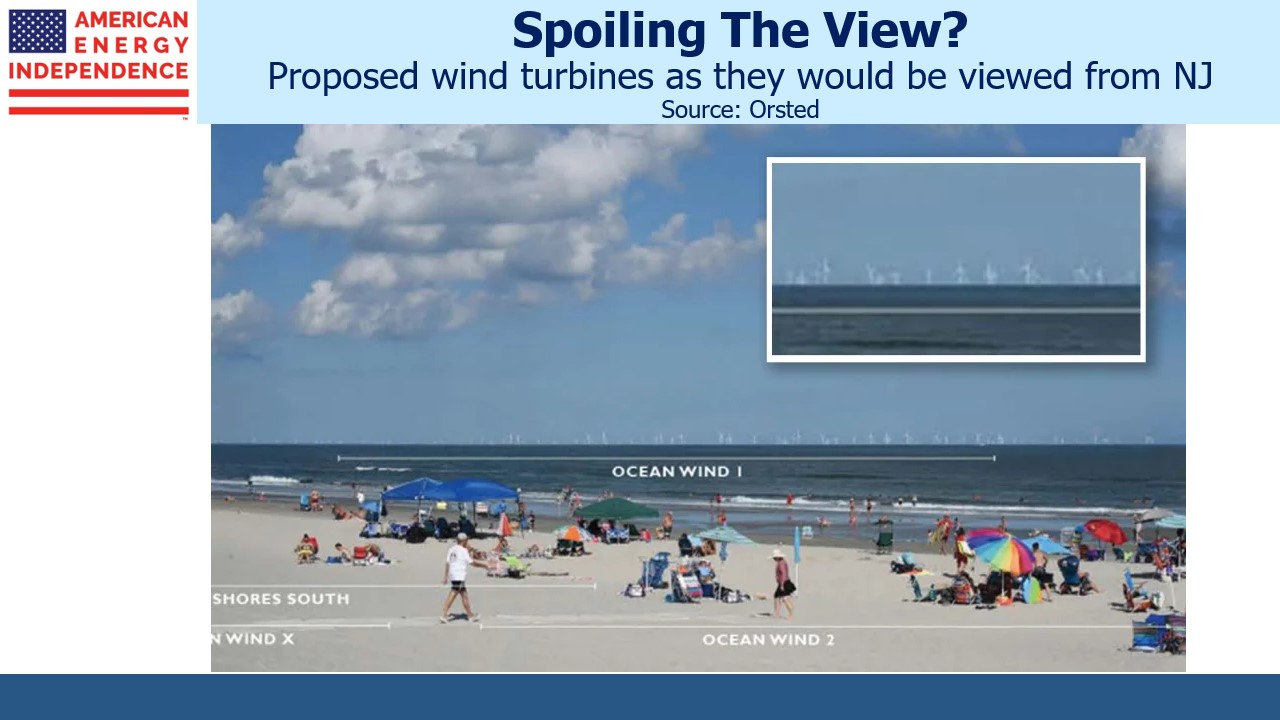

ProtectOurCoastNJ opposes offshore windpower because of the threat to wildlife, including whales. They cite the noise from construction, arguing that, “Vibrations from driving 36’ diameter steel piles 150’ into the sea floor will radiate for miles.” They argue that the nutrient-rich cold pool of water which sits near the surface will be disrupted by the turbine blades. The electro-magnetic field from the high-voltage cables will disorient fish. They worry about nautical navigation around the turbines, leaking oil and other hazardous chemicals, the increased cost of electricity and the view. The wind turbines will be clearly visible from the beaches of the Jersey shore.

Britain relies heavily on offshore windpower. There are turbines in the English Channel. I’ve seen them when visiting friends who live on the southeast coast. They are visible, but I must confess that they look as far off as a passing cargo ship and are about as objectionable.

However, the simulated photos of what the NJ offshore turbines will look like does portray them as more visible than the UK version.

ProtectOurCoastNJ goes on to list many more sensible power sources to reduce emissions. These include switching from coal to natural gas, greater use of nuclear power and carbon capture. They sound as if they are subscribers to this blog.

The point is that environmentalists are far from a homogenous group. There will always be a group opposing just about any construction. Unusually, ProtectOurCoastNJ has a pragmatic outlook and offers sensible alternatives for the windpower they oppose. Mountain Valley Pipeline isn’t the only energy infrastructure project to struggle with opposition from activists.

In other news, NextDecade (NEXT) announced their long-awaited Final Investment Decision (FID) to go ahead with their Rio Grande LNG export project, and the stock fell sharply. This was because NEXT’s share of the cashflows of Stage 1 turned out to be lower than their prior guidance – 20.8%, whereas investors were expecting around a third.

This was disappointing, and the consequent sell-off in our opinion leaves the stock priced just for Stage 1 (Trains 1-3) with no added value for Stage 2 (Trains 4-5). NEXT is guiding for much better economics on Stage 2 assuming it ultimately goes ahead. Although Stage 2 isn’t reflected in the price, we think on a per share basis it could be worth 2-3X Stage 1. They also have Next Carbon Solutions which is focused on helping industrial companies capture and store CO2. Some people at NEXT think there’s as much value in this as the LNG business, although the stock price ascribes no value to it.

NEXT is a multi-year story. We still like the stock.

The post Environmentalists Opposed To Windpower appeared first on SL-Advisors.