This post will analyze and compare some pharmaceutical companies developing a vaccine for Covid-19 from an economic perspective using the Eta® statistics on the MacroRisk Analytics® platform. These statistics can assist financial advisors and investors in understanding what economic forces have been driving the stock prices of these companies and how these companies compare in terms of economic risk.

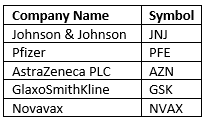

According to a Forbes article dated June 16, 2020, the following five pharmaceutical companies are developing a Covid-19 vaccine:

The table above presents only some of the companies developing a vaccine for Covid-19. (Moderna is another company, for example, that is developing a vaccine but was not analyzed in this post because its stock does not have at least three years of trading history).

These five companies will be compared using the FiveRisks report by MacroRisk Analytics as of November 6, 2020.

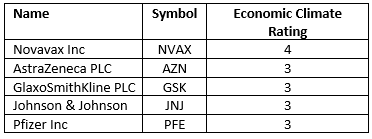

Economic Climate Rating

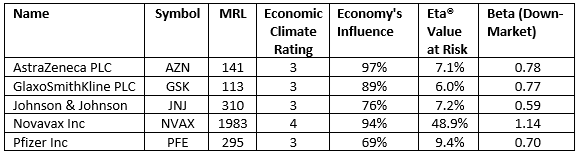

The first statistic that will be analyzed is the economic climate rating. It is a star rating ranging from one to five stars. A rating of one means that the current economy is expected to not be suitable for the asset (i.e., the economy is expected to provide headwind). A rating of three means the economy is expected to be neutral for the asset. A rating of five means that the current economy is expected to be suitable for and benefit the asset (i.e., the economy is expected to provide tailwind). Here are the economic climate ratings for the five companies.

Novavax had the highest economic climate rating of four meaning the economy is expected to be somewhat favorable compared to other companies for which the economy is expected to be neutral.

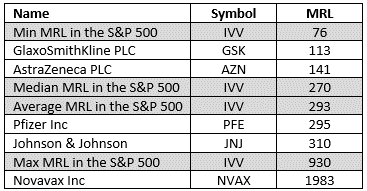

MacroRisk Level

The second statistic is the MacroRisk Level (MRL) which measures how sensitive an asset is to changes in the economy. The lower the MRL, the lower the asset’s economic risk is expected to be and vice versa. Here are the MRLs for the five companies and also the median, average, minimum and maximum MRLs for the S&P 500 index for comparison.

As can be seen, Novavax stands out withs a very high MRL of 1983. This is higher than the maximum MRL of 930 in the S&P 500 Index as of November 6, 2020 illustrating the high level of economic risk associated with the stock of this company.

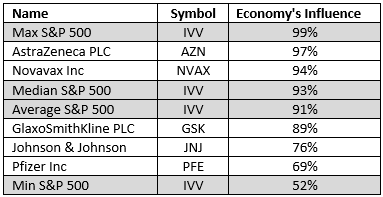

Economy’s Influence

The economy’s influence measures how much of the stock price of an asset is driven by changes in the economy rather than company specific information. The higher the value, the more the asset is driven by the economy and vice versa.

Johnson & Johnson as well as Pfizer have low economy’s influence statistics demonstrating that the stock prices of these companies are believed to be driven more by company specific information than what happens in the economy.

Eta® Value at Risk

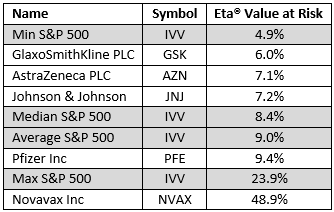

The Eta Value at Risk statistic measures the expected percent change in the price of an asset, up or down, given an unexpected event that has a five percent probability of happening (whatever this event may be). This is a measure of risk. The lower the statistic, the lower the expected risk of an asset is believed to be and vice versa.

Again, Novavax illustrates high expected risk with the Eta Value at Risk of 48.9%. This means that given an unexpected event with a five percent probability, its stock price is expected to increase or decrease by 48.9%.

Down-market Beta

The down-market beta measures downside risk. It is the expected percent change in the value of an asset when the S&P 500 Index (in this case) drops. If the down-market beta is less than one, the asset is expected to lose less value than the S&P 500 when the S&P 500 drops. If the down-market beta is higher than one, the asset is expected to lose more value than the S&P 500 Index when the index drops. The lower the down-market beta, the less risky an asset is expected to be and vice versa.

In terms of the down-market beta, all of the subject companies except one have lower risk than the average company in the S&P 500. Novavax has somewhat higher risk than the average S&P 500 company with the down-market beta of 1.14 which means that if the S&P 500 Index drops by one percent, the stock price of Novavax is expected to drop by 1.14 percent (i.e., if the S&P 500 drops by 10%, Novavax is expected to drop by 11.4%).

Summary

The goal of this post was to provide some statistics to analyze some of the pharmaceutical companies currently developing a vaccine for Covid-19 from an economic perspective. These statistics show where these companies stand in terms of economic risk in relation to the S&P 500 Index.

The table below will summarize the statistics presented earlier in this post. These statistics are as of November 6, 2020.

The statistics shown in this post can be accessed through the MacroRisk Analytics platform. This platform helps analyze portfolios and thousands of companies, mutual funds, ETFs, etc. with the economy in mind because The Economy Matters®.

Our “The Economy Matters Reports” are also available through Interactive Brokers, FactSet, Capital IQ, and Refinitiv.

Original Article can be found on macrorisk.com