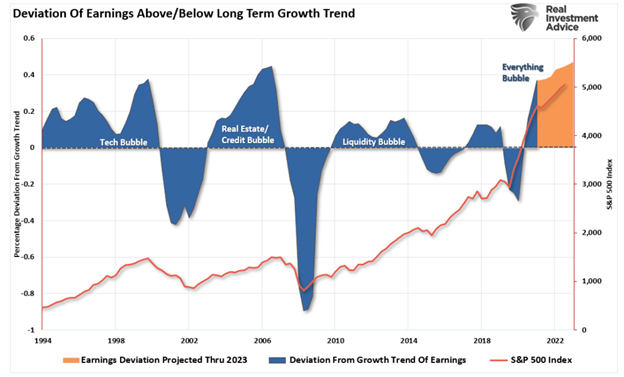

Earnings estimates are more deviated from long-term growth trends than at any point in history. As a result, analysts and Wall Street are overly optimistic as the Fed tightens monetary policy against a potentially disinflationary environment.

Analysts, by their very nature, are always overly optimistic. Such is why we play the “beat Wall Street estimates” game every quarter as Wall Street lowers estimates until there is a high “beat” rate by companies.

“The biggest problem with Wall Street, both today and in the past, is the consistent disregard of the possibilities for unexpected, random events. In a 2010 study, by the McKinsey Group, they found that analysts have been persistently overly optimistic for 25 years. During the 25-year time frame, Wall Street analysts pegged earnings growth at 10-12% a year when in reality earnings grew at 6% which, as we have discussed in the past, is the growth rate of the economy.

This is why using forward earnings estimates as a valuation metric is so incredibly flawed – as the estimates are always overly optimistic roughly 33% on average.” – The Problem With Wall Street Forecasts

Once again, analysts have become exceedingly optimistic in their estimates.

Estimates Are Extremely Optimistic

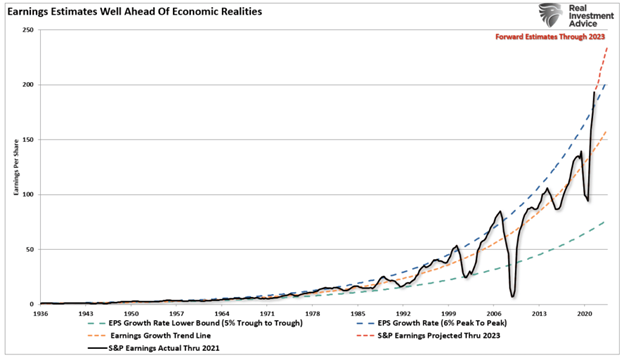

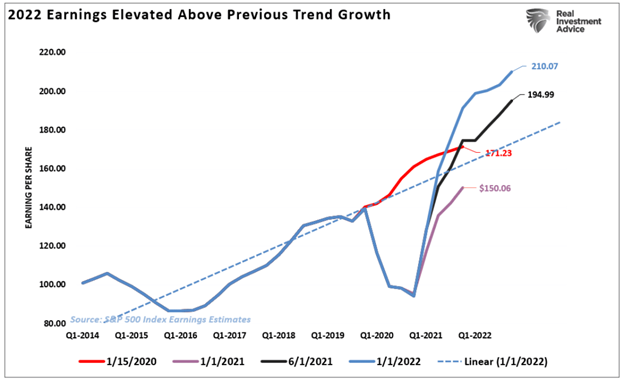

Despite economic growth weakening as inflation increases, liquidity reducing, and profit margins under pressure, analysts continue increasing their earnings estimates. Currently, estimates for the Q4-2022 are $219.87/share according to S&P, up from $207/share at the end of 2021. As shown, that level will exceed the historical 6% exponential growth trend, which contained earnings growth since 1950, by the most significant deviation ever.

The only two previous periods with similar deviations are the “Financial Crisis” and the “Dot.com” bubble.

With analysts extremely exuberant, there seems to be little concern for investors. However, I would caution against such complacency. As shown, reversions are historically very swift.

The most significant drivers to bottom-line earnings remain accounting gimmicks, share repurchases, and lower tax rates. However, as we advance, there are numerous risks to earnings.

- Changes to tax code and/or rates

- Increased borrowing costs from higher rates.

- Increased wage costs

- Inflationary pressures

- Decreased demand

- Slower economic growth

- A reversal of share buybacks either through choice or legislation

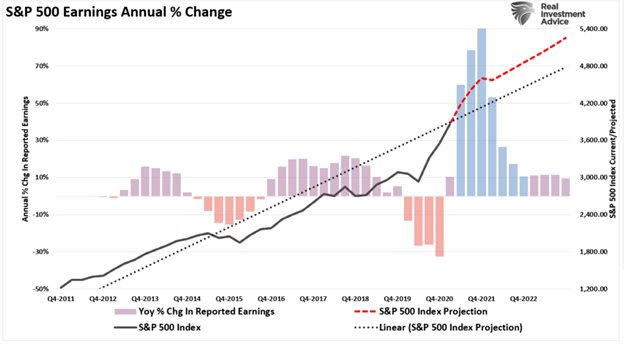

However, regardless of those potential impacts, the annual rate of change in earnings will slow markedly as year-over-year comparisons become more challenging.

The “Sugar High” Reversal

The “sugar high” of economic growth seen in the first half of 2021 resulted from a massive deficit spending surge. While those activities create the “illusion” of growth by pulling forward “future” consumption, it isn’t sustainable. Importantly, profit margins will follow the reversal of that liquidity.

Before falling victim to the “buy the market because it’s cheap based on forward-estimates” line, make sure you understand the “what” you are paying for. Earnings are a derivative of economic growth over time. What consumers “spend” in the economy drives revenue and earnings. As economic growth slows, so will earnings growth rates.

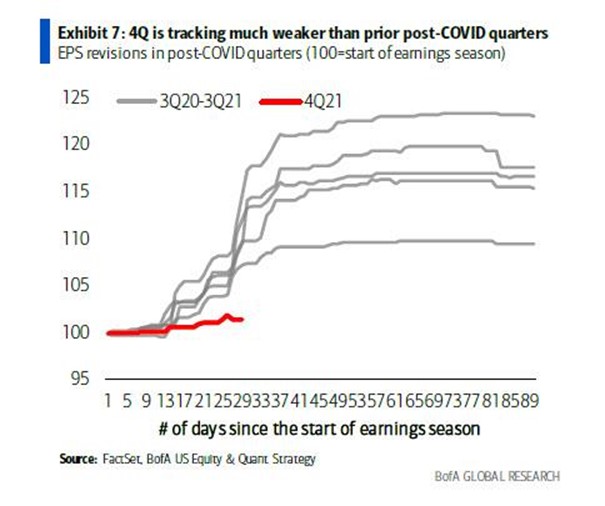

Wall Street analysts are always exuberant, hoping for a continued surge in earnings in the months ahead. But such has always been the case. However, as noted recently by TheMarketEar, fourth-quarter earnings are sending an important message.

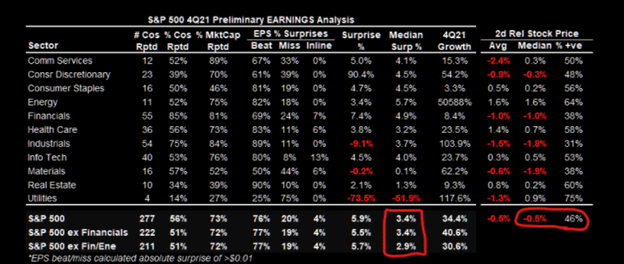

“56% of S&P 500 companies representing 73% of market cap have reported 4Q21 earnings. The results are good and broad across sectors as widely anticipated. 34.4% earnings growth is strong, but down from ~42% in 3Q21 as the growth rate of change slows. Also notable was the lack of stock price follow-through in response to reports with less than half the companies outperforming the market in the days around their report. Price doesn’t lie”

The “Sugar Rush” reversal will have significant implications for earnings as consumers’ ability to “pull forward” consumption abruptly ends.

While Wall Street equity strategists continue to hope that earnings growth will continue to accelerate, there is ample evidence such will not be the case.

Earnings Already Disappointing Expectations

Already, as noted, we are seeing the reversal of growth between Q3 and Q4 of last year, while at the same time, analysts are lifting estimates.

Such could be problematic, as Morgan Stanley recently noted.

“In the current earnings season, 4Q consensus EPS was tracking just 2% above where it stood on Jan 1. Such was led by tech and financials. Revenue beats are even more precarious, tracking at just +1% versus consensus. That is far weaker than prior quarters since COVID when EPS was +11% on average vs. consensus by Week 3.” – Zerohedge

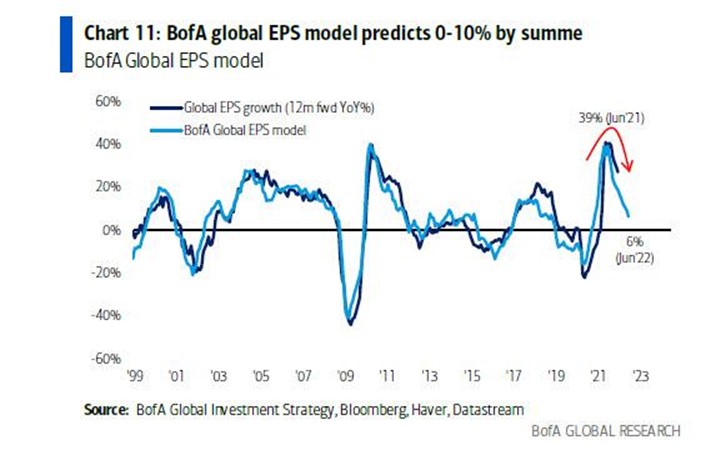

BofA is now expecting global EPS growth to tumble to 0-10% by the summer. Such will likely coincide with the Fed hiking rates and tapering bond purchases, accelerating an economic slowdown.

Such brings me to a conclusion from Zerohedge, which I could not pen better.

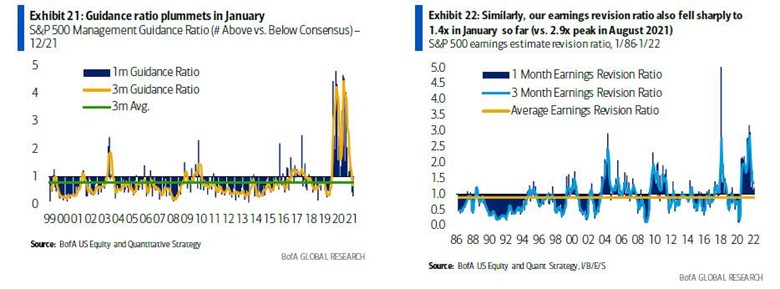

“Which brings us to the punchline. There is persistent optimism among investors that the current earnings soft patch will promptly recover. However, the guidance ratio from corporations, who know their business better than anyone, has plummeted to Feb 2020 level.

The biggest deterioration remains in guidance. BofA’s guidance ratio tracker (number above vs. below-consensus guidance) tumbled to just 0.29x so far in January. Such is only slightly better than the Feb 2020 level when COVID first hit (0.26x). The 3-month ratio is 0.67x versus the long-term average of 0.80x.

Consistently, Q1 EPS also fell 0.6% since the earnings season began, representing the first downward revision for forward-Q1 EPS since COVID. Similarly, the bank’s earnings revision ratio also sharply fell to 1.4x in January veruss the 2.9x peak in August 2021.”

So, if you are betting on accelerating earnings in the future, you may want to reconsider your plan.

Such is mainly the case given the Fed’s plan to tighten monetary policy.

The Fed Will Derail Earnings

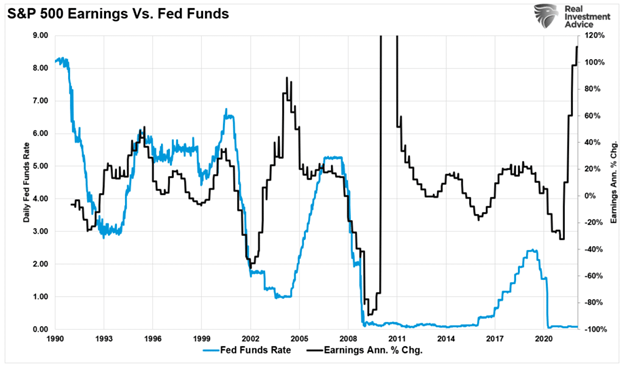

While few Wall Street analysts expect substantially weaker economic growth in 2022, there is a high probability such will be a reality. The most considerable risk to earnings comes as the Fed begins to “taper” bond purchases and hike rates.

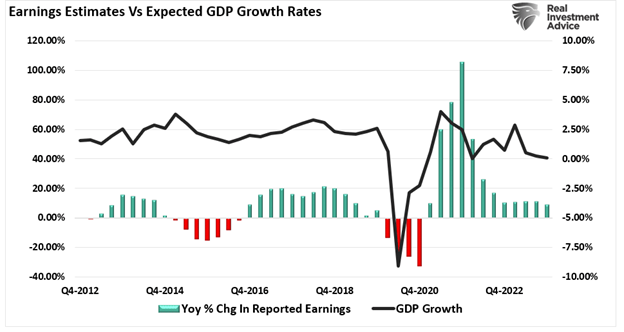

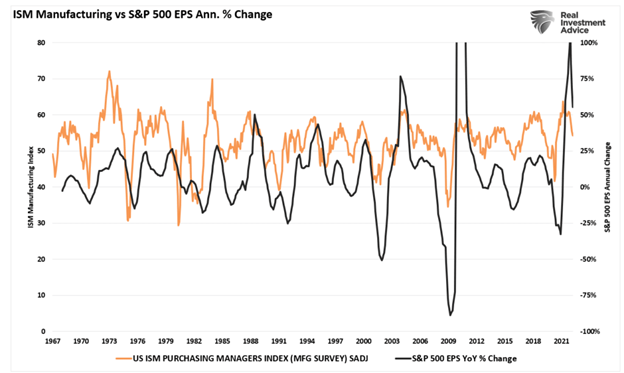

There is a high correction between the annual change in earnings, estimates, and the economy. Such gets shown in the chart below of the annual change in earnings versus the ISM Manufacturing index. As the economy slows, it should be no surprise that earnings also slows along with profit margins.

When the Fed hikes rates, that tightening of monetary policy slows economic growth further. That risk gets exacerbated when the economy is dependent on low rates to support economic growth.

Such is why earnings don’t survive rate hikes.

No one is expecting a recession. Yet there are few tailwinds supportive of continued economic resurgence to meet current earnings estimates.

- Economic growth outside of China remains weak

- Employment growth is going to slow.

- There is no massive disaster currently to spur a surge in government spending and reconstruction.

- There isn’t another stimulus package like tax cuts to fuel a boost in corporate earnings.

- Deficit spending is reversing to normal run rates

- Unfortunately, it is also just a function of time until a recession occurs.

Wall Street is notorious for missing significant turning points in markets and leaving investors scrambling for the exits.

While no one on Wall Street told you to be wary of the markets in 2018, we did. Of course, we also warned you early in 2020. but it largely fell on deaf ears as “F.O.M.O.” clouded basic investment logic.

It is pretty likely before we get to the end of 2022, it will happen again.