As in previous years, the Federal Reserve was clear. It said it was going to raise rates, and it did. Many investors learned last year, to their peril, not to fight the Fed. Going forward, the Fed has said it will raise rates and keep them elevated. Many investors will most likely learn the same lesson this year. Don’t fight the Fed…

“Market timing is impossible – managing exposure to risk is both logical and possible.”

– Benjamin Graham

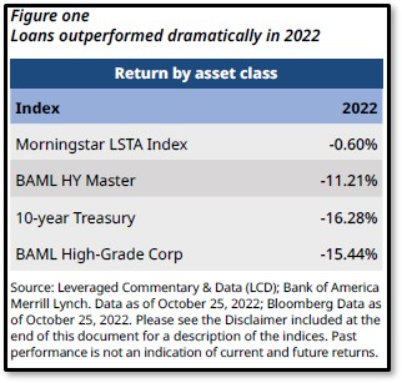

The loan market was not fully immune to the macro-induced volatility of 2022. However, the relative outperformance of loans versus many other asset classes and markets more exposed to interest rates was stark (see figure one). Loans outperformed in dramatic fashion and provided the reduced downside risk that we regularly discuss with our investor partners. The resiliency was unambiguous. Low quality certainly underperformed while dispersion increased and the push/pull between fundamentals and technicals and the haves and have-nots continued.

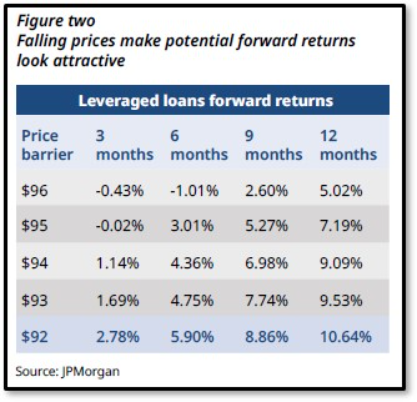

Regardless, loans today still offer a value and an income profile not witnessed in years. The JPMorgan Leveraged Loan Index is currently yielding c.9.92% at an average price of $92.83.1 These levels suggest robust forward returns (see figure two below).

In our opinion, it is difficult to see performance from traditional equity and fixed income products beating these levels over the coming year. Based on these numbers and the historic record of the index, we believe this is a once-in-a-decade opportunity. But do investors have the courage to take it? Unfortunately, many humans and organizations are not designed to make timely investment decisions. Daily media commentary is dominated by headlines designed more to elicit a response – a click – than to inform. It can color perceptions and encourage excessive caution. Indeed, this gloomy coverage is helping to create the current opportunity. We believe loan price and yield levels today are factoring in far- and wide-ranging default and loss outcomes.

“The investor’s chief problem – and even his worst enemy – is likely to be himself.”

– Benjamin Graham

PORTFOLIOS NEED TO REFLECT FUTURE OPPORTUNITIES, NOT PAST REALITIES

We do not deny there are good reasons to be fearful. Higher inflation, higher interest rates, lower growth and volatility are all causes for concern. This is a tough environment for companies with weak and rate-sensitive balance

sheets. We believe defaults will inevitably move higher from essentially non-existent levels. But what might that actually mean?

The three-year average default rate for leveraged loans during the Great Financial Crisis was between 5% and 6% (depending on the index), while the three-year average recovery rate was 63.57%.2 These levels suggested credit costs of approximately 3.5%. The memory of 2007/8 still lingers large and we believe this has dampened investor sentiment. Yields and spreads have not been this attractive in years and currently compensate investors for far- and wide-ranging default and loss outcomes – more than 3.5%, in our view.

Furthermore, this may be the most predicted recession in my career. If markets are forward-looking, are companies, consumers and other economic actors not preparing?

So how do we mitigate the risks to maximize investment potential? Last year dispersion was a key theme within the market in our view as low-quality risk delivered significant underperformance. For us, it was a year to focus on resiliency – quality companies with high profit margins, pricing power and those who are less rate sensitive as well as sectors less susceptible to any wider economic malaise. Cashflow and liquidity were king. As I expect the risk of prolonged economic and/or rate stress as well as liquidity shocks to remain in 2023, the prudent strategy seems to us to be more of the same. Additionally, at today’s yields and spreads, there is no need to stretch for more risk/return as the economy further adjusts to new realities.

“Far more money has been lost by investors preparing for corrections – or trying to anticipate corrections – than has been lost in corrections themselves.”

– Peter Lynch

ROMO

It is common for people to talk about FOMO – the Fear Of Missing Out – but today, more rationally, it is perhaps time to focus on a new phrase: ROMO – the Risk Of Missing Out.

Dislocation has created some attractive entry points in the loan markets. Income and yield in credit provide a historic opportunity if capital is deployed intelligently (avoiding the weaker of the herd) and with purpose. It may still be too early to invest in a wholesale manner, but it may not be too late to start nibbling at asset classes that are priced for downside protection.

“Investment is about discipline and patience. Lacking either one can be destructive to your investment goals.”

– Benjamin Graham

1. JPMorgan: Leveraged Loan Daily Update as of December 30, 2022.

2. JPMorgan & Morningstar/LSTA Leveraged Loan Index. Three-year averages were calculated using the JPMorgan Leveraged Loan Index default and recovery statistics at the end of December 2008, 2009 and 2010 and S&P/LSTA Leveraged Loan Index default statistics. Past performance is not indicative of future results.