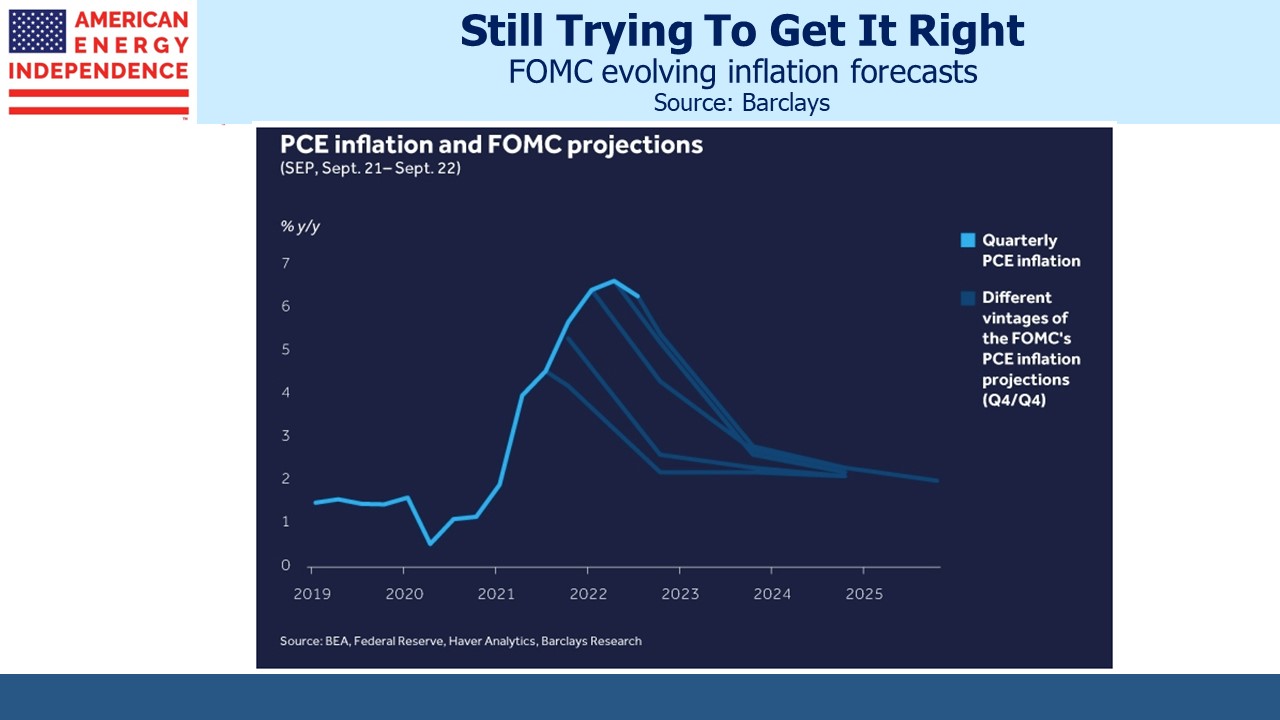

The Fed has a poor forecasting record, something Wall Street never tires of pointing out. The chart below from Barclays shows the FOMC’s constant self-correction on inflation through successive meetings.

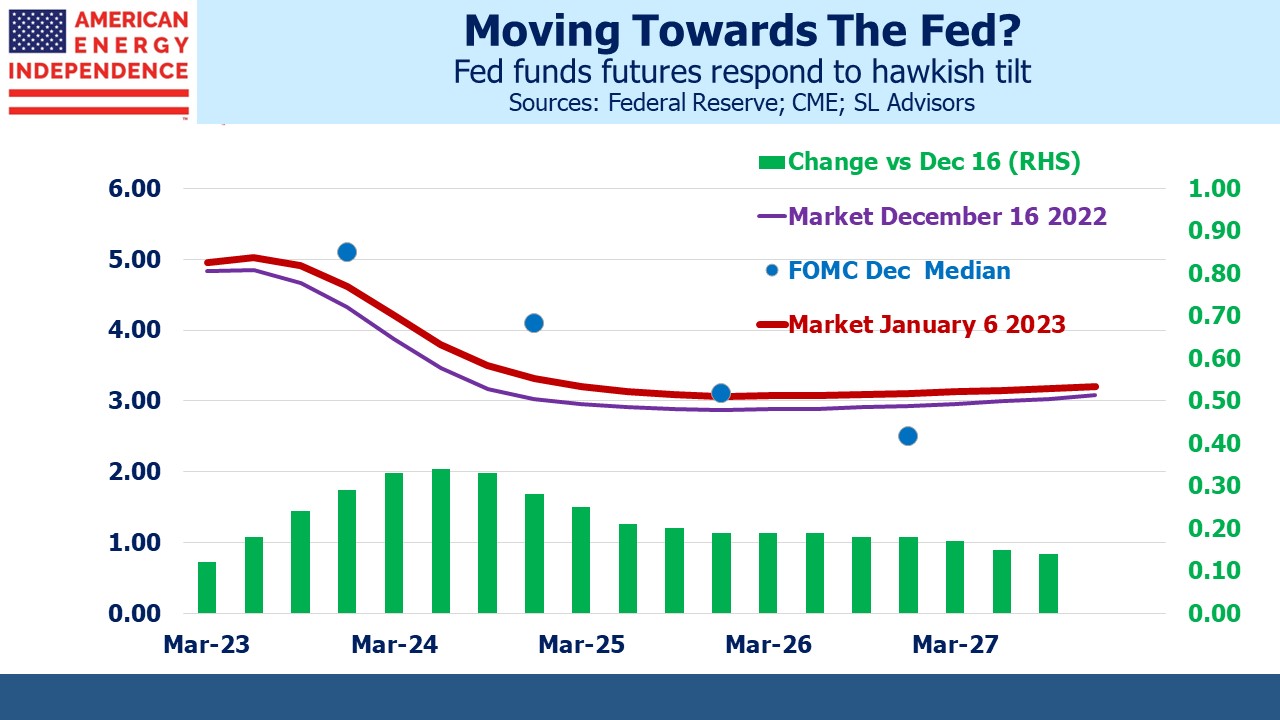

Fed chair Powell downplays the blue dots but often refers to them at his press conferences. Usually, the dots move towards the market as the Fed even has trouble forecasting their own policy rate. A recession later this year is the consensus forecast. It’s conventional wisdom that tighter policy will depress growth and induce a pivot. Fed funds futures imply easier policy by year’s end, although with less conviction than a month ago. The minutes released last week showed members expect, “a sustained period of below-trend real GDP growth would be needed.”

Futures modestly bowed towards the blue dots, with rate expectations a year out moving up 0.25% or so since the last FOMC meeting.

Inflation is finally falling and is widely expected to return to 2% within a couple of years. Long-term inflation expectations have remained surprisingly sanguine. Blackrock has a different view. In their 2023 Global Outlook they expect the “politics of recession” to force easier policy on central banks prematurely.

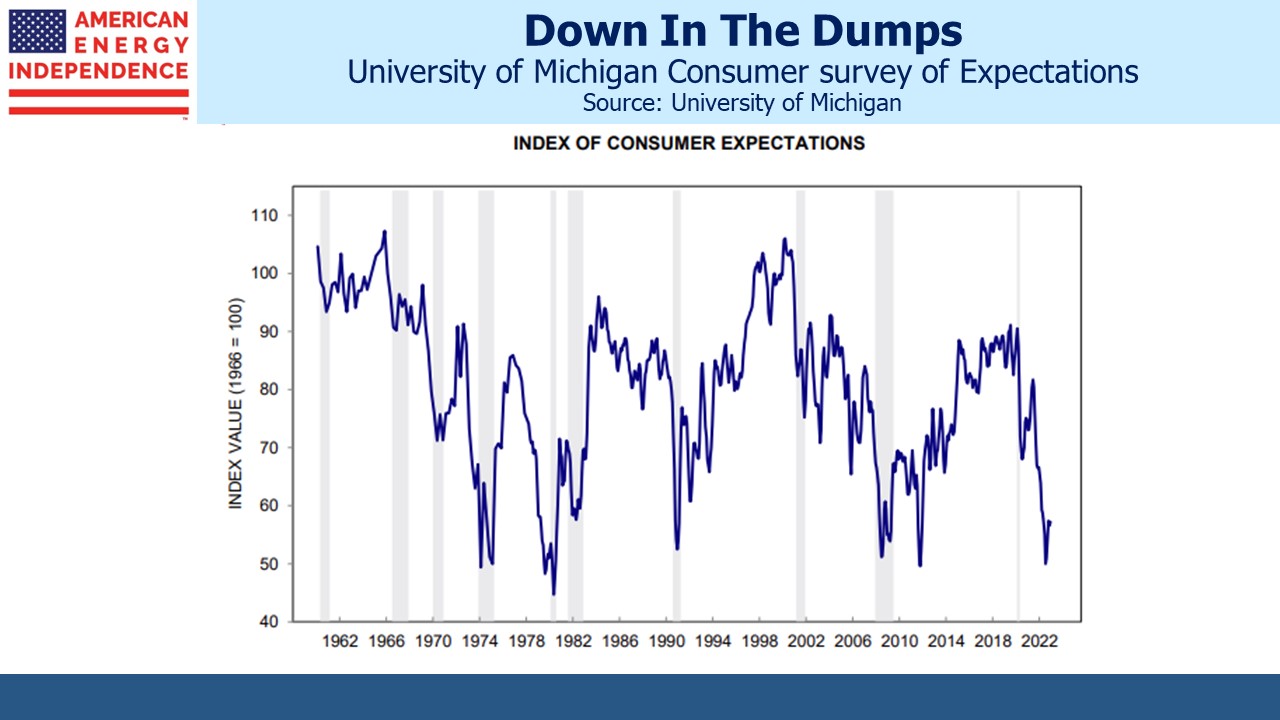

We noted recently that market sentiment measures are as negative as extremes such as the 2008 financial crisis and even turbulent 1980. Inflation was public enemy #1 and there was broad political agreement to vanquish it. Consumer expectations are recession-like and the economy is well beyond full employment.

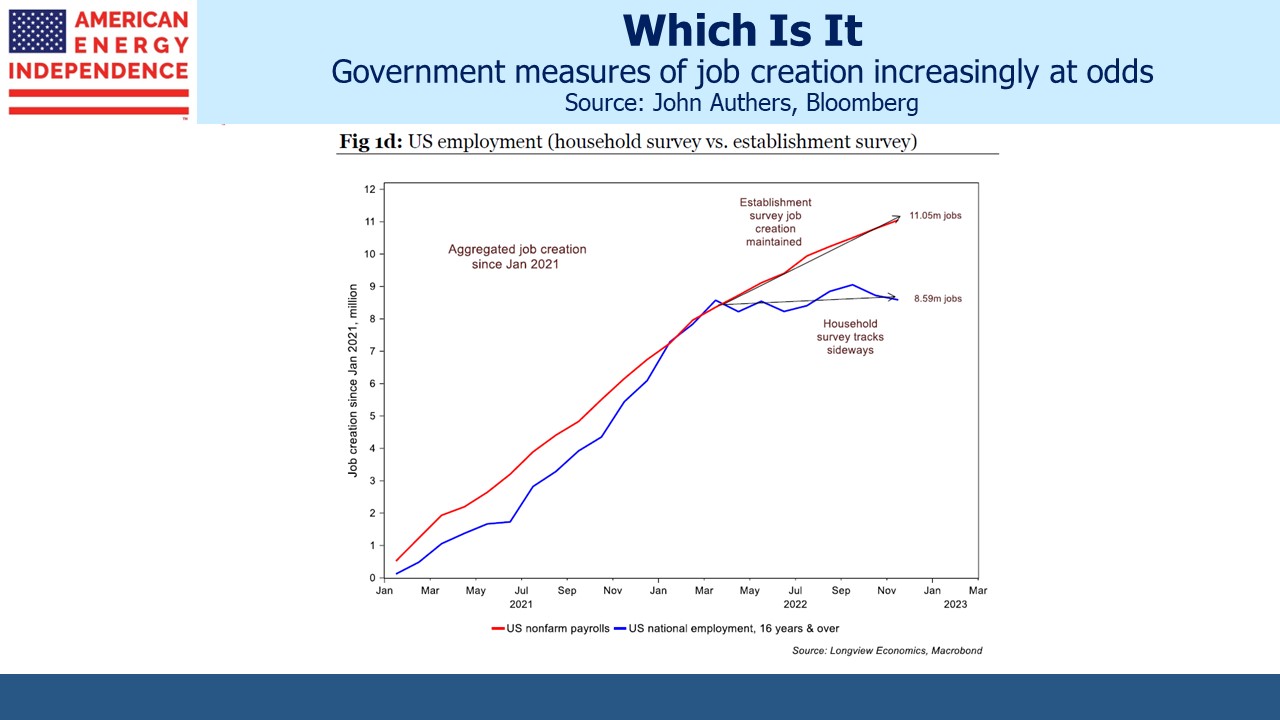

And yet, there are conflicting measures of the job market. The Establishment survey, which targets businesses, and the Household survey, which targets people, are diverging sharply in estimating job creation. Through December a gap of over 2.3 million jobs opened up between the two in the past year, approximately when the Fed began tightening monetary policy. Friday’s household survey registered an additional 717K workers, so the discrepancy has closed somewhat.

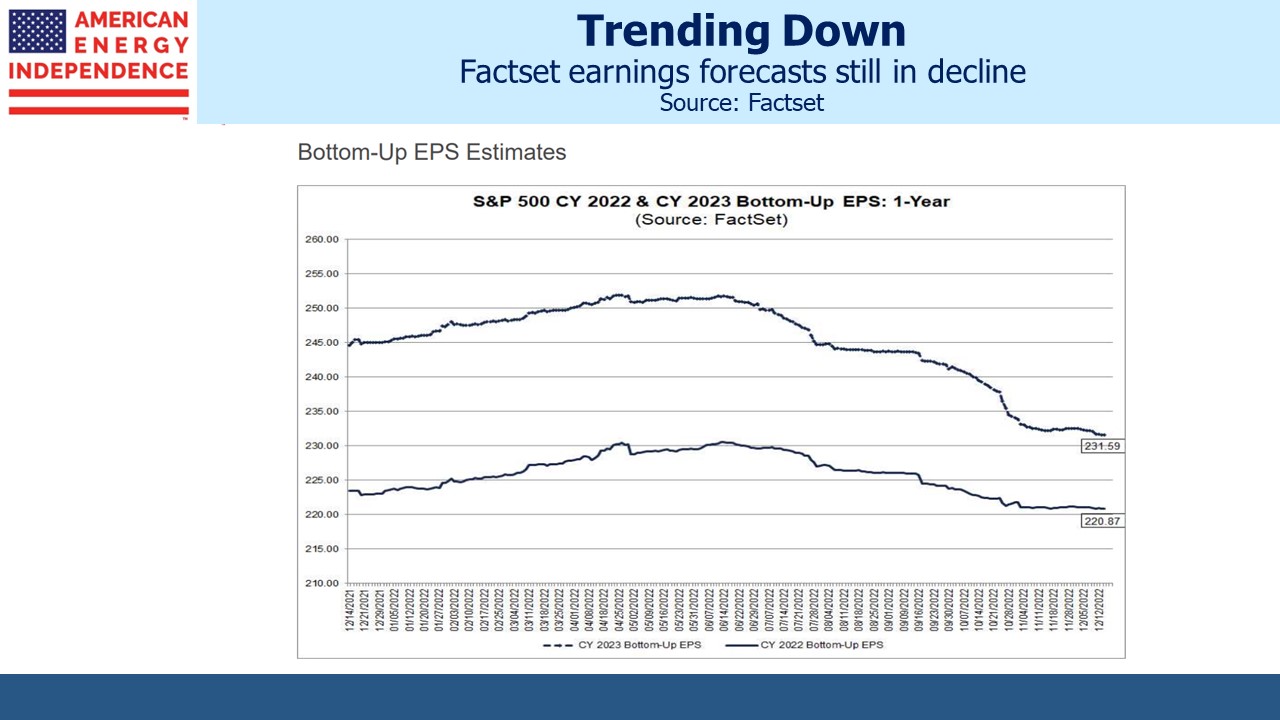

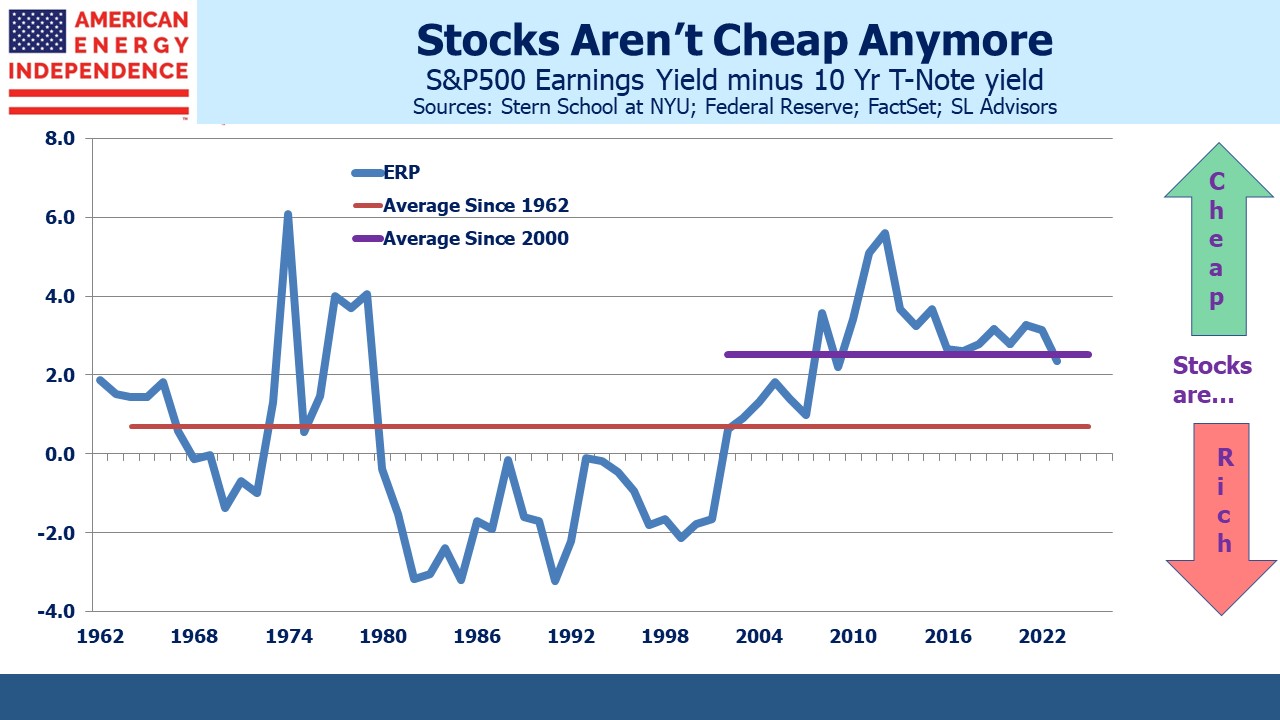

Analysts’ earnings forecasts are trending down and are expected to grow less than 5% this year. As a result, the Equity Risk Premium (S&P500 earnings yield minus the ten-year treasury yield) suggests stocks are at neutral valuation.

This suggests looming economic weakness sufficient to bring inflation back to 2%. But consumer sentiment is already so negative that evidence of a slowdown, such as a couple of weak employment reports, are likely to expose Fed policy to political criticism. Enthusiasm for reducing inflation is unlikely to withstand economic weakness.

This is the point of Blackrock’s view that we’re going to live with higher inflation. They cite three reasons: (1) an aging population (2) geopolitical fragmentation, and (3) the energy transition.

An older population means reduced eligible workers. The participation rate edged up to 62.3% and the unemployment rate fell to an historic low of 3.5%, both consistent with that long-term trend. China’s appeal for manufacturing has weakened with extended covid restrictions. Along with the risk of eventual conflict with Taiwan, companies are bringing production closer to home. The disinflationary effect of globalization is receding.

The energy transition is also inflationary, in two ways. The first is that it drives prices higher. If solar and wind were cheaper they’d be ubiquitous instead of around 14% of power generation which is itself around 19% of US primary energy.

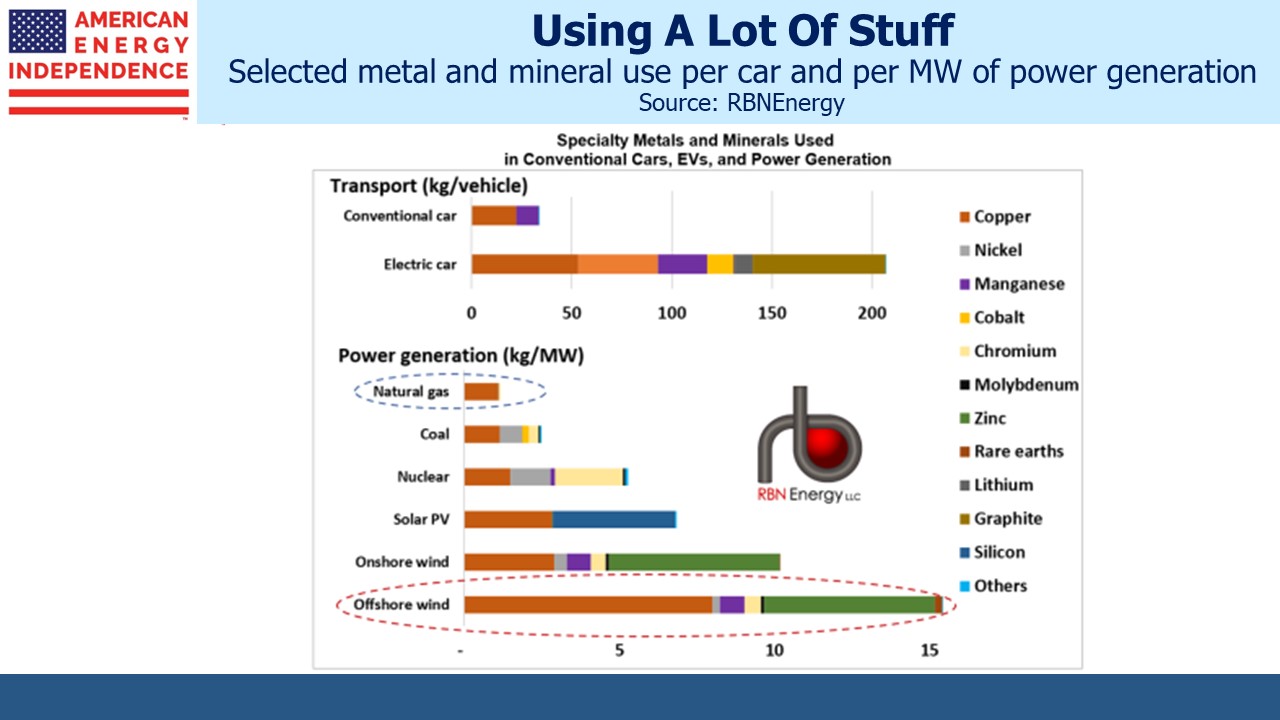

The second inflationary impulse from solar and wind is coming from their consumption of steel, cement, copper and other resources. RBN Energy compares the inputs needed to power a town of 75,000 homes with a single 100 MW combined cycle natural gas plant or 200 MW of windpower. More power output is needed than for the natural gas plant because intermittency requires generating an excess that can be stored for when it’s not windy. They estimate you’d need 200X as much iron ore, 50X as much concrete and 20X as much specialty metals and minerals such as copper, chromium and zinc.

Manufacture of wind turbines is already driving up the prices of inputs. Companies such as Vestas and Siemens Gamesa are renegotiating contracts to try and restore profitability. Avangrid has told Massachusetts that the Commonwealth Wind project, the largest offshore wind farm in the state’s pipeline, “cannot be financed and built” under existing contracts.

None of the three drivers of inflation described above is necessarily deserving of a monetary policy response. Many would regard higher energy prices in support of reduced CO2 emissions as appropriate. Natural gas prices have collapsed in recent days due to unseasonably warm weather and doubts about whether the Freeport LNG export facility will be in operation again by late January as promised by the company. But looking ahead, the energy sector is likely to remain both a source of, and a hedge against, inflation.

The post Don’t Bet On A Return To 2% Inflation appeared first on SL-Advisors.