One is backed by hope and vaporware and the other by incredibly valuable assets.

Key Points

- The latest mania of cryptocurrencies, tokens, and Defi is collapsing before our eyes.

- Assets are only assets if they are backed by something tangible that has real value.

- Sleeping at night has never been more important to investors. Brands can help.

“If there’s ever a place I can be that I’m not going to get into trouble it’s going to be at FTX…”

Kevin O’Leary, Investor, Shark Tank Co-Host

Fads, Mania’s, and Bubbles…Not Timeless Investments.

By now, you have likely seen and heard the news about FTX’s epic collapse & bankruptcy filing last week. Over the last year, lots of smaller cryptocurrency platforms have gone under and the hacking of customer digital wallets has been rampant. This mania could be larger than the Internet bubble in the late 1990’s. At the peak, the value of all crypto assets rose to an estimated $3 trillion dollars. That amount of assets makes something “systemically important.” As we sit today, those assets have fallen to an estimated $800 billion, and I highly doubt the carnage is over. The whole thing had mania and bubble written all over it, yet some of the smartest investors, including top venture capital firms like Sequoia, seemingly did very little due diligence along the way.

The fear of missing out on big deals and enormous potential profits forced otherwise intelligent investors to ignore many of the warning signs. We can, again, thank the Fed for allowing this mania to grow to $3 trillion. When you artificially suppress interest rates and keep the cost of capital at virtually zero, lots of bad businesses & industries get created. For a while, FTX seemed to be one of only a few firms being run by adults. As it’s turning out, FTX and it’s co-founder, Sam Bankman-Fried (SBF), could be at the epicenter of alleged fraud & deceit. Admittedly, I have struggled all along to understand the purpose of the entire mania-driven thematic because, at its core, if an “asset” (token) can be created out of thin air and have a value assigned to it strictly because of the greater fool theory, how stable or durable could that asset be? I wanted to believe, I truly did, I just couldn’t get there.

Without being backed by something that had real tangible value, an asset is only valuable so long as there’s demand from others to own it. What multiple do I put on vaporware, hope, and the greater fool theory? My calculator kept coming up with zeroes. The argument was, exchanges like FTX, Binance, or Coinbase, were tangible, and therefore safer. But if a crypto exchange’s mission is to allow speculation in assets that aren’t assets at all, is the exchange itself valuable? Perhaps that’s why SBF, a staunch believer in the crypto thematic, was aggressively divesting his crypto-created net worth into real businesses with real value, as fast as he could? Again, the signs were present everywhere.

Bottom line: the crypto markets are showing signs of being nothing more than just another mania that’s now bursting. Trillions of dollars have been lost.

Retail and institutional investors are losing confidence, and this is likely not over. It’s perfectly fine to “invest” in speculations but the core of someone’s portfolio should be invested in real and valuable assets.

Intangible Assets + Tangible Assets = Real Value.

It’s estimated that roughly 84% of the total value of the S&P 500 comes from intangible assets like intellectual property (IP), patents, and brands. Starting in about 1995, the value of these intangible assets was estimated to be worth more than that of valuable tangible assets like property, plant, and equipment. Combined, these two asset-types offer investors a real and lasting edge. Our team appreciated this phenomenon enough that it prompted us to create a brand-dedicated investment strategy. Up until then, investors could not easily gain access to this intangible asset thematic. Jeff Bezos, founder of Amazon, once defined “brand” as “it’s what people say about you when you’re not in the room.” Currently, the brand of Amazon is estimated to be worth $705 billion by brand valuation firm, Kantar. The entire market cap of Amazon is roughly $1 trillion. This brand, an intangible asset, is backed by the tangible assets owned by Amazon the corporation. This intangible asset has real value unlike the vaporware being speculated on across all these crypto exchanges. Investors that desire to sleep at night with their investments should focus on assets and businesses backed by something tangible like cash flows, earnings, revenues, equipment, and trademarks. Perhaps that’s why one of the greatest investors of all time, Peter Lynch, spent a lot of time researching and investing in great brands.

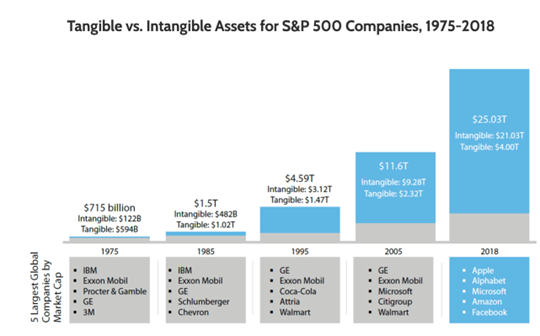

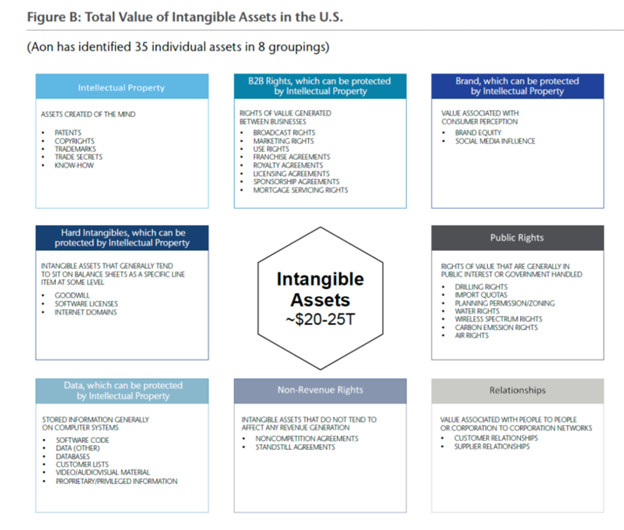

The charts below come from an AON IP Solutions report in 2018 highlighting the rise of intangibles as part of total corporate value. Given how important intangibles are to total corporate value, we think one should endeavor to have some exposure to this thematic inside a portfolio.

The first chart above highlights the growth of intangibles from 1975-2018 and estimates these corporate assets are now worth >$25 trillion. Surely that’s large enough for some portfolio dedication.

The second chart below defines intangibles and highlights how valuable they are across the corporate enterprise. Imagine how much it costs and how much time it takes to create all of these assets. That’s a real and lasting competitive moat, my friends. Why in the world would an investor not want to own a basket of companies with all these assets embedded in the corporate value of the stock?

Owning Valuable Intangible Assets Helps You Sleep at Night

The markets have been incredibly volatile this year. Now, more than ever, understanding what you own so you can sleep at night is vital for investors. We will get through this uncertain, inflationary period. Remember, equity markets go up roughly 80% of the time. This makes equities an important wealth gathering asset class over time.

Over the last 100 years we have had wars, terrorist attacks, currency crises, pandemics, recessions, financial panics, and inflationary periods like today. In the end, stocks have compounded at roughly 9-10% per year over long periods of time. We are currently in one of those 20% periods where equities are not gaining value YTD. When you know how the movie ends, isn’t it wise to use weakness like we have today to add to equities for a time when the markets are in bull-phase? In a world currently filled with fear, uncertainty, and doubt, having exposure to highly valuable assets like brands seems more important than ever. Owning valuable assets does not always ensure a company’s stock will go up every year as we are witnessing in 2022. But it does allow investors to have some comfort in knowing that valuable assets are always compelling to own, particularly when they go on sale like today. Mania’s will come and go, but real assets, valuable IP, and incredibly valuable brands selling highly desirable products and services will never go out of style. I’m not sure there is a more timeless investment phenomenon than investing in the brands we all know, trust and love.

Look around your house, analyze your activities during your last vacation, and think about the things you are doing to save for your retirement. Think about the frequency with which you interact with certain companies and how much money you spend on their products and services. Now multiply that frequency and monetary commitment by tens or hundreds of millions of people around the world. Then compound that activity over decades and ask yourself if investing your hard-earned money in the beneficiaries of these activities will provide an attractive financial outcome. I suspect if you do this, you’ll see the incredible value we see today with great assets being on sale. As today’s crypto mania unwinds, the singles & doubles approach to investing seems to get more and more compelling.

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.

The Chipotle hypothetical cost averaging example highlights the potential power of holding core positions in industry leading brands and being committed to adding to these positions when the market acts irrationally. Cost averaging leading companies can add significant value to your long-term portfolio even if you do not catch the absolute bottom in the stock. Details on this hypothetical are below.