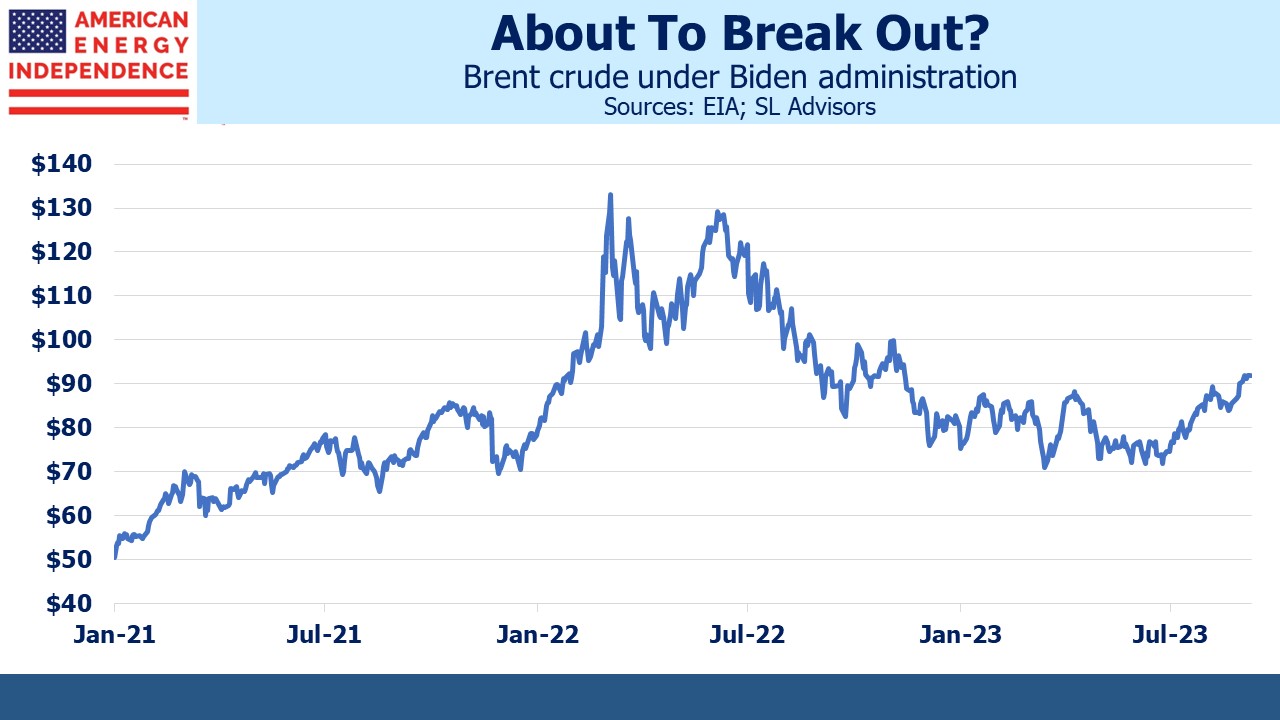

Crude oil has rallied recently, in a much-delayed reaction to numerous analyst forecasts that have been bullish all year. A couple of months ago Goldman’s commodities head Jeff Currie, who is leaving the bank, cut his year-end forecast for Brent crude from $95 per barrel to $86 while maintaining his long-term bullish outlook. He blamed ongoing releases from the US Strategic Petroleum Reserve (SPR) and “a more discerning approach to sanctioned oil,” meaning that Iran and Russia are exporting more than he expected.

Currie and other analysts have maintained a bullish long-term outlook because they see a growing supply-demand imbalance. This has been delayed by the issues mentioned above, but there are signs that crude is entering a sustained uptrend.

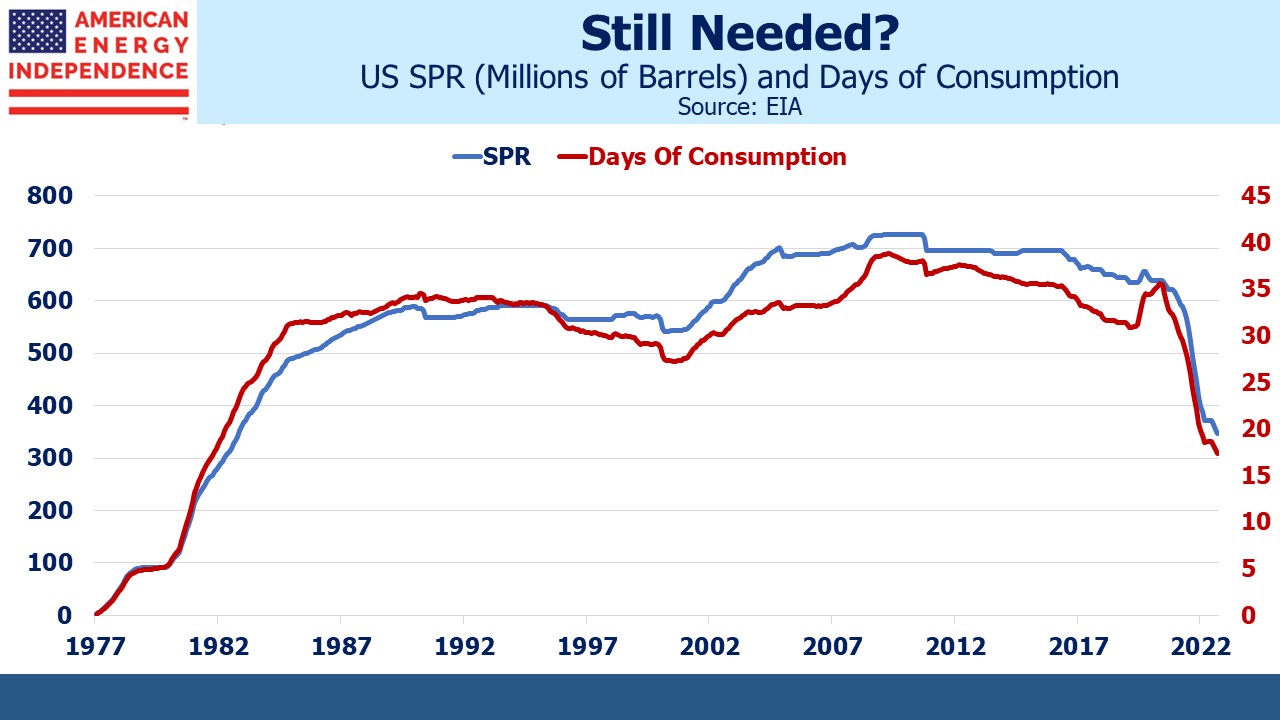

Sales from the SPR have weighed on prices. Last year the Administration released crude oil prior to the midterms, leading to criticism that they were cynically risking our energy security in a short-term effort to buy votes. While this may have been the motivation, sales have continued and the SPR is at its lowest level in forty years.

The US consumes about 20 Million Barrels per Day (MMB/D) of crude oil and petroleum products, a figure that hasn’t changed much in over two decades. The sharp decline in the SPR means it covers just 17 days of consumption compared with the 30-40 days that was common for much of the SPR’s existence.

The 1975 Energy Policy and Conservation Act was passed in response to the 1973-74 OPEC oil embargo during the Yom Kippur War. America’s energy security is dramatically different nowadays, thanks to fracking and horizontal drilling. The White House is likely to dip into the SPR again in the run up to next year’s election. Doing so will be politically expedient, but perhaps we no longer need to keep oil in storage given our ready access to domestic supply.

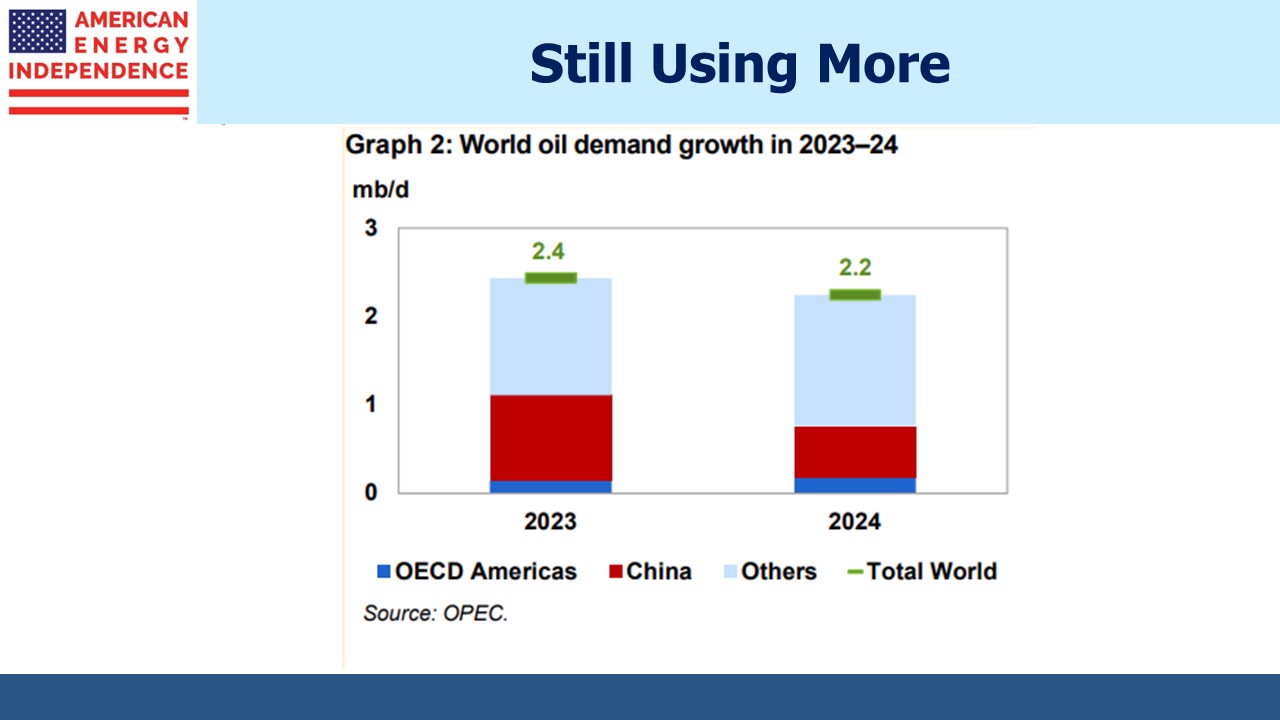

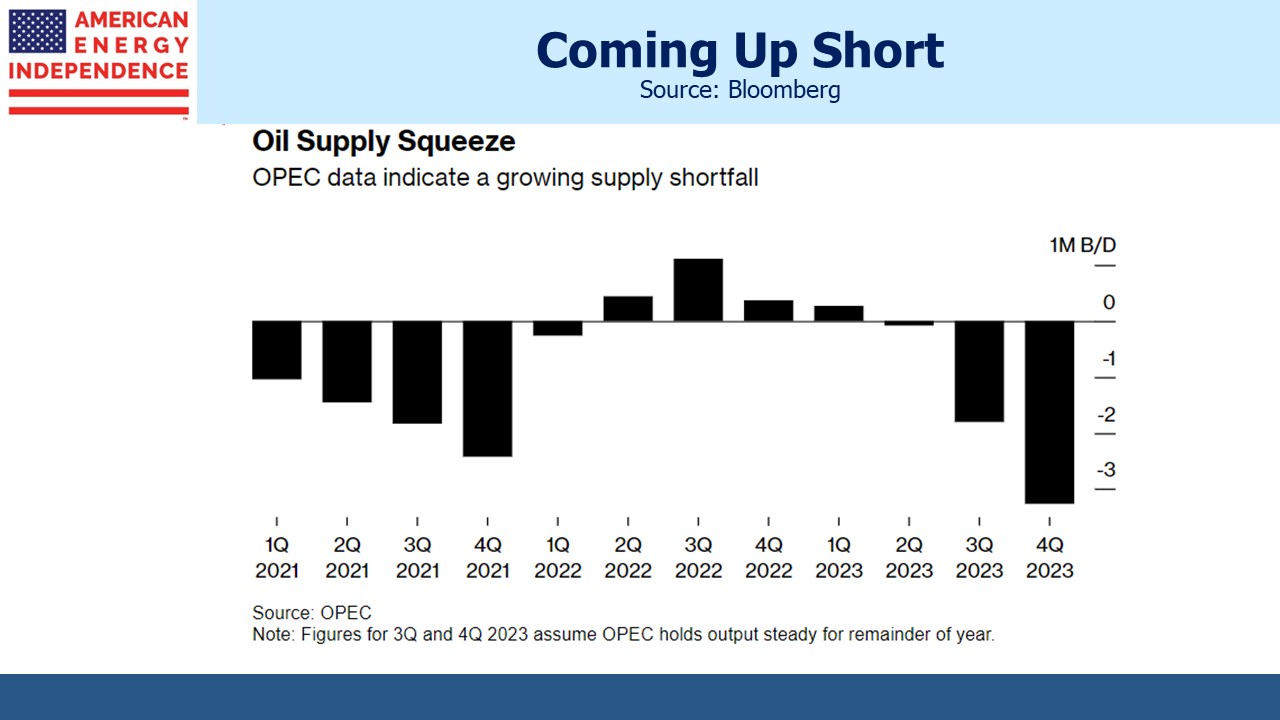

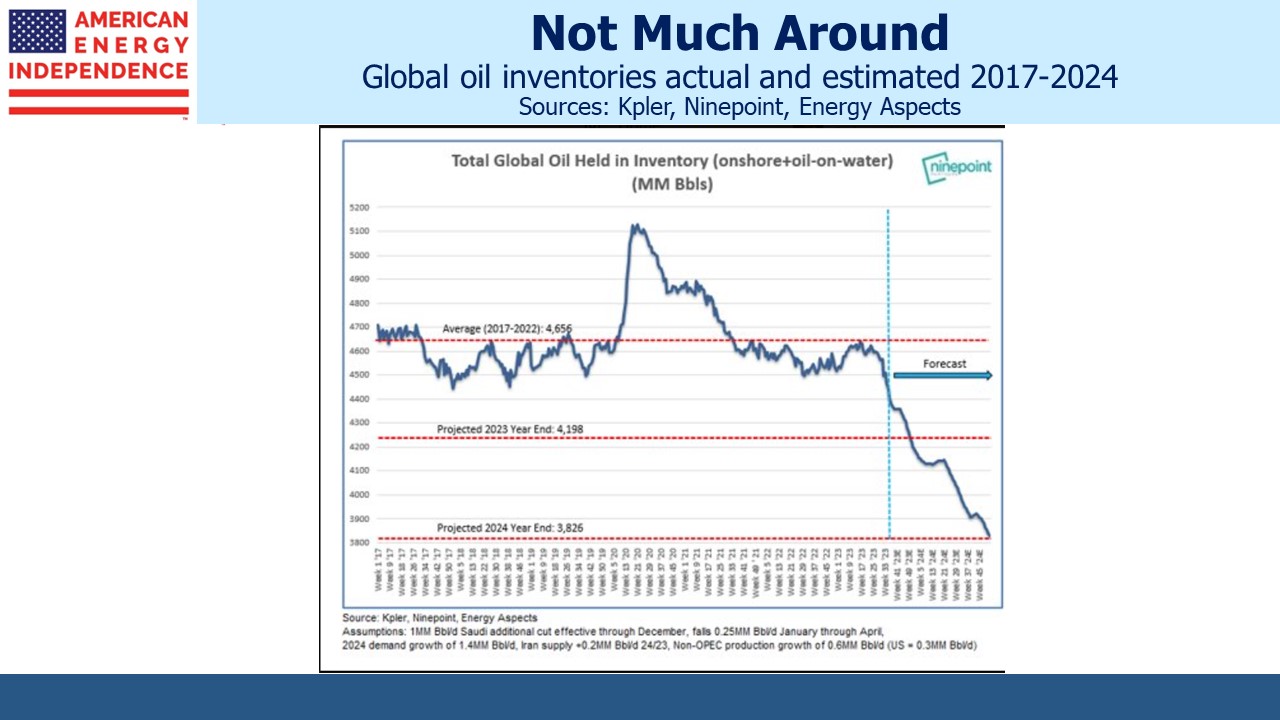

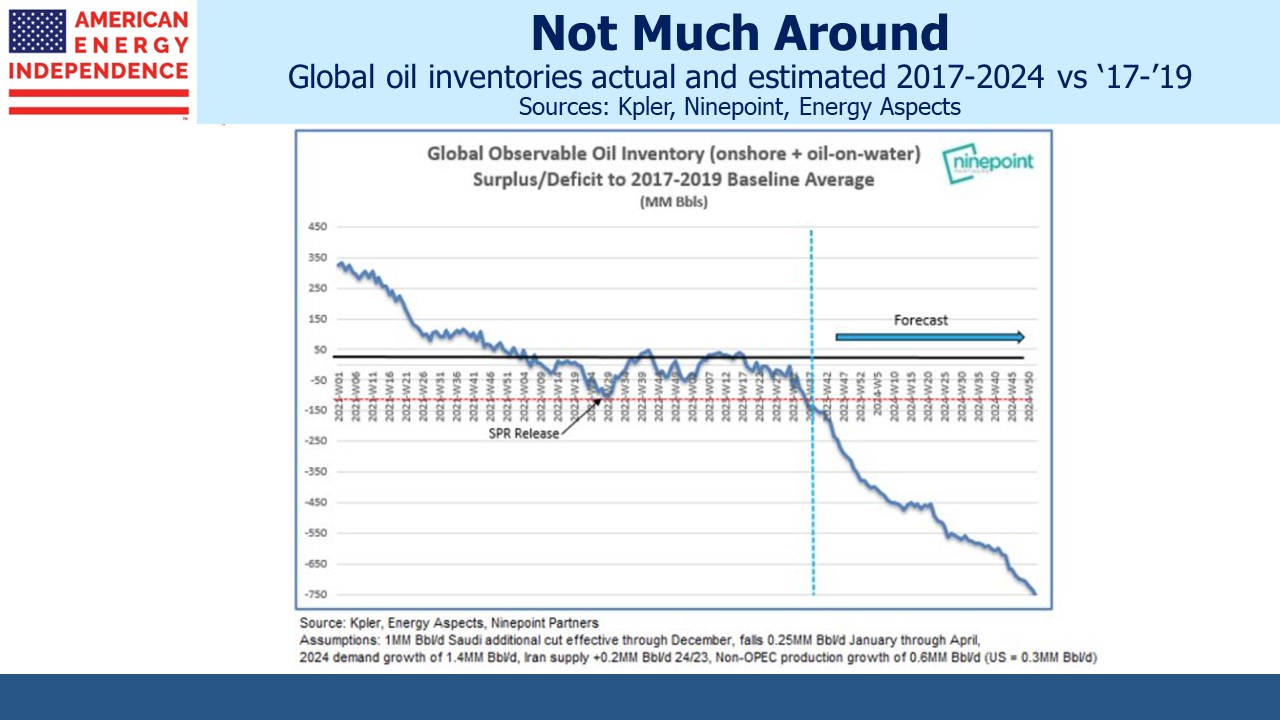

OPEC+ has responded by limiting supply, since they want the highest price that can sustain current demand. OPEC expects global oil demand this year to set a new peak of 102.1 MMB/D and to rise further next year.

Meanwhile they see a growing supply shortfall, exacerbated by the Saudis and Russia extending their 1.3 MMB/D cut through year’s end. Other analysts agree.

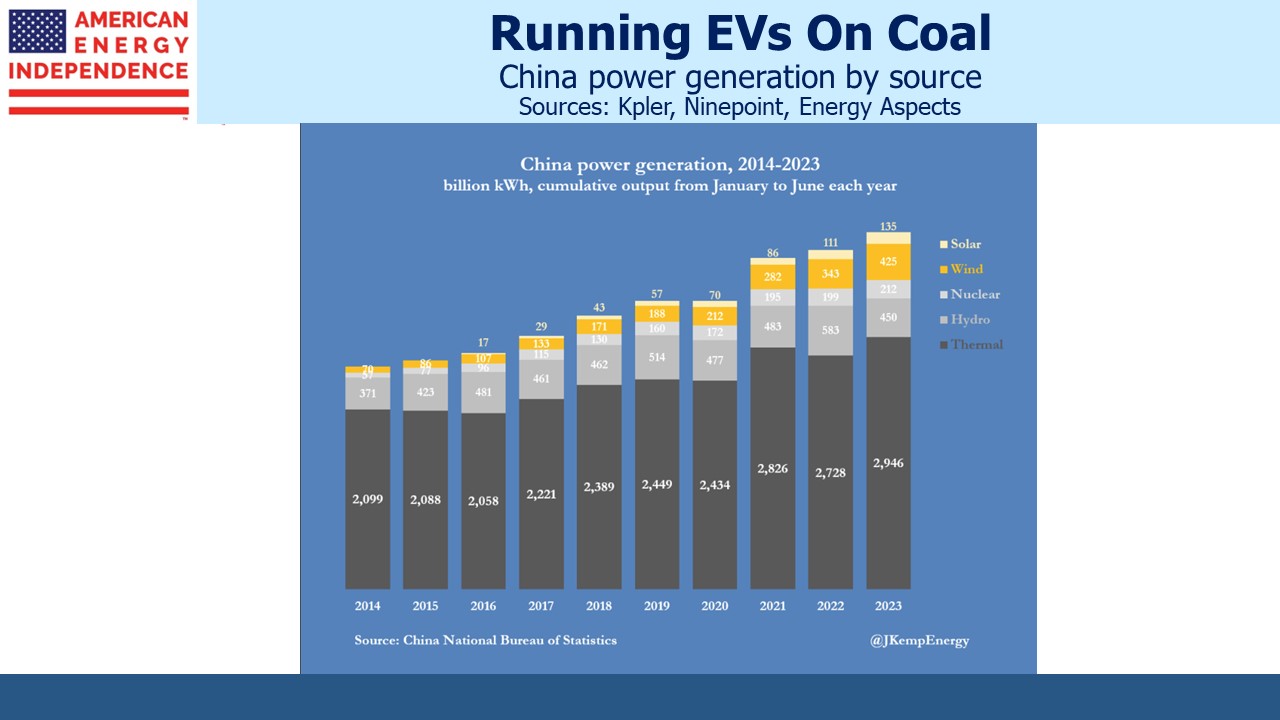

The International Energy Agency (IEA) expects 2024 global oil demand growth less than half of OPEC’s. They see gasoline demand peaking over the next couple of years at 26.6 MMB/D as Electric Vehicles (EVs) continue to gain market share, especially in China. They see EV sales growing from 10.8 million last year to 25.9 million by 2028, at which point they’d represent more than a quarter of new car purchases. By then crude oil demand will be over 3 MMB/D lower than without EVs.

However, since China gets 60% of its total energy from coal and 71% of its electricity, the growth in EVs led by China hardly seems a cause for celebration. Given the greenhouse gas emissions and local pollution from coal, it’s quite possible the world would be better off if China stuck with internal combustion engines.

The Tesla owners I know love their cars, but they all have another conventional car for long trips. An Uber driver once told me that she was happy with the Tesla leased from the company but confessed to spending an hour recharging it in the middle of every day. EV sales have momentum, but I’m in no great rush to join. It’s bad enough worrying about recharging my iphone battery, never mind my wheels.

The IEA expects growth in jet fuel and petrochemicals (lubricants, solvents etc) will continue to push global oil demand higher at around a 1% annual rate. Nonetheless, they share the short term concern of others that low inventories, extended OPEC+ production cuts and increased demand from developing countries could push prices higher over the near term.

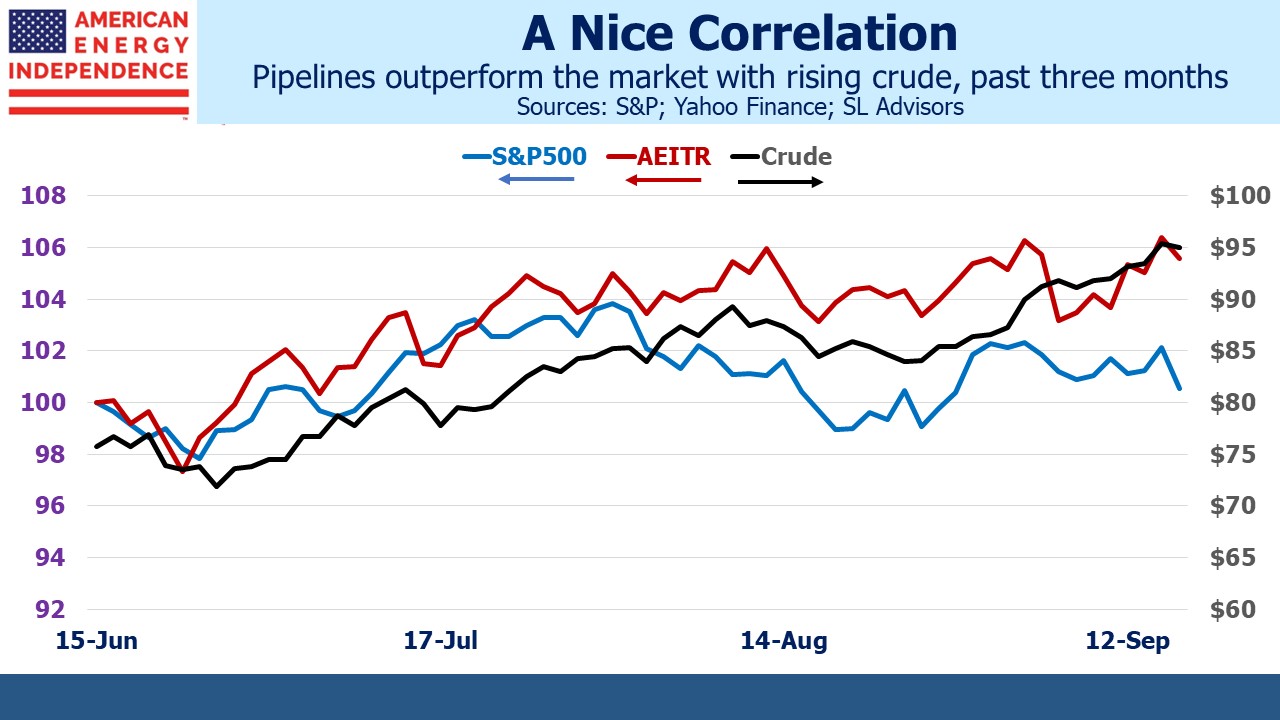

Discussion of the correlation between crude oil and midstream energy infrastructure is common when they’re both falling. We’ve written about this topic in the past. The relationship between pipeline stocks and commodities has been weak over the past couple of years (see Oil And Pipelines Less In Sync) However, over the last three months Brent crude has risen over $15 per barrel.

Pipeline companies are unlikely to revise earnings guidance, but there’s little doubt that this latest move shows sentiment towards the energy sector is improving. The fundamentals have been strong for a long time.

We have three funds that seek to profit from this environment:

Energy Mutual Fund

Energy ETF

Inflation Fund

The post Crude Climbs The Wall Of Supply Worries appeared first on SL-Advisors.