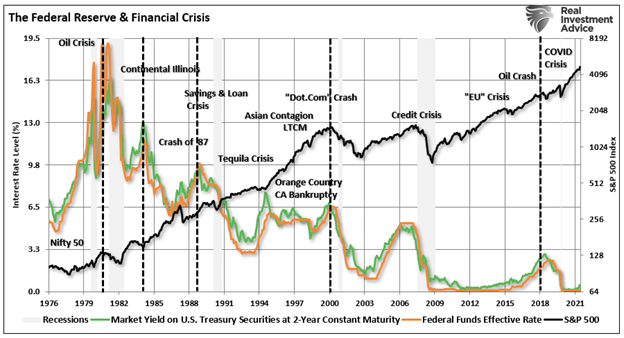

Could the Fed trigger the next “financial crisis” as they begin to hike interest rates? Such is certainly a question worth asking as we look back at the Fed’s history of previous monetary actions. Such was a topic I discussed in “Investors Push Risk Bets.” To wit:

“With the entirety of the financial ecosystem more heavily levered than ever, the “instability of stability” is the most significant risk.

The ‘stability/instability paradox’ assumes all players are rational and implies avoidance of destruction. In other words, all players will act rationally, and no one will push ‘the big red button.’

The Fed is highly dependent on this assumption. After more than 12-years of the most unprecedented monetary policy program in U.S. history, they are attempting to navigate the risks built up in the system.“

The problem, as shown below, is that throughout history, when the Fed begins to hike interest rates someone inevitability pushes the “big red button.” Such has been the case each time the Fed has hiked rates.

The behavioral biases of individuals remain the most serious risk facing the Fed. While they may hope that individuals will act rationally as they hike rates and tighten monetary policy, investors tend not to act that way.

Importantly, each previous crisis in history was primarily a function of extreme excesses in one area of the market or economy.

- In the early 70’s it was the “Nifty Fifty” stocks,

- Then Mexican and Argentine bonds a few years after that

- “Portfolio Insurance” was the “thing” in the mid -80’s

- Dot.com anything was a great investment in 1999

- Real estate has been a boom/bust cycle roughly every other decade, but 2007 was a doozy

What about currently?

A Bubble In “Everything”

No matter what corner of the market or economy you look there are excesses.

- Real estate,

- FANG-NATM (Facebook, Apple, Netflix, Google, Nvidia, Amazon, Tesla and Microsoft)

- EV’s – Tesla is a $1 Trillion dollar company.

- Corporate debt,

- Credit,

- Private equity,

- SPAC’s,

- IPO’s,

- “Meme” stocks; and,

- Options speculation

The list could go on, but you get the idea.

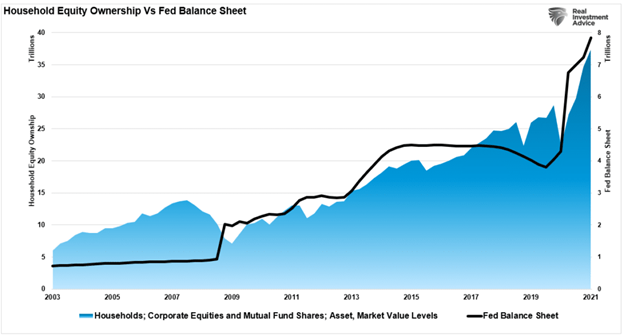

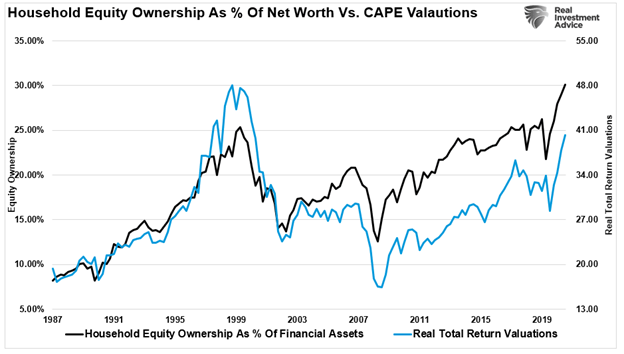

There is a correlation between the Fed’s interventions and the surge in speculative risk-taking. As shown, household equity ownership is highly correlated to the Fed’s balance sheet.

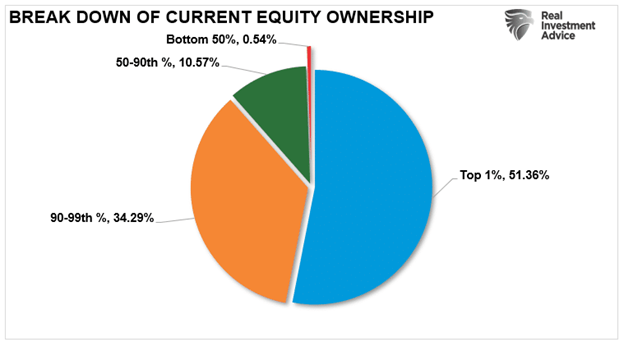

Unfortunately, in order to invest in the financial markets, individuals must have disposable income with which to invest. However, while the massive interventions by the Fed inflated the most prominent financial bubble in history, it did little to boost economic growth or prosperity. As a result, the top 10% of income earners own roughly 90% of the financial market assets.

Not surprisingly, after more than a decade of ultra-accommodative monetary policies, risk appetites surged as participants came to believe the Fed eliminated all “risk.”

Of course, if there is “no risk of loss,” why not take on more risk? Such is exactly what everyone did.

A Bubble In Leverage

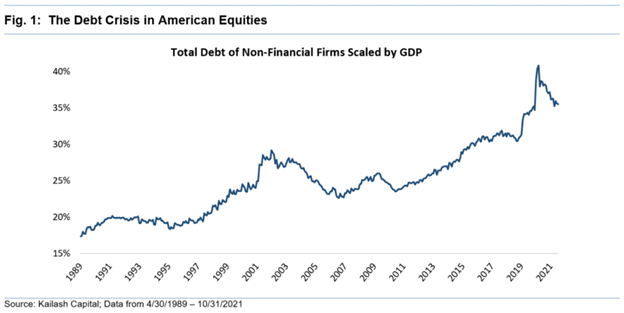

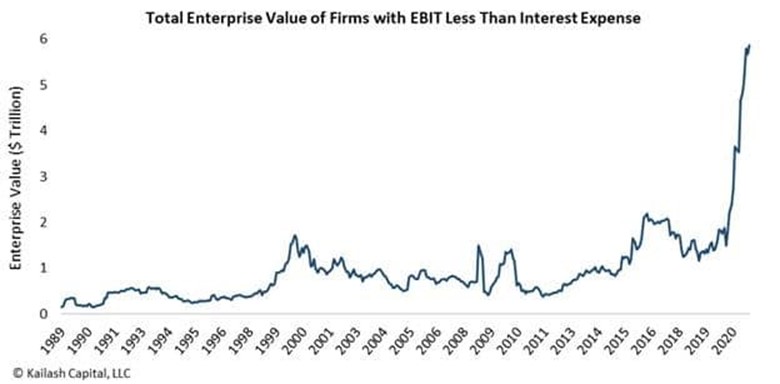

In Seth Klarman’s famous book, “A Margin Of Safety,” he discussed the 1980’s bond mania before it imploded. At that time, many companies issued bonds even though they could not afford to pay the interest expenses. Today, we call such companies “zombie companies,” as they must feed on cheap debt to stay alive. Currently, the market capitalization of these zombie firms is at a record.

Chart courtesy of Kailash Concepts

Chart courtesy of Kailash Concepts

The obvious problem is what happens when they cannot refinance their debt. Unfortunately, as Kailash Concepts explains, debt itself is a significant risk.

“Currently, the world is awash in financial alchemy. There is currently a record number of companies unable to cover their interest expense from profits.

Since 2007, a big part of America’s debt crisis has moved from the financial sector to non-financial stocks with too much debt. We believe the mix of record debt and record equity valuations is likely a side effect of real rates approaching lows last seen in 1973. Whether we are right or wrong on the causality, the facts are intimidating in our view.

Our research has documented that the world has never been less prepared or less equipped to deal with a possible outbreak of inflation or pull-back in Federal largesse.

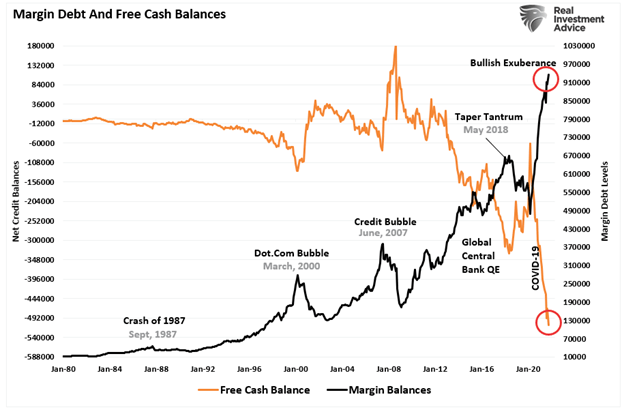

However, it isn’t just a corporate leverage bubble. It is also a bubble in investor leverage as individuals take on debt to chase markets.

Of course, the critical thing about “margin debt” is that it fuels the bullish advance. But, unfortunately, it also accelerates the market’s eventual decline as leverage reverses. Such is always a brutal and mauling event, which is why Wall Street calls it a “bear market.”

The Risk Of A Policy Mistake Is Enormous

In “Rising Interest Rates Matter” we discussed how if interest rates rise, the Fed tightens monetary policy, or the economic recovery falters, a financial crisis is possible.

“In the short term, the economy and markets (due to current momentum) can DEFY the laws of financial gravity as interest rates rise. However, they act as a ‘brake’ on economic activity as rates NEGATIVELY impact a highly levered economy:”

- Rates increases debt servicing requirements reducing future productive investment.

- Housing slows. People buy payments, not houses.

- Higher borrowing costs lead to lower profit margins.

- The massive derivatives and credit markets get negatively impacted.

- Variable rate interest payments on credit cards and home equity lines of credit increase.

- Rising defaults on debt service will negatively impact banks.

- Many corporate share buyback plans and dividend payments are done through the use of cheap debt.

- Corporate capital expenditures are dependent on low borrowing costs.

- The deficit/GDP ratio will soar as borrowing costs rise sharply.

Most importantly, over the last decade, the primary rationalization for overpaying for equity ownership is that low rates justify high valuations. Unfortunately, with inflation surging, which shrinks profit margins, and the Fed set to hike rates, valuations are likely a bigger issue than most suspect.

As Mohammed El-Erian stated in a recent interview:

“Investors should keep an eye on the risk of an abrupt shift from a relative valuation market mindset to an absolute valuation one. If that happens, you should stop worrying about the return on your capital and start worrying about the return of your capital.”

However, for now, there is no reason to worry about the next “financial crisis.”