Key Points

- Corrections & bear markets happen as a normal part of the economic cycle.

- Even the most admired & profitable brands experience big corrections.

- There’s always demand for top assets as they go on sale. Buy these dips.

Corrections & Bear Markets Happen. The Upside? They Offer Investors Opportunities

I’m sure you’ve seen the long-term data on equity markets. Historically, equity markets are positive roughly 80% of the time, or 8 out of 10 years. So far this year, they are negative. In addition, the average annual drawdown peak to trough is ~14% (source: J.P. Morgan Guide to the Markets Report). What’s the good news? The statistics show that every savvy investor gets at least one opportunity to buy great assets on sale during shorter-term periods of volatility. That knowledge is your secret weapon as an investor today. While these volatile and down periods never feel good, they do offer investors the ability to build bigger positions in common sense strategies. Every consumer loves the opportunity of a good sale. But for some reason, when stocks are down, investors freeze. If you invest in companies that have a history of long-term outperformance as we do, you’ll likely be very happy at the end of your investment period. More importantly, if you are willing to add to these positions when great brands go on sale, you’ll likely be even happier.

Great Brands Are Not Immune from Corrections & Bear Markets

Intuitively we all know when markets go down, even great companies tend to fall along with markets. Sometimes there’s a reason for these falls, and sometimes the selling of everything takes businesses down even when they shouldn’t be down. That is the opportunity for the wise investor. To illustrate this point, I’ll post the long-term charts of a few of the most admired and profitable brands and highlight the drawdowns they have experienced over time. I’ll also show what the long-term total return of these great brands looks like. The moral of the story is this: if you can identify a leading brand serving an important and growing market, the stock tends to beat plain vanilla benchmarks while potentially experiencing large drawdowns along the way. Intuitively, an investor that’s willing to add to a position when it’s on sale should achieve even greater outperformance. That’s where we can add some real value. It’s impossible to know when the market bottoms for this bear market cycle but I have complete confidence that being savvy and buying more stock of some of the greatest businesses in the world will lead to attractive returns over time.

Exhibit #1: Nike, NKE

Below I’ve included a chart of iconic footwear and apparel brand Nike which dates back to late 1992. There have been multiple deep drawdowns to take advantage of and comparative outperformance over the long-term. Between 9/19/92 and 9/12/2022, Nike stock compounded at +15.1% annual versus the S&P 500 Index at +10.0% and versus the Consumer Discretionary Index at +10.7%. Nike offered a +6,792% return versus the S&P 500 of +1,663.9%.

Imagine what the return would have been if one added to their Nike position on those big drawdowns!

Exhibit #2: Amazon, AMZN

In Amazon, we see multiple drawdowns, including the Internet bubble popping, with AMZN stock down over 90% from the highs. Poorly run companies never recover from drawdowns. Great companies with visionary management and enormous growth opportunities use tough times to broaden their markets and take market share. Over the period of 5/14/1997 to 9/12/2022, Amazon stock compounded at roughly 34% per year versus the S&P 500 performance of roughly 8.5% per year. The Consumer Discretionary Index compounded at about 10.4% per year.

Imagine what your return would have been if you added to the Amazon position on those big drawdowns! Our team utilizes big sales to buy more of the top brands.

Exhibit #3: Blackstone, BX

One of the biggest, most long-lived mega-trends we know of is still very much alive. A portion of the assets from institutions, insurance companies, and consumers are migrating away from traditional stocks and bonds and moving into “alternatives” like real estate, real assets, infrastructure and private credit. The leading brands benefitting from this migration are Blackstone and KKR, two of the top private equity firms. In fact, these firms get stronger in times of chaos. Collectively, the PE industry has about $3 trillion in dry powder that helps them take advantage of the dislocations happening all around the world. Blackstone is the heaviest hitter in PE. Their real assets category and stock have performed incredibly well since their 2007 IPO. To receive great returns, you had to be willing to endure some gut-wrenching drawdowns. With hindsight, you could get out and then hope to get back in lower, but very few investors have that skill. We prefer to hold a core position in our favorite brands and add to them meaningfully when they go on sale. Blackstone stock has annualized at ~14.4% since the IPO in late June 2007 versus the S&P 500 at 8.9% and the Financial Services Index at 3%. BX offered a 680% return versus the markets 267% return.

Imagine what your return would have been if you added the Blackstone position on those big drawdowns! In 2008, Blackstone assets under management was $94 billion, today AUM is roughly $1 trillion. That’s a lot of stable fee revenue, folks.

Exhibit #4: Chipotle, CMG

Chipotle remains the most dominant fast casual restaurant chain in America. When the company is saturated in America, Chipotle’s great management team will grow internationally. Even with the E. coli issue in 2015-2016, the stock has compounded significantly better than the market or the sector index. To achieve this long-term return, you had to avoid being shaken out during big drawdowns. When the business changes forever, you move on, when the business is simply experiencing short-term issues and a falling stock price, you take advantage and build bigger positions. Annualized returns of 27% versus the markets roughly 11% were well worth the patience, in my opinion.

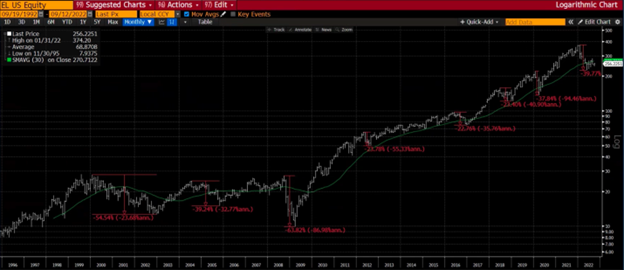

Exhibit #5: Estee Lauder, EL

I won’t pound this drum anymore; you get the picture! Big drawdowns, strong long-term outperformance. Buy the dips in quality leaders.

SUMMARY:

It’s very easy to sell when markets are struggling, it’s an understandable yet emotional response to sell. What’s difficult, however is getting back into the market. The best buys are often when it feels most scary, that’s just the nature of markets. The Consumer Discretionary, Technology, and Communications sectors have a long history of outperformance versus the S&P 500, but it doesn’t happen every year. These three sectors are generally where the most admired and profitable brands live. Most of the top brands have experienced large pullbacks in their stocks yet very few things have changed from a fundamental perspective. Investors are once again getting a great opportunity to build positions in great brands on sale. History shows you buy these sectors when they have underperformed for 1-2 years. Revenue growth, EPS growth and free cash flow growth rarely happen in a linear fashion. But leaders of industry, aka top brands, take market share and get stronger in times of turmoil. When markets go on sale, leaders with strong track records of outperformance have historically been very savvy decisions. No one knows where markets will go in the short-term but buying great assets when on sale is a prudent, logical, and wise thing to do. That’s exactly what we, at Accuvest Global Advisors, are doing.

Disclosure:

This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.