Key Points

- Spending is in our DNA. Currently, our actions towards “safety” tell a story.

- Consumers are making choices because they have been over-paying for everything.

- Selective Indulgence is a key part of consumer spending; some brands are winning big.

Spending is in Our DNA

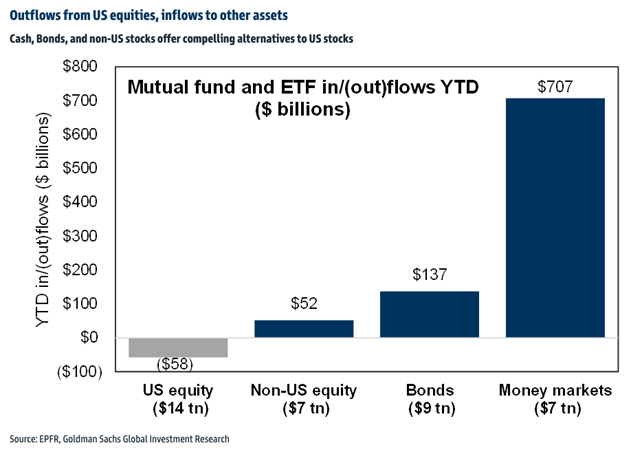

In last week’s blog, I noted Retail Sales recently hit a new record of $7 trillion over the trailing 12 months. Aggregate spending is a bit above the long-term trend, so we expect the spending dynamic to change as consumers continue to make important choices. As personal income goes positive as inflation cools over time, positive spending and saving dynamics will emerge. For now, consumers are a bit nervous about the current economy, the political uncertainty, and the potential for an economic slowdown. They are being bombarded with negative news stories which keeps them from wanting to take risks in places like the stock market. To highlight this, the chart below shows where consumers are putting their money so far this year.

Money market funds yielding ~4-5% hold about $7 trillion of our money today, which earns much more than our checking accounts. When consumers are nervous, holding more cash is always the first impulse and it makes us feel better. What I fear, they will stay in “safety” much longer than they should, which ultimately hurts their ability to generate the returns required to meet their long-term retirement goals. The best times to put our cash to work are the times when it feels the least attractive. That will never change. With markets performing much better than expectations, we suspect high net worth investors could begin to feel like they made a poor choice de-risking equities in Q4 last year. If the equity markets stay elevated, a FOMO effect could begin to build from those under-invested. FOMO happens when we are faced with falling behind in returns and feel compelled to chase equities, typically at the wrong time. The stats below show consumers have voted for safety for now. Equity outflows, safety asset inflows, and massive flows to money market funds is what has happened YTD. That tells me a lot as a contrarian investor.

Consumers Continue to Make Choices on Their Spending

Back to retail sales and the trends we see currently. We know with certainty that spending is in our collective DNA as a society. We are now beginning to see signs that consumers are not spending broadly but making important choices with their limited dollars. That will have implications for many businesses across a multitude of industries over the next 2 quarters. Last week, we talked about the mean reversion in spending and the parts of the goods economy that were still getting attention from a wallet-share perspective. The moral of the story: the spending was heavily skewed towards “needs versus discretionary wants.”

Selective Indulgence is a Key Focus for Those Willing to Spend Discretionary Dollars

Research firm McKinsey recently released an intriguing report discussing the state of the consumer entitled, “Overall consumer spending growth is slowing, but consumers still intend to splurge on select categories.” The authors cite the concept of selective indulgence as the key focus for spending. Our work also suggests things like travel, recreation, eating out, and live events are preferred areas of attention. Generally, younger consumers and higher-income consumers seem to be the most positive, with the middle consumer a bit more cautious. Thus far from an earnings perspective, there’s strong evidence of strength across travel and lodging brands as well as recreation categories and the ancillary goods and services that benefit from our recreation activities. That should remain resilient as we enter the summer vacation season.

It’s quite clear from earnings across the whole group of consumption categories, there’s trade-down activity happening broadly. Our take: consumers are saving money in some places so they can splurge in other places. That behavior does not scream we have a “super-bullish consumer” but it also doesn’t scream a, “super-bearish consumer.” That’s why our current portfolio is currently balanced by discretionary spending beneficiaries and needs-based spending beneficiaries. The recent BofA & J.P. Morgan consumer spending reports also confirmed consumers are making choices and they are balanced by needs and wants.

From an “intent to splurge” perspective, the chart below shows the spending categories most cited in the McKinsey report. Roughly 40% of respondents cited the intent to splurge in 2023. Their focus is cited below. Eating out and in, travel, recreation, out-of-home entertainment, and apparel and footwear were noted widely. What I found interesting though, was the intent to splurge on grocery being part of the results. Normally, grocery is a staple of life, so splurging is not generally associated with a staples of life. Again, I would call the results of the survey as encouraging but not wildly bullish for continued, above-trend spending.

What Looks Most Attractive in the Selective Indulgence Thematic?

Out of home entertainment:

One key area of focus is events and concerts. Live Nation is the dominant live events brand around the world. In their recent quarterly report, they cite, “for the first time in three years, all of our markets are fully open. Over 19 million fans attended our shows across 45 countries, and we sold over 145 million tickets with record levels of activity across all markets.” Simply put, the pent-up demand for live events and concerts is a key source for revenge spending around the world. LYV also cited “global demand for live events is unprecedented. Revenue was up 73% to $3.1 billion. We have sold 90+ million tickets YTD and demand shows no signs of easing thus far.” The stock has had a robust recovery off the lows but is still well-off all-time highs and arguably they have better pricing power, higher demand, and stronger sponsorship opportunities as brands all over the world begin allocating more to this business segment after being absent for 3 years. The ancillary goods and services around live events and travel should also perform well. Those include beer, wine and spirits, apparel merchandise, and overall food and beverages like Coke, Pepsi, and energy drinks.

Travel:

We are just beginning the summer travel season and virtually every part of the travel infrastructure is screaming the same thing: we are going on vacation and travelling to places like Vegas in droves. As our savings have been drawn down, we have been saving money over the last few months so we can spend more on our vacations. We will eat out, buy beauty products, buy snacks and beverages and likely shop for apparel & footwear while on vacation. The travel platforms like Booking, Expedia, Airbnb, and hotels like Marriot, Hyatt, and Hilton have all reported strong bookings while seeing consumers more interested in price discounts. Even airlines, some of the worst businesses in the world to run and invest in, are seeing record demand with lower airline fuel prices. For now, the “selective indulgence” trade is alive and well.

Disclosure:

The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.