Key Points

- Today’s October retail sales report highlight’s the strength of U.S. consumers.

- For now, high prices across most goods and services are putting a damper in confidence.

- The 1% is doing the heavy lifting from a consumption perspective. Invest accordingly.

“Households are wealthy, flush with cash, and ready to spend—setting the stage for a lasting, self-reinforcing surge in demand.” Bridgewater Associates 10/19/21

Retail Sales

I’ve said it repeatedly over the last 5 years and it warrants repeating: nothing is more predictable than a consumers’ propensity to spend. If you haven’t implemented a consumer spending dedicated core equity position yet, you are missing a thematic that drives 70% of our $21 trillion economy. The same theme drives every major economy. How can anyone ignore a $40 trillion a year, highly predictable thematic in a portfolio? We can help you get right-sized for this opportunity.

The 16.3% annual growth for retail sales is well beyond what we have seen in the prior few decades. When the pandemic hit, I wrote about the potential for revenge spending once consumers were able to get back to normal spending trends. Here’s the thing though, when you pull the rubber band back and it becomes as stretched as it can get, the reaction in the opposite direction is often just as fierce. That analogy is timely when talking about consumer spending. In last week’s report I reminded readers of the $4 trillion in savings and money market funds and that this money would slowly but surely begin to trickle back into the economy. The sheer magnitude of our collective savings tells me the consumer spending tailwind will last for another 3+ years. You simply can’t spend this amount of money all at once, there’s a shortage of goods in inventory and the shortages are broad based. From toys to houses to sneakers to Airbnb’s to clothes to furniture, inventories are at historically low levels and demand has never been higher. And we wonder why the prices of every good and service has gone straight up. This will normalize over time but for now, revenge spending is real and sustainable, and a shortage of goods will take more time to get resolved.

Consumer spending has been broad based, and this is the largest monthly gain since March as record household wealth drive a rabid appetite for everything not nailed down. October retail sales were +1.7% versus the 1.5% estimate. It probably would have been higher if there were enough autos available for purchase. The appetite for appliances, cars, apparel, eating out, travelling, and home goods continue to be quite high. Just remember, monthly retail sales can be volatile and lumpy at times but overall, the trend is quite positive for the brands that are in high demand as we head into the holidays. I suspect some of the inventory issues will lead to getting more gift cards than merchandise but in the end, we will get the products we want. I’m talking about you, iPhone 13!

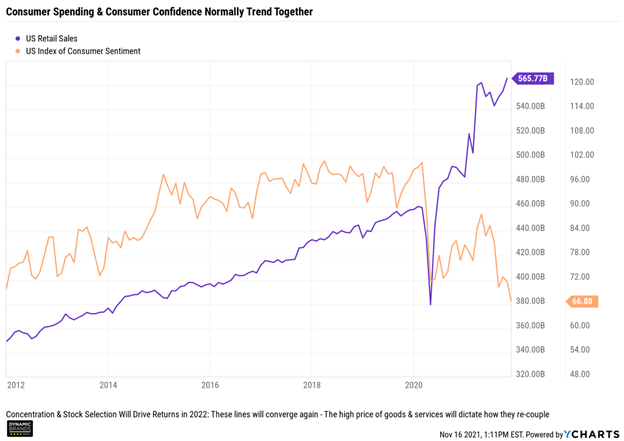

Consumer Confidence is Suffering Because of High Prices

Clearly, we are spending but the latest consumer confidence report shows we aren’t happy about how expensive things are. We are probably not happy about not getting instant gratification as inventory levels stay low but, in the end, we moan and groan but keep spending. As we move into 2022 though, I am positioning the portfolio up in quality and favoring the brands and spending categories consumers will most likely be willing to pay up for a bit longer. Not every brand will have a good 2022, many purchases will be deferred or will not happen because prices are too high, and the perceived value is too low. From an investment perspective, this means that a more concentrated portfolio is warranted and stock picking should outperform index investing. A sharp contrast from 2021 when the lowest quality businesses recovered well from the pandemic lows and the indexes have performed well.

I’ll ask that you look at the above chart again and focus on the consumer confidence line. Incredibly, confidence numbers are lower than where they were at the worst part of the Pandemic. Our lack of confidence today versus mid 2020 is for a different reason but it really is a stark reminder of what’s happening out there in consumer-land. Consumers getting squeezed from every angle makes us all a bit edgy. I am shocked that confidence is this low at this stage of the recovery. That’s an important datapoint for this stock picker.

Nevertheless, I have a lot of confidence that retail sales will stay elevated given how much money there is in savings and how strong & sticky the current wage gains will continue to be. It’s the consumer confidence line that will likely mean revert higher. If confidence turns north, spending could get a new catalyst just in time for spring and summer vacation planning.

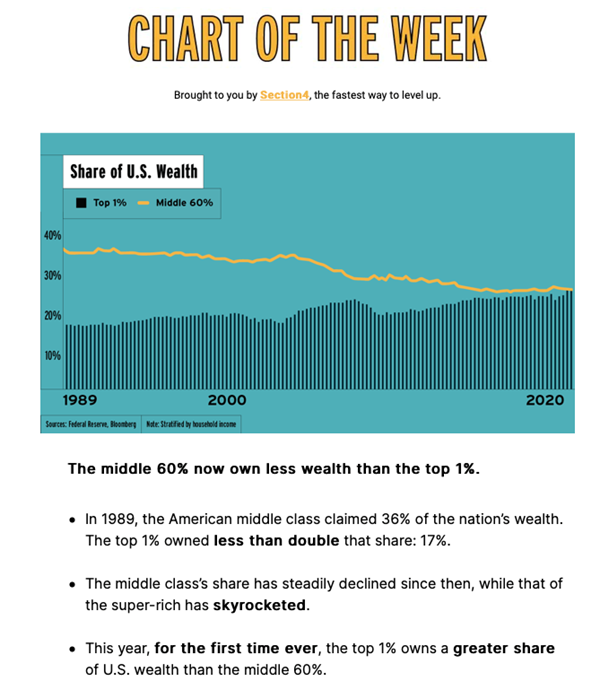

The 1% are doing the heavy lifting for spending these days.

The above chart comes from Professor Scott Galloway of Section4 and it highlight’s a less than stellar trend in America. The middle class, which has been shrinking for decades, continues to get squeezed. People either fall to the lower income cohort or jump up to the higher income, higher net worth basket. Granted, there’s some positive developments here as more households join a higher income cohort but this country was built on a strong and growing middle class, so I don’t love the overall message here.

For the first time ever, the top 1% owns a greater share of U.S. wealth than the middle 60%.

My job is to analyze the data across macro-economics, corporate fundamentals, demographic trends, and brand relevancy. The work we do as a team helps us understand what parts of consumer spending have positive trends that seem sustainable and which brands stand to benefit the most. When we look at the last 5 years, there’s a clear trend: the brands that are aspirational in nature, that sell products and services in high demand and that have pricing power because they serve a higher income customer have tended to perform much better than those that serve the shrinking middle class or lower income cohorts of America. There are a handful of wonderful companies that are clearly serving all demographic groups well and their share prices have performed admirably. Companies like Target, Costco, and Dollar General come to mind. Overall, though, the upscale brands have performed much better than the rest of the consumer stocks. I think this trend continues.

All in all, consumer spending continues to be robust and consumer sentiment is about as bad as it ever gets. All we need is some holiday cheer, an easing of prices driven by better inventory levels and consumer confidence should re-join the party.

Disclosure:

This information and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.