Key Summary:

- Investors are still neutral at best on the opportunities for risk taking in 2024.

- The “smart money” has a history of being wrong as often as retail money.

- There’s a lot of potential fuel in the form of positive flows to come in 2024.

Important thesis: If equities generate roughly 8-10% a year over time, the leaders of industry should, in theory, compound at 13%+ over time. We have significant proof on this topic where top brands are concerned. For a variety of reasons, the last few years has been difficult for the average stock. Betting against consumption-focused stocks after a poor two-year period has been a poor investment decision. We see massive opportunity across the consumption landscape as great companies play catch-up to reach more typical annualized return metrics.

Pictures Tell a Thousand Stories

I thought I’d look at some consensus views for 2024 with a few examples of where consensus was flat-out wrong in 2023. The charts below are from Goldman Sachs Research where they interviewed >300 of their clients for their views across a wide range of assets.

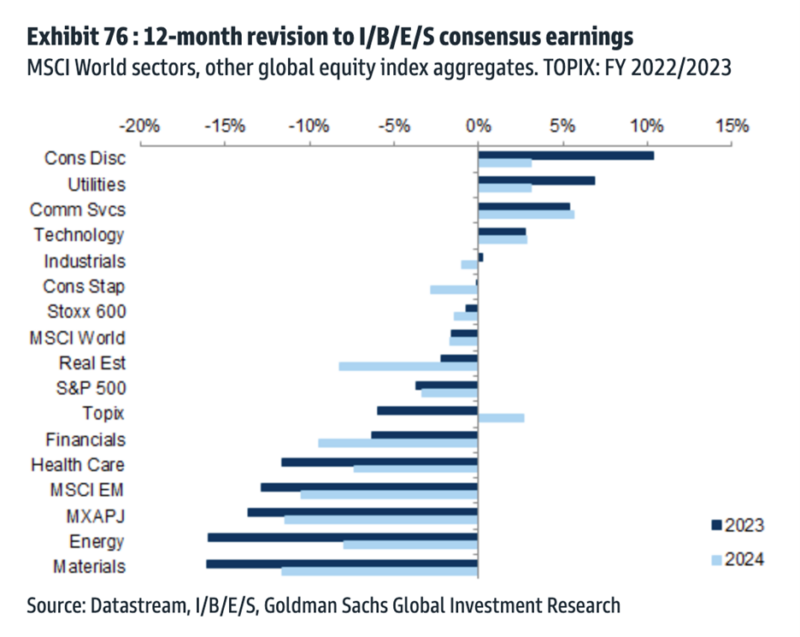

12-Month Estimate Revisions:

In 2023, these sectors showed the best positive earnings revisions: Consumer Discretionary (the recession that never came), Utilities, Communication Services, Technology. It just so happens that Tech, Consumer Discretionary, and Comm Services were the top sectors by performance. There tends to be a correlation here. For 2024, analysts again show positive earnings revisions across Consumer Discretionary, Utilities, Comm Services, Tech, and the Topix Index (Japan). The negative revisions are coming across Industrials, Staples, Real Estate, Financials, Healthcare, Energy and Materials. Call me crazy but I think the negative estimate revisions will turn positive before July 4. I think analysts are generally too bearish yet again.

General bullishness or bearishness:

Overall, the wall of worry continues. We like that.

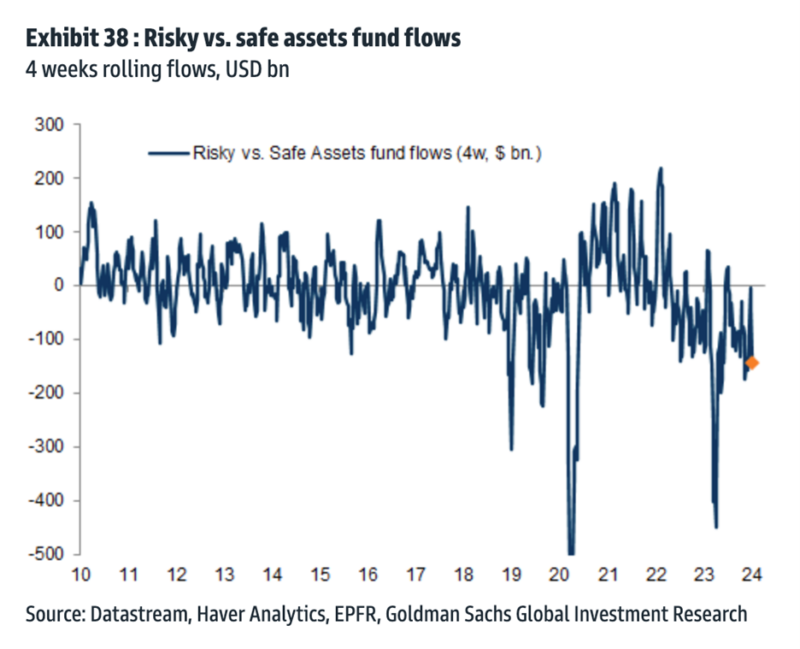

The data continues to be very clear: asset flows are not highlighting bullish views almost across every asset class. Chart 1 shows the flows into risky versus “safe” assets. The current reading is well under “normal” ranges offering a contrarian buy signal.

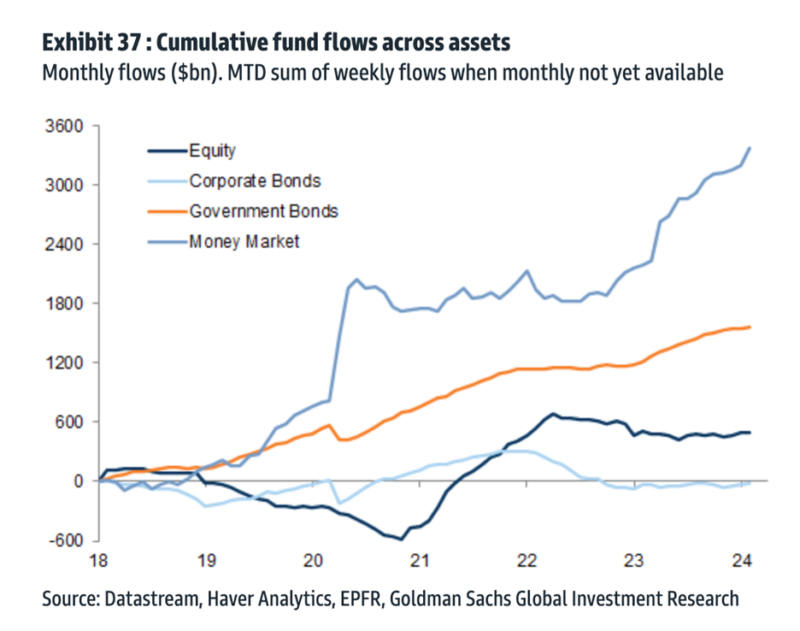

General Flows Favor Money Market Assets:

With money market funds showing rising yields, it’s no wonder the category showed remarkable flows. But, will some of these flows reverse as yields ease going forward? I still suspect equities and fixed income will be beneficiaries as some of this safe money leaves for potential better returns in 2024 and 2025. Remember, global money markets now have >$8 trillion in assets set to earn less than they did the year before.

The Recession that Hasn’t Come:

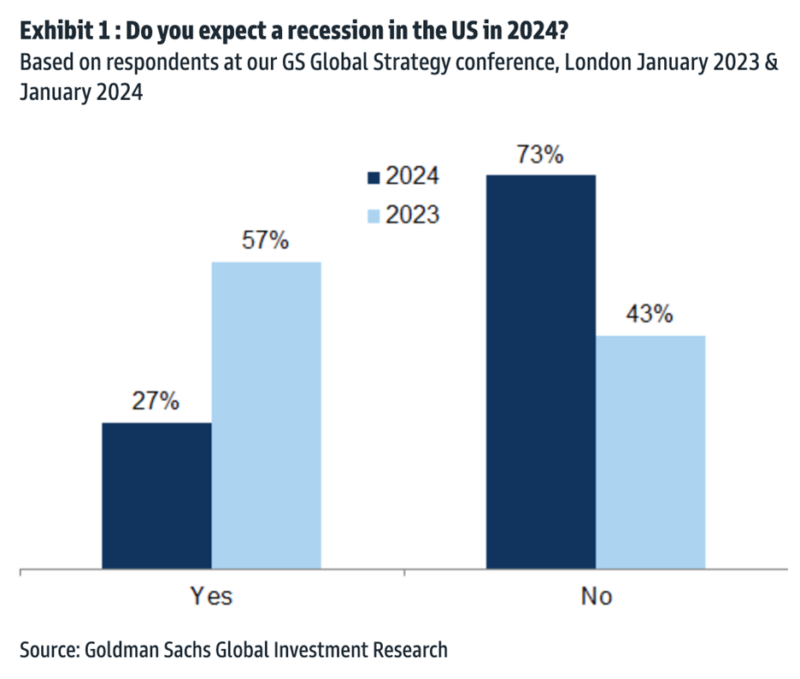

57% of the “smart money” expected the U.S. to be in recession in 2023. After being wrong and seeing strong equity returns in 2023, 73% of this cohort now does NOT expect in recession in 2024. Price movements really do drive opinions about the future.

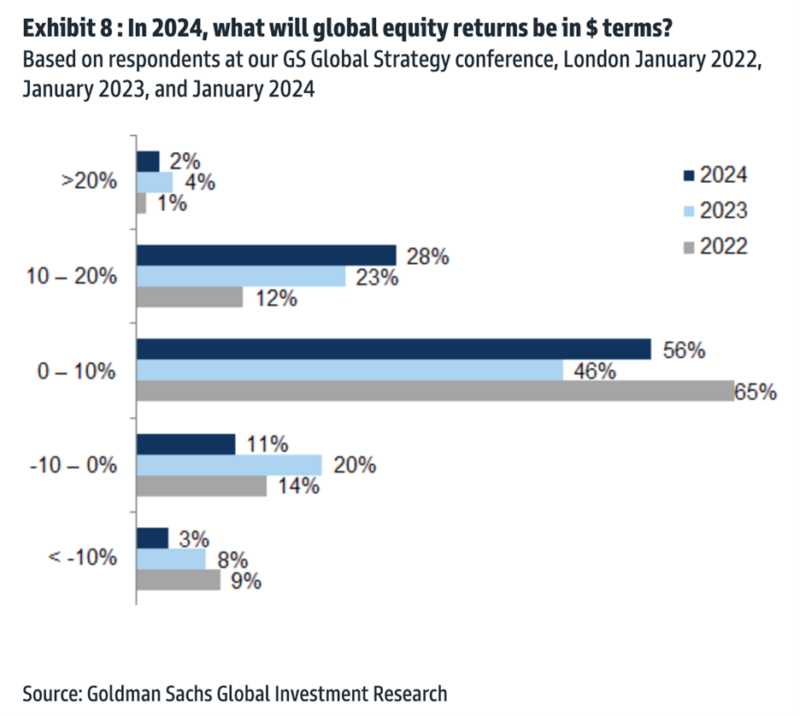

In the chart below, 70% of the GS clients interviewed expect global equity returns to be somewhere between -10%+ and +10%, not a real bullish outlook. Only 2% of clients expect another +20% year and 28% of clients expect +10-20% returns. In 2023, 74% of clients again expected the range of returns to be >-10% to +10%. Perhaps they never expect strong returns?

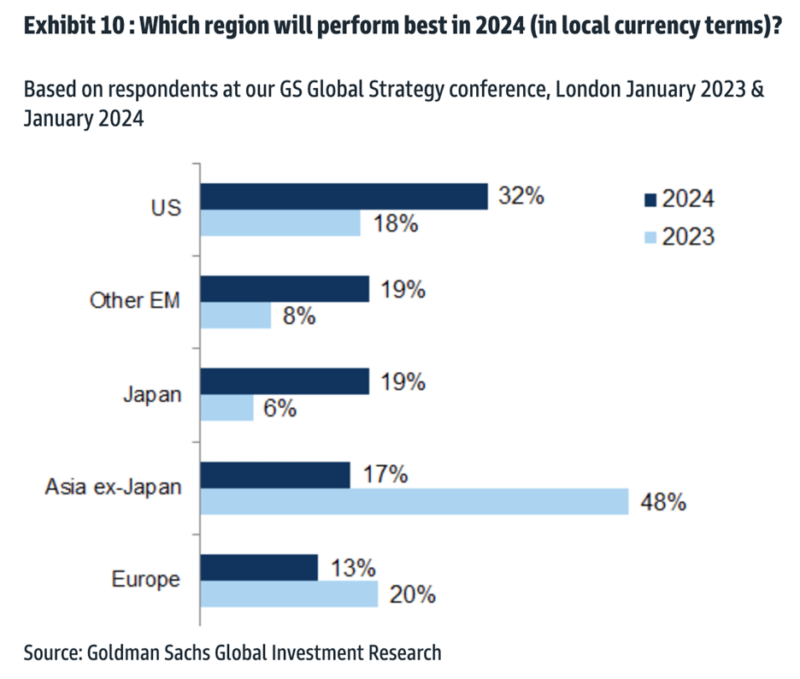

In 2023, clients expected Asia ex-Japan to be the best performing region. WRONG, it was one of the worst performing regions. They also expected Japan to generate a poor return. WRONG, Japan was +~20% for the year. Only 18% of clients expected the U.S. to perform well. WRONG, the S&P 500 was +26%. For 2024, the expectations are for the U.S. to be the leading return generator. The contrarian in me wants more non-U.S. exposure as well as U.S. brands with high international sales.

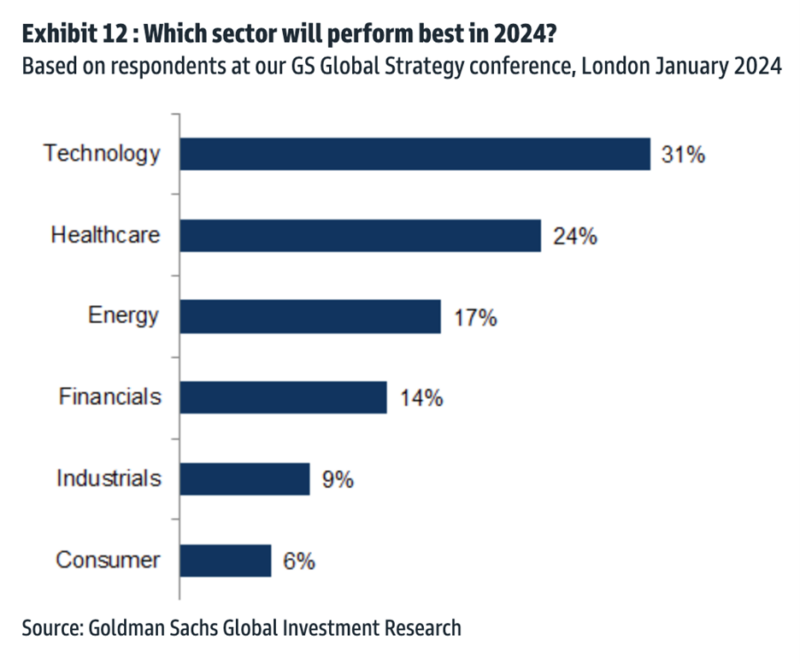

Which Sector is Expected to be the Best Performer:

Not surprisingly given all the AI chatter, Tech is expected to be the top performer. We still like tech but are being very selective after a strong 2024. The most surprising to us, Consumer Discretionary is expected to be a poor performer. We like this contrarian set-up as we continue to see positive revisions and a consumer that still has room to spend and is generally financially healthy and employed. Remember, investors are chronically underweighting the consumer, generally a bad idea given it’s a top performer over most time periods. That’s why we created the Brands strategy. Healthcare & Energy are expected to perform.

Where Will the 10YR Treasury end 2024?

We know by looking back in time, a goldilocks environment for equities has tended to be with inflation in the 2-4% range with Fed Funds (base rates) in the 4-5% range. If the 10YR average for 2024 is in the 4% range or below as 78% of the clients expect, and with the Fed cutting rates in the 2H of the year, this goldilocks scenario appears to be more and more likely. Yet, it’s disconnected with how the masses are currently positioned.

Disclosure: The above data is for illustrative purposes only. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.