“Climanomics”: (or climate economics) is defined as innovative monetary, fiscal, and social economic policies that support the climate change agenda for a more sustainable future.

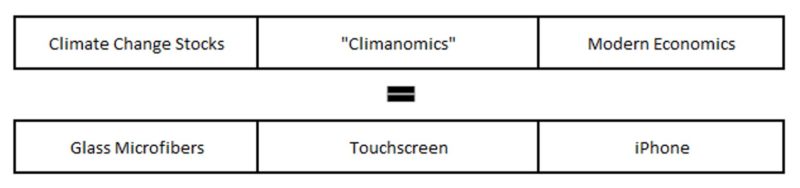

Climate Change to Economics has a similar relationship as the touchscreen to the cellphone.

The year 2022 has started off painfully with equities selling off amid slowing growth prospects, Federal Reserve hinting at rate hikes, persistent inflation, and looming COVID dislocations. Even though US growth rates for 2021 were the highest since 1984, the broader equity market continues to sell off with the S&P 500 Index approaching correction territory (YTD). In tangent, the broader bond market continues to feel the convexity pains of increasing interest rates while commodity prices hit some of the highest levels since 2014. Market volatility remains at the forefront as markets continue to quest for equilibrium.

Some market strategists have displayed concerns for growth companies amid the access to capital tightening as a more hawkish Fed attempts to rein in 40-year high inflation of around 7%. Even though growth has underperformed value YTD in 2022, that should not be a proxy to gauge innovation outlooks and environmentally conscious initiatives. Per usual, Wall Street groups all growth and all value in their respective artificially defined segments. Furthermore, investors overgeneralize economics as an all-inclusive mechanical end-product. However, it is important to remember that a machine cannot properly function without all its’ parts. Building upon this thought, part enhancements (through innovation) can improve the efficiency and output of any mechanical product (including the economy). Very partially, the final product is many times the only concern; meanwhile, the inputs and interdependent components of the final product are the actual alpha generators exceeding consumer expectations. This misrepresentation infects most biases. Thus, the product is “only as good as the parts it is made up of”.

That same axiom is applicable to the economy. As most would agree, the economy is the all-encompassing mechanical product that is dynamic enough to adapt to its’ external forces. Nonetheless, that also means that sub-economic factors (or product parts/components) make up the overall economic machine. The most well known sub-economic components of the overall economy are the business cycle, quantitative tightening/easing, capital reserves, sectors (automobiles, food, services), etc. As with most consumer products/machines, the product itself must be continually enhanced to fulfill present issues while also continually evolving to meet an individual’s higher expected output (individual expectations have a consistent aggregate compounded annual growth rate). This dynamic is the most visible by a snapshot of the regular pattern of new consumer product launches/upgrades (such as the iPhone 11, 12, 13, etc.). Metaphorically, that would also mean that novel sub-economic factors must also evolve to meet novel issues and support individual compounded annual growth of expectations (CAGE).

Climate Change: An Important Factor of the Economy

Retrospectively, one enhanced sub-economic factor is climate change. Sustainability and environmentally conscious initiatives have been at the forefront of social, political and investor agendas. However, reducing greenhouse gas emissions and the subsequent carbon in the atmosphere that causes increasing global temperatures remains very capital intensive as technological advancements are necessary to tangibly start seeing a positive impact on the environment. Thus, innovation and growth remain vital to resolving a pending long-term environmental issue with a pressing timeline for action. Furthermore, it is important to note that this contemporary sub-economic factor is not idiosyncratic, but rather systematic as climate change, emissions and global temperatures impacts all sectors, businesses, environments, etc. directly, indirectly, or” at some point” in the future. Referring to our product analogy, some products experience a “steadfast anchoring”, or the novel feature becoming more important than the product itself (as seen with the touch screen on the cellphone). The touch screen became the proxy for the cellphone or the gold standard of expectations. The same perspective can be applicable to climate change economics or as we coin, “climanomics.”

The Growing Importance of “Climanomics”

In short, “climanomics” is the combination of innovative monetary, fiscal, and social economic policies that support the climate change agenda for a more sustainable future. “Climanomics” is not just a compound word that will be occasionally used to address the backdrop to climate change initiatives and carbon emissions, but rather, it is a pleonasm (redundant). Since climate change effects our lives at various degrees, potentially enabling it to encompass all of economics, “climanomic” (climate conscious economics) has the viability to engulf modern economics completely. Thus, “climanomics” is the all-inclusive description of a more sustainable and environmentally friendly future or, in short, the touchscreen to the modern cellphone.

Taking this one step further, the touchscreen to cellphone analogy is also applicable to specific stock selection or inclusion in a portfolio. However, there are some issues with anchoring when the anchoring has a different basis. Regularly, investor perceptions of companies and stocks fall victim to “regressive anchoring” or the connotation that an equity resembles only one aspect of its’ impact on the overall market/industry. In essence, the company becomes a replacement for the industry it dominates. Investor biases falsely interpret a company’s competitive advantages by having blind spots on the total appreciation story. For instance, Microsoft many times is viewed as a tech giant that only develops, manufactures, licenses, sells, and supports software products. Investors regressively anchor Microsoft as “only” an infrastructure software company; meanwhile, beyond the investor’s blindside, Microsoft is on the front lines to halting climate change as the company aims to be carbon negative (or take carbon out of the atmosphere) through a detailed plan as seen here. Furthermore, Microsoft’s technology, innovation prowess, and digital focus remain the key baseline infrastructure necessary for a mainstream and robust sustainable future through modern sustainable infrastructure. When an investor changes their perspective as discussed in “A Potential Investment Opportunity of a Lifetime: And it’s Not Cryptocurrencies or Basic Innovation”, investors may start to realize that Microsoft is much more than just a mega cap infrastructure software company. Rather, investors will understand that the company is a pivotal component of “climanomics.” Companies similar to Microsoft as well as the innovative start up climate focused companies, all define an aggregated definition “climanomics” in action or the sub-economic component of modern economics. More granularly, the companies within “climanomics” illustrate the “steadfast anchoring” element to modern economics, but only if the investor’s perspective is from the same basis.

In summary, specific stocks are the components that make up “climanomics” in current economics or they are metaphorically the glass microfibers that make up the touchscreen in a cellphone as displayed below:

Source: Catalyst Capital Advisors LLC

01/31/2022

With that said, many investment managers have realized this potential opportunity to monetize the idea of climate change and carbon reductions as lucrative growth opportunities remain prevalent. However, it remains pivotal to focus on the necessary infrastructure needed for climate change initiatives to realize this opportunity. Thus, focused, innovative perspective-based managers who can discern opportunities between companies that truly make up the core definition of “climanomics”, understand the interdependency of all environmental advancements to basic economic theory, and pursue their own direct impact on halting climate change and reversing the course of global warming for a more sustainable future remain best positioned to monetize a fundamentally just cause.

One such strategy is NZRO, the Strategy Shares Halt Climate Change ETF. We believe NZRO is the perfect cocktail mixed with making an impact indirectly on climate change through ETF fund holdings/investments. Strategy Shares is also investing money into private companies focused on curbing and mitigating the deleterious effects of climate change, supporting the capital-intensive innovation of “climanomics.”

Progress is capital intensive and NZRO can be that capital source. While there is a belief think large scale change can only be brought about by esoteric institutions and accredited investors, ETFs like NZRO defy this theory by enabling retail investors from across the spectrum to have a platform to directly stop climate change. NZRO uses a fundamentally driven, activist investment approach supported by both retail and institutional investors alike.

As mentioned earlier, NZRO’s holdings only consist of those companies that we believe has the potential for price appreciation through idiosyncratic opportunities along with their bullish positioning within “climanomics.” For context, our holdings remain exposed to Goldman Sachs’ Top Green Picks for 2022, including Goldman Sachs’ most important company, Microsoft, which is a top 5 holding of NZRO (potentially due to their importance on the infrastructure of our future development as a society). These investments aim to achieve long-term capital appreciation with the additional wager to appreciate at the forefront of “climanomics.” Additionally, profits from the fund will be invested into private companies that we believe are poised to be the next leaders in “climanomics” or “soon-to-be” modern economics. As with all venture capital type investment strategies, the chance for a unicorn investment remains a statistical probability, touching all avenues for growth potential. Providing the avenue for everyday investors to make an impact on climate change is our number one priority, while enabling investment returns and our mission — to curb climate change’s deleterious effects on our environment – to be synonymous.

NZRO from Strategy Shares has a mission of providing all investors and individuals (retail to institutional investors) the opportunity to actively curb climate change. Strategy Shares is committed to halting and reversing the impacts of climate change. Investors can learn more about how to act, as well as access the Fund’s holdings, at NZRO.co.

Disclosures:

Shares of NZRO are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. Brokerage commissions will reduce returns.

Investors should carefully read and consider the investment objectives, risks, charges, and expenses of the Strategy Shares Halt Climate Change ETF. This and other important information about the Fund is contained in the full or summary prospectus, which can be obtained by calling (855) HSS-ETFS (855-477-3837) or at www.StrategySharesETFs.com.

Risk Considerations

Investing involves risk, including loss of principal. The Fund is a new with no history of operations for investors to evaluate. There is no guarantee that this, or any investment strategy, will succeed.

The Fund’s climate change investment focus on securities of issuers that seek to prevent or mitigate the deleterious effects of climate change may affect the Fund’s exposure to certain sectors or types of investments. The Fund is non-diversified meaning it may invest a larger percentage of its assets in a smaller number of issuers and will generally be more volatile and more sensitive to the performance of any one of those issuers due to economic, political, market or regulatory events affecting them. The Fund’s relative performance may also be negatively affected if such sectors are out of favor with the market or the exclusion of certain companies in particular those involved in fossil fuels if they are performing well.

Investments in foreign securities may be more volatile and less liquid than investments in U.S. securities due to risks relating to political, social and economic developments abroad, including economic sanctions and differences between the regulations and reporting standards and practices. Emerging market countries may have relatively unstable governments, weaker economies, and less-developed legal systems with fewer security holder rights.

The Fund may have a high turnover of the securities held in its portfolio. Increased portfolio turnover causes the Fund to incur higher transaction costs, which may adversely affect the Fund’s performance and may produce increased taxable distributions.

The Strategy Shares are distributed by Foreside Fund Services, LLC, which is not affiliated with Rational Advisors, Inc., or any of its affiliates.