In 2020, the ARKK Innovation ETF (ARKK) caught the imagination of the investing public after generating a 152% return for the year. ARKK seeks to invest in cutting edge, innovative companies – tomorrow’s most promising companies – through an active approach managed by Kathy Woods, a well-known and established portfolio manager that the Street loves to hate. Time will tell whether Kathy Woods is able to drive alpha in ARKK – but what we know for sure is that ARKK provides a much higher beta and volatility level as compared to the major indexes such as the S&P 500, Dow Jones Industrial Average, and even Nasdaq Composite indexes.

Based on the excitement and attention surrounding ARKK entering 2021, issuing banks were quick to construct structured notes with varying exposures using ARKK as an underlier. Structured notes take advantage of the unique characteristics of options as building blocks in forming an investment exposure. However, one has to recognize that (1) options are complex and (2) these unique exposures sometimes feel too good to be true. Following are some best practices when reviewing structured notes:

-

Understanding Exposure: The huge benefit of options is to construct an exposure that works for you! NOT necessarily to capture alpha. For example, if someone is more conservative, they may want more downside protection which will have the tradeoff of less upside participation – this investor is in essence lowering their beta while still receiving a wanted exposure to an index or company. Unfortunately, probabilities are hard to fully comprehend by most investors, especially within a structured note, resulting in some headline offerings with teaser rates that are too good to be true!

Focus on the trade-offs between risk and reward and whether that matches your true goals rather than winning based on a view that “a stock will never fall that much” or a “what a great yield” sort of thinking.

-

Sizing: When investing in a structured note not based on a major index, one must take into account what the appropriate size of an investment should be, regardless of the perceived “safety” of the investment. When dealing with a product like ARKK, which is an aggressive growth exposure, even more caution should be taken when it comes to the percentage of assets invested.

- Costs: Banks will typically take a spread on both the option and fixed income component of the note as well as charge an upfront fee. On a product like ARKK, the spread and fee will typically be higher than that of an index. If one chooses to get out prior to expiration, there will be an additional cost to exit

Let’s look at one offering: A 5 year Contingent Autocall on ARKK struck March 24, 2021

-

Upside: 9.75% annual coupon

- Contingent: If ARKK is flat or up on its one-year anniversary or any observation date thereafter (monthly)

- Contingent: If ARKK is flat or up on its one-year anniversary or any observation date thereafter (monthly)

-

Downside:

- No coupon if ARKK is below 60% of the initial level

- Downside risk on a 1:1 basis if ARKK drops below 75% of the initial level (e.g., ARKK down 40%, you receive 15%)

- No coupon if ARKK is below 60% of the initial level

Understanding Exposure: In a stock that is very volatile and expected to end a year up or down double digits, returns are limited to a teaser rate of 9.75%. If ARKK is up, the bank will call the note and the client will receive 9.75% over a one-year period (feel free to e-mail to learn how the bank makes money here). The downside, on the surface, seems great. After all, the stock would need to drop 40% to no longer receive a coupon and 25% to start incurring losses. Those are big down numbers that investors generally have a hard time assessing the odds for.

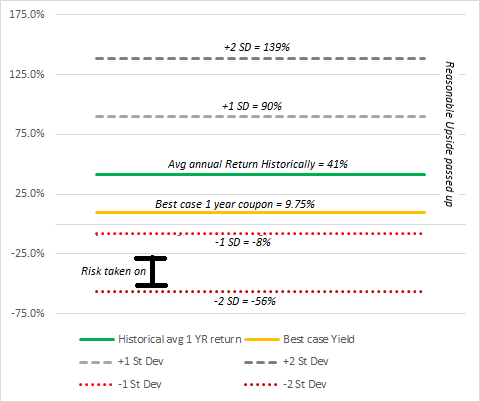

However, as can be seen in the graph above, the investor is giving up material upside (up to 130% in a 2 standard deviation event) while still taking on material downside (given the reasonableness of the stock dropping 56% in a year). Does this exposure make sense?

Sizing: Note above. For a product like this, despite the feel of a bond, it is risky and should only be allocated to a small portion of one’s wealth.

Costs: According to Goldman, the estimated value at time of issuance was 94.1% of the issued price. Our guess is the lower level is probably more accurate. The true cost though is in not understanding that downside.

As of writing this blog, ARKK was trading below $70, a drop of 42.7% which means no more coupons and a loss of 17.7% if the structure matured today. Given the volatility of the product though there is hope yet that these investors can recover!

If you’re interested in learning more about our approach to options investing, click here to visit our website.