Key Summary:

- Generally, diversification across equity size and style boxes creates a smoother ride.

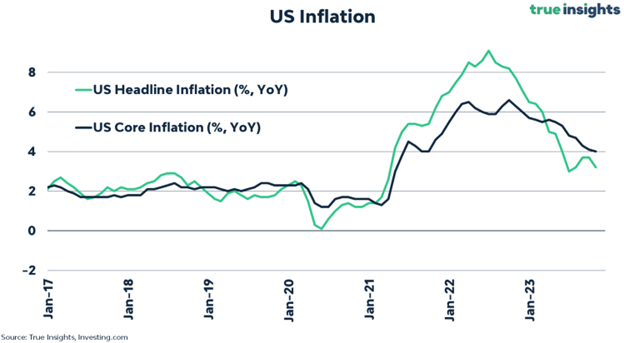

- CPI is now stable and trending modestly lower with the Fed able to be patient.

- The stage is now set for broader participation across size & style boxes.

Important thesis: If equities generate roughly 8-10% a year over time, the leaders of industry should, in theory, compound at 13%+ over time. We have significant proof on this topic where top brands are concerned. For a variety of reasons, the last few years has been difficult for the average stock. If buying low and selling high is still a solid approach, investors are getting some wonderful buying opportunities today, particularly in quality, smaller companies. And remember, when bearishness is as extreme as it is today, that’s usually a pretty good contrarian signal for investors.

The Theory on Diversification

Our industry preaches to own everything, all the time. Sometimes that approach works, sometimes it doesn’t. Case in point: the last two years of performance across styles and size have been extreme. Below, I highlight the 2-year cumulative returns and annualized returns of the large caps, small caps, a top 50 portfolio, a growth-oriented basket, and an equal-weighted S&P 500 basket via Ycharts. Growth handily outperformed value. Mega-cap outperformed smaller caps. Domestic stocks handily beat international. We are certainly not surprised by the difference in returns given the kind of environment over the last few years. Naturally the largest, most stable companies should, in theory have performed better than most businesses with high inflation, and rapidly rising interest rates. Bigger companies have more levers to pull than smaller ones generally.

A New Broad Market Catalyst: Inflation is Easing and the Fed Can Be Patient.

As I write this note, the markets are vaulting higher on a better-than-expected CPI print. This implies our inflation problem continues to be trending in the right direction, which could allow the Fed to stop raising rates going forward. If markets can stop focusing on the Fed and inflation, they can turn back to focusing on what ultimately matters most, earnings and forward corporate guidance trends. Some companies are performing well, others are struggling mightily. Stock picking is still very important. Currently, we do not see a recession on the near-term horizon which is a positive for stocks in general. Slightly falling prices, broadly, will matter for equities over the next 12 months as a potential catalyst for more participation.

2024 Could be the Year Where Smaller Companies Rebound Strongly.

Investors are NOT Positioned for It.

As I showed above, the Russell Small-cap index before today’s big rally has returned -27% over the last two years while the S&P 500 largest 50 company Index has returned +0.76%. Even the great Nasdaq 100 Index is -3.18% for the last two difficult years even while having a terrific recovery YTD. There are a ton of implications for this but the primary opportunity for investors is for better returns going forward. And this comes at a time when all the sentiment data is incredibly bearish and money flowing into money markets is historic. Fact: It’s very rare to have such dreadful returns for 2 years in a row outside of very difficult recessions.

Yes, markets pulled forward future returns in 2020 and 2021 given all the fiscal and monetary stimulus.

Yes, profitless stocks generated 2000-bubble type returns, and many have since fallen by 70%+. As stocks find their footing and the Fed goes dormant with inflation trending lower, a more normal equity environment could be in the offing.

Below, is a chart of the Russell Small-Cap Index showing the 4-quarter rate of change (pink bars) and the 8-quarter rate of change (yellow bars) of the index. As you can see, it’s quite rare to see so many down bars consecutively and historically, it’s been very wise to add more to the smaller market cap companies. This also implies that as smaller companies begin to recover, the overall market returns will be broader versus the concentration we have seen over the last 12 months. Our team is certainly paying attention and focused on adding more great brands with smaller market caps while still maintaining a core weight in leading mega brands.

Disclosure: The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.