[vc_row][vc_column][vc_column_text]As I’ve said in many of these missives, there is always something to worry about. I get paid to look for the obvious punch as well as where the sucker punches may come from. Recently, we have a new brick to add to the “wall of worry”: the coronavirus outbreak. According to published reports, more than 60,000 cases of the virus have been reported in more than two dozen countries, resulting in about 1,300 deaths, almost exclusively in China. This is a topic everyone is talking about and our thoughts are with those affected, here and abroad.

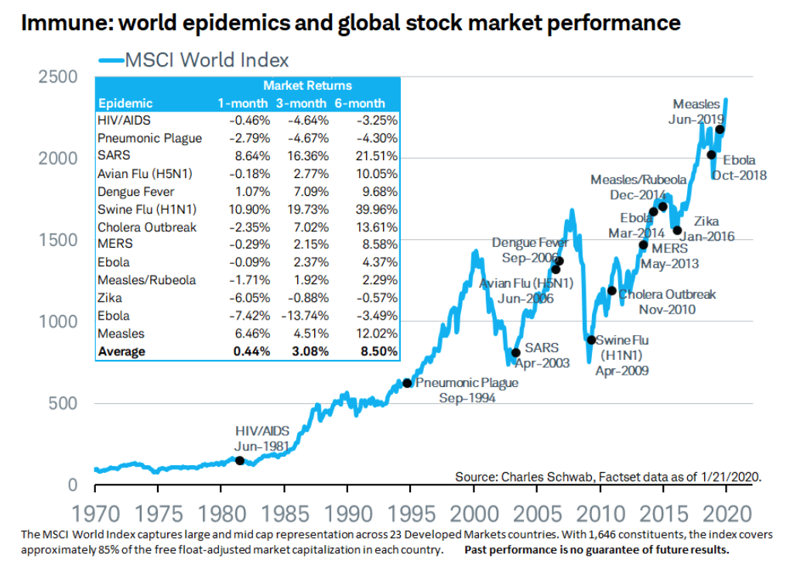

From a markets-perspective though, I think it’s important to remember how markets work. They anticipate things, react early and often very swiftly, sometimes overdo it on the downside, then the sun comes out. Remember, hurricanes don’t last very long so please try and not panic sell. We are all watching this virus and how/where it spreads very closely. Here’s some perspective via the Dow Jones Industrial average. While the headlines sound scary, they don’t often have a meaningful impact on the stock market and future performance after the initial news jolt. To put things in perspective let’s look at other previous epidemics and their resulting market returns.[/vc_column_text][vc_column_text] [/vc_column_text][vc_column_text]Let’s widen the lens a bit and see how these other epidemics looked on the stock chart of the MSCI World Index. Again, short-term volatility given the unknowns but long-term nothing to see here.[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]Let’s widen the lens a bit and see how these other epidemics looked on the stock chart of the MSCI World Index. Again, short-term volatility given the unknowns but long-term nothing to see here.[/vc_column_text][vc_column_text] [/vc_column_text][vc_column_text]There is zero appetite for equities currently so of course they keep going higher. I looked at the flows to ETF’s and active funds last week and there’s a continuation of the same trend from the last 12 to 24 months. The money is flowing into perceived “safety assets” and out of stocks. In my 26-year career, I have never witnessed such a hated bull market. I am a contrarian by nature, so when the masses trip all over themselves to buy something, I generally run the other way.

[/vc_column_text][vc_column_text]There is zero appetite for equities currently so of course they keep going higher. I looked at the flows to ETF’s and active funds last week and there’s a continuation of the same trend from the last 12 to 24 months. The money is flowing into perceived “safety assets” and out of stocks. In my 26-year career, I have never witnessed such a hated bull market. I am a contrarian by nature, so when the masses trip all over themselves to buy something, I generally run the other way.

Lately, Tesla stock is a great example. We owned Tesla and have recently sold it. Why? It was the only thing anyone wanted to talk about and the current price discounted over a decade of perfect news and fundamentals. Tesla became too “crowded” for us and that changes the risk profile of holding any asset. I’m not greedy and I like to get to parties early so I can get a good seat that’s close to the exit when the late comers start acting out of character.

What’s another crowded trade? Fear, I’ve said it many times. Money continues to flow heavily into bonds and defensive equities and ignores growth stocks. That makes me feel good about my positioning currently. Surely bonds aren’t risky right? Well, if the 10 year Treasury were a stock it would be trading at roughly 60x earnings with no growth, given the governments horrifically bad balance sheet and being run by people (politicians) that couldn’t innovate if they had the playbook in their hands. Bonds offer very little yield and even less margin of safety after 39 years of the bull market. All I hear is “equities can’t go higher, this is the longest bull cycle in history, it has to end.” Really? The bond bull market has gone on for 39 years now, but equites are the problem? I’m just not buying it, and neither is the price action in stocks.

Rates are low here because they are even lower elsewhere else. Whether the masses like it or not, most stocks are wildly cheap relative to the current interest rate environment and the attractive liquidity conditions provided by most global central banks. Even Warren Buffett said last year, “if rates and inflation stay this low for the foreseeable future, it means stocks are very cheap.” In a world where rates are abnormally low, inflation as measured by the Fed is low and growth is slow, companies that can grow faster than GDP and that have solid balance sheets, are operating in strong secular growth opportunities here and around the world and are run by forward-thinking, innovation seeking people, will continue to perform. Stocks will have corrections along the way, they always do but until the masses and the media stop calling for every pullback to be “the next 50% crash”, I’ll be buying the dips in quality brands.

Opportunities from Chaos:

The human side of this virus are heart breaking, no one will dispute that. However, out of chaos often comes opportunity, so with that in mind I wanted to try and identify some future opportunities that should present themselves once we have “peak virus” sentiment. The first to go down are often first to recover.

Alibaba and China Tech

We are most focused on e-commerce as a long-term opportunity but also a short-term opportunity. As Alibaba (BABA), Ten Cent (TCEHY) and others get sold from short-term virus fears and the economic slowdown that is occurring, long term investors have an opportunity to begin accumulating these shares on big dips. Make no mistake, these two great China tech brands are a dominant force in China and throughout Asia. They are investing heavily in artificial intelligence, cloud computing, social media and digital payments. As hundreds of millions of people work from home, they are likely to communicate via platforms like Wechat, owned by Ten Cent. That’s a boon for software companies providing online collaboration software, social and e-commerce services. If you are home and need something, you will likely buy things online, delivery is still happening on a limited scale in China. It’s the physical stores we are staying away from for now. If you’re stuck in your home and want to take a break, you’ll likely play video games and watch TV and movies. All theatres are close in China currently so that demand dries up for now but in two to five months, there will be major pent up demand for what we deferred during the virus outbreak. The stocks affected will all suffer short-term earnings and revenue hiccups, but they will largely have wicked snap-backs once the virus is contained, so be opportunistic and buy these great consumer brands when the market acts irrational short term.

Disney, Nike, Apple, Lulu Lemon, Starbucks

These amazing U.S. consumer brands have been thriving in China for years, they will have short term hiccups, their shares largely have pulled back a bit and these great global franchises are on my buy list on big down days. These stocks should bottom first, if they haven’t already. I’m watching closely. In my experience, you want to be aggressive and an opportunist when great businesses go on sale for short term problems that will be fixed in a year or less. Before the virus outbreak, Starbucks and Nike reported a great quarter and would have raised guidance were it not for the unknowns surrounding the virus. Apple reported an absolutely magnificent quarter but will also see short term slowdowns in china. If the supply chains in China that serve U.S. tech and retail brands are disrupted further, inventory will need to be drawn down while the supply chain disruptions work their way through the system but eventually, the inventory will need to be replenished so weak quarters will be followed by snap-back quarters making comparisons year over year look much better next year. Disney has closed their theme parks in China and theatres are closed but they will likely see a surge in traffic once the virus is contained. Lululemon is thriving in Asia and China so I suspect the next quarter will have a cautious tone and any weakness around that name will be bought by me and many other managers.

Bottom Line:

Here are some bottom-line takeaway points to consider:

- The coronavirus outbreak is not going away soon, but such “hurricanes” do not last forever.

- The market tends to sell first, ask questions later and the media and their ad dollars are hoping you stay glued to their programs and panic sell your portfolio. Ignore the noise.

- Sentiment towards stocks is still quite dreadful and most investors are opting for the safety of historically expensive bonds and defensive equities that have little growth and tech stock valuations.

- Investors should consider being opportunistic, particularly in great brands that are being affected short term. Sales are a very good thing long term!

Disclosure:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.[/vc_column_text][/vc_column][/vc_row]