As a thematic investor, my job is to identify the most important and prevalent trends here and around the world to invest in through the leaders or “brands” that are most relevant. When I look at the world currently and into the future here’s the most important investment themes an investor can invest in today include the following:

- Consumerism

- Globalization

- Automation

- Digitization

- Experiences

CONSUMERISM: KEY POINTS:

- It’s enormous at $40 trillion per year globally

- It’s under allocated to and clients understand it

- It’s historically been an alpha generator

Consumerism: The $40 trillion investment opportunity

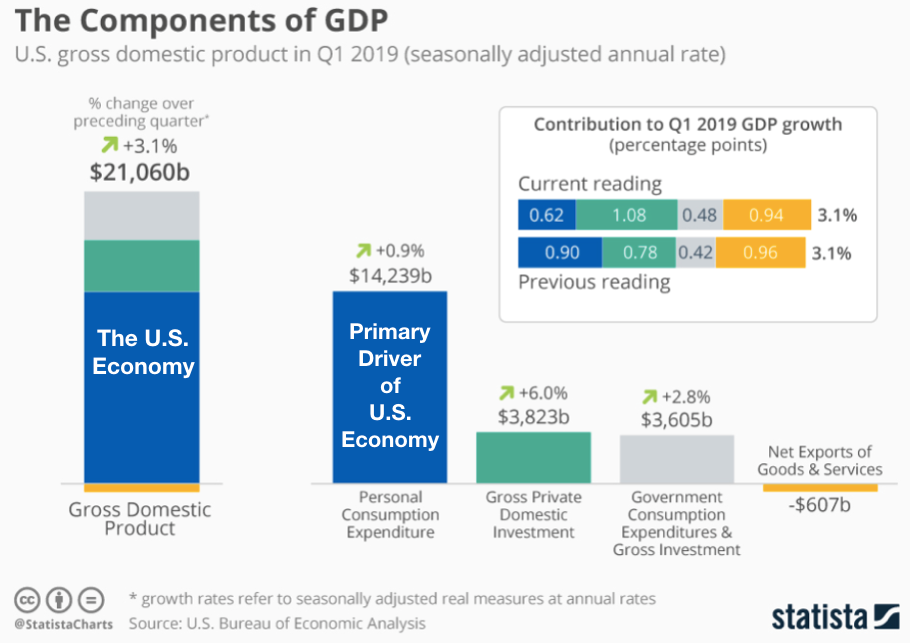

As I have written numerous times in these posts, household consumption is ~70% of total GDP and is, by far, the most important driver of the U.S. economy. It’s also 60% of world GDP making it the most important driver of economies and therefore stock markets. The link between the economy and the equity market is important for allocators to remember.

Because the two are linked so closely, allocators need to make sure their portfolios are sufficiently exposed to the parts of the consumer economy that are thriving. The basket of these stocks should serve as the core allocation in a portfolio. There are many ways to build a portfolio, index funds and active funds come to mind, but it’s vitally important to know how much and where your exposures are so you can map them back to whether they are appropriate in today’s world. If you do not have the time or resources to do a holdings-based analysis of your portfolio, we are happy to help. It’s a particularly smart time to perform such an analysis given we are close to year end and it’s always nice to begin the new year positioned for what seems to be the best possible outcomes for clients.

Consumerism: An Easy Conversation to have with Clients

The best clients are those that understand what they own and why they own it. They tend to panic less in volatile times and stay in allocations because they recognize the companies in their portfolio. That’s what a portfolio of the leading brands offers a Financial Advisor and their clients. Peter Lynch had the best track record on Wall Street investing in this simple theme: invest in what you know.

Surely such a simple and well understood theme is well represented in the average investor’s portfolio, right? It turns out there’s a wild disconnect between the knowledge and appreciation of the theme and the actual holdings inside a typical portfolio. Let’s drill down on that by assessing the S&P 500 as a core index and the ETF assets across sectors.

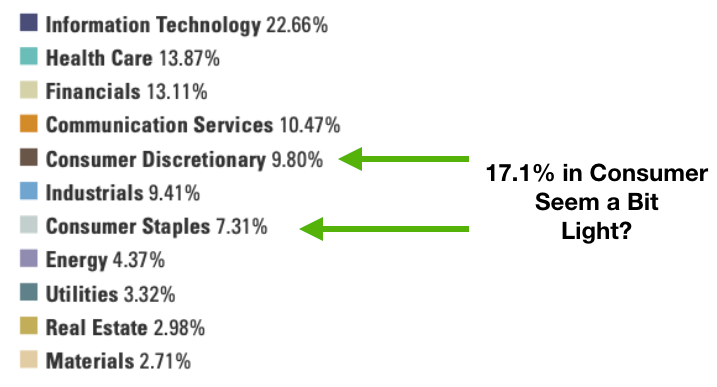

Here’s what the S&P indices say about the S&P 500 index: Standard and Poor’s considers the S&P 500 index to be the “500 leading companies in leading industries serving as a proxy investment for the U.S. economy”. This description is spot-on in my opinion but a closer look inside the index shows it’s disconnected from the actual make-up of the economy. Let’s look at the sector weights below to illustrate this point further:

If 70% of the economic output comes from the consumer and the S&P 500 is the proxy investment for the economy, why does the index only have a 17% weighting to traditional consumer stocks? What’s the moral of the story? There’s likely $9 trillion in index assets invested in the wrong proxy for the economy. There’s absolutely nothing wrong with using the S&P as a core allocation but it certainly isn’t the best choice if your goal is to track the real economy.

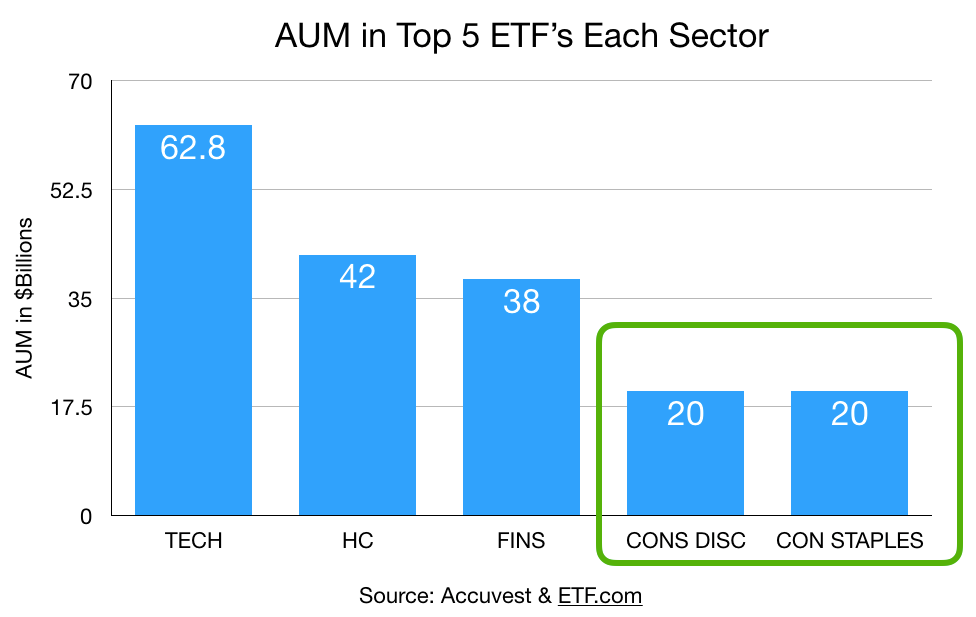

I can tell you from experience analyzing the average Financial Advisor’s client active mutual fund holdings that they are also chronically underweight the beneficiaries of a consumer economy. In the chart below, I show what the data says about the potential exposure to Consumerism via the ETF market. I added up the assets from the five largest ETF’s in the major sectors for this analysis. Hopefully, we will see a chunky allocation to the consumer ETF’s and that’s where the disconnect is coming from.

It turns out that there’s significantly less assets invested in the consumer sector ETF’s too. How is this possible? Everyone knows the consumer is the strongest and largest part of the economy and yet there appears to be no evidence that investors are benefitting from that knowledge when looking at their holdings across index funds, active fund and ETF’s. In my opinion, that’s a major opportunity to upgrade a portfolio.

Consumerism: It’s historically been a strong alpha generator

To be clear, my approach to investing in the Consumerism theme is focused on owning the beneficiaries of our “lifetime spending”. As human beings, we begin consuming at birth and stop at death so if your goal is to track the theme broadly, you need to include the beneficiaries across all the spending industries. For simplicity though, let’s just show the past performance of the two primary consumer sectors: Consumer Discretionary and Consumer Staples versus the S&P 500 over the last 20 years. The result is that the consumer stocks seem to have offered significant value over a broad-based index. This should not be a surprise to anyone given how important the Consumerism theme is to the economy.

The Bottom Line on Consumerism

Historically, Consumerism has been a large, important, stable, predictable, investible, and an alpha generator. However, most investors likely do not realize how under-exposed they are to this important theme. Another key point is that active funds and ETF’s are typically chronically underweight the beneficiaries of Consumerism. I also believe that Index investors benchmarked to the S&P 500 ($9 trillion in AUM) are not really getting the exposure to the real economy they should be getting. Because Retail Sales alone is 30% of GDP, this level of investment in a portfolio is likely the minimum one might use as a baseline allocation to the theme.

The bottom line for investors is that Consumerism is a $40 trillion per year phenomenon that warrants dedication in a portfolio. The most relevant brands are positioned to capitalize from this persistent theme.

Let’s face it, it’s a wonderful time to assess what exposures you should add as we head into year end. If you do not have the time or resources to do a holdings-based analysis of your holistic portfolio, I am happy to do it for you, send me your portfolio tickers and weights and I will turn it around in 24 hours. My email is eric.clark@accuvest.com.

DISCLOSURE:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.