We know the consumer drives 70% of U.S. economic output and drives 60% of world GDP or roughly a $44 trillion yearly addressable market opportunity. These are not opinions; they are well known facts. One of the most frequently asked questions in meetings that I have with clients is this:

“If the consumer drives the economy does that make the consumer a good investment only for strong economies and an avoid during slowing economies or recessions?” Given increased market volatility as a result of the Coronavirus and impeachment talks, I think it’s a great time to talk about the defensive characteristics offered through a consumer investment allocation.

Let’s face it, as consumers, we spend our money on “needs” and “wants.” In this blog post, let’s talk about the need’s portion of the consumer spending theme. I would describe a consumer need as a staple, but not as narrowly as the industry defines a staple. As consumers, there are a number of staples that we continue to consume in good times and bad. Let’s look into our monthly spending again and identify some of the spending categories that tend to be very predictable and stable:

- Cell phone bill – Think Verizon and AT&T

- Groceries – Think Kroger, Costco, Walmart

- Household products – Think Church & Dwight, Johnson & Johnson, Colgate, Clorox, Proctor & Gamble, and the Kimberly Clark and Company.

- Soft drinks – Think Coke, Pepsi, and Energy drinks like Monster Beverage

- Packaged foods & meats – Think Tyson Foods, General Mills, Mondelez, Hershey, and McCormick spices.

The above are the normal and well-known consumer staples. But as you know, people consume plenty of other staples, many of which are driven by our age and entertainment needs. That said, let’s add some extra staples of life to the analysis:

- Pharma – Think Pfizer & Merck.

- Managed healthcare – Think United Healthcare and Anthem.

- Medical devices – Think trauma and normal wear and tear of our limbs via Stryker & Abbott Labs

- Insurance – Think Progressive Insurance & Allstate

- Everyday essentials – Dollar Tree and Dollar General

- Discount apparel – Think TJX and Ross Stores

- Fast food – Think McDonalds, Yum Brands (KFC, Taco Bell, Pizza Hut, Habit Burger), and Coffee via Starbucks.

- Entertainment – Think movies, streaming and cable via Comcast, Disney

- Cell phones – Crazy thought but Apple is quite likely the most impressive consumer tech staple ever created.

- Utilities – Think Nextera the largest renewable energy brand in America.

- Personal storage facilities – Think Public Storage

- Waste removal – Think Waste Management

- Consumption supply chain – Think cell towers via American Tower, payroll via ADP, food distributors via Sysco.

As an allocator of capital, I think it’s important to remember that the stock market historically experiences drawdowns each year. Sometimes it’s easy to forget, particularly after a big up year like 2019. In fact, over a long period of time, the stock market’s average drawdown per year is roughly 14%. It never feels good, but it happens with regularity. As the market pulls back currently, just remember we had a significantly overbought and extended market that basically went straight up for many months in a row. It’s normal to have some “give back.” We now have a new worry in the wall of worry theme via the Coronavirus. Like SARS and others, this will likely blow over but in the short term, it can create more volatility that ultimately offers an attractive buying opportunity. Volatility is the friend of the long-term investor. I love that Warren Buffet quote. I generally favor offense over defense so long as the economy is attractive, and no recession is likely. That’s the situation we are currently in. We have low growth, low inflation, low rates, an accommodative Federal Reserve and easy central banks all over the world. That tends to be a decent environment for stocks.

If there’s a high degree of uncertainty and/or a recession more likely, the defensive brands tied to the staples of life offer a significant buffer to market volatility and a group I tend to turn to in times of high market stress. The defensive brands serving consumers have historically experienced less volatility and gone down less than the overall market. The typical investor portfolio holds stocks, bonds, cash and even alternative assets so when stocks are struggling, the bond and cash allocation tends to pull its weight disproportionately for a period of time. That’s what makes the staples of life a great compliment to the equity strategies you already have in the portfolio. Here’s three turbulent market environments and the corresponding return for the S&P 500 and the above basket of defensive brands (equal weighted):

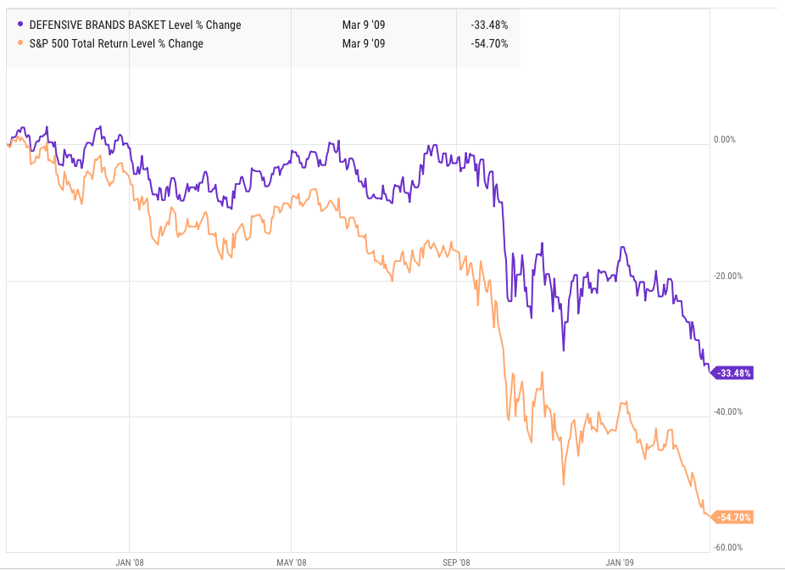

Time period #1:

Peak of the market 10/1/2007 to the generational low on March 9, 2009. The above defensive basket returns via this look-back was -33.4% versus the S&P 500 Index at -54.7%. When you add the bonds and potential cash allocation during the worst financial crisis of our lifetimes, the overall drawdown wouldn’t have been nearly as bad as the headlines indicated.

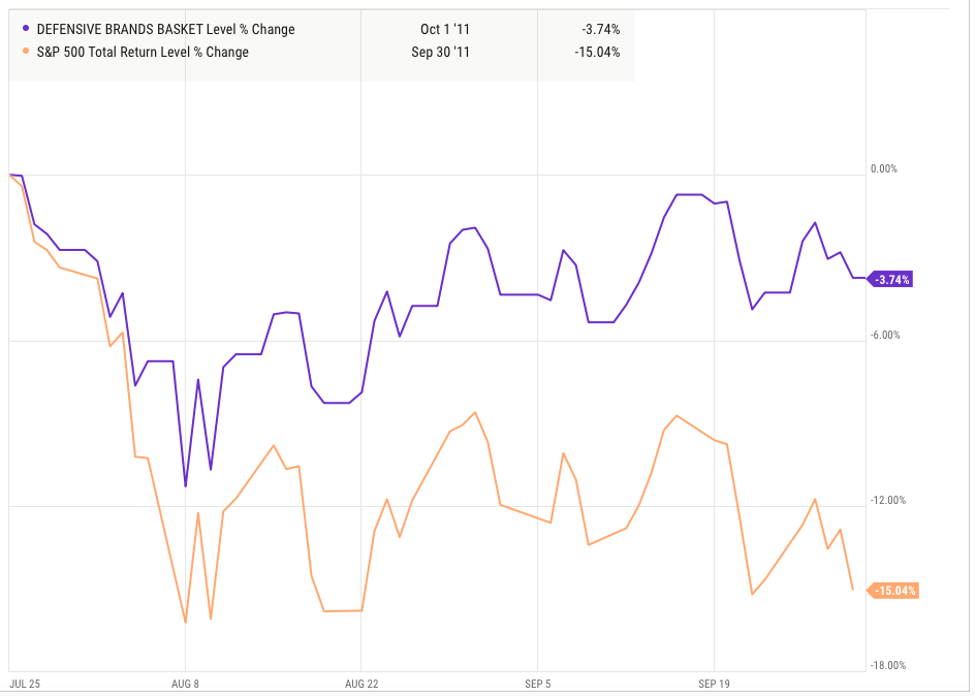

Time period #2:

European crisis and large correction between 7/25/2011 and 10/1/2011. The above defensive basket returns via this look-back was -3.7% versus the S&P 500 Index at -15%. Again, when you add the bonds and potential cash allocation during a crisis, the overall drawdown wouldn’t have been nearly as bad as the headlines indicated.

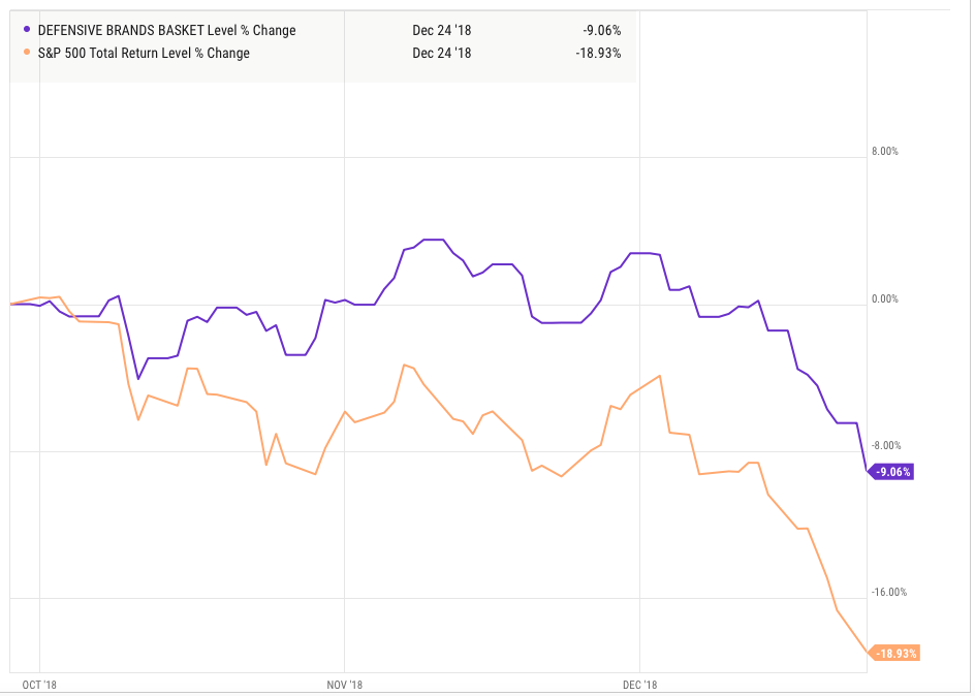

Time period #3:

The Fed hikes rates into an economic slowdown, while at the same time removing liquidity was the most recent big drawdown. From 9/30/18 to the bottom on 12/24/18, the above defensive basket returns via this look-back was -9% versus the S&P 500 Index at -18.9%. Yet again, when you add the bonds and potential cash allocation clients typically have from normal asset allocation, the overall drawdown wouldn’t have been nearly as bad as the headlines indicated.

Note: the source of all charts is Ycharts.com

Bottom Line:

Here are some bottom-line takeaway points to consider:

- From my former posts, we know the consumer discretionary stocks tend to outperform most other traditional sectors and the S&P 500 when the economy is performing well and out of recession. Since the stock market is higher ~80% of the time, having exposure to the “consumer wants” category seems smart.

- Exposure to the “consumer needs” or defensives offers a portfolio some volatility dampening during turbulent markets and recessions and works quite well with other defensive assets.

- Historically speaking, combining leading discretionary and the staples of life brands offers a portfolio strong balance in good times and bad so you can ride through a full market cycle without too much angst.

DISCLOSURE:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.