Let’s move away from the macro news this week and talk about something very important: Demographics. To illustrate this topic, let’s look at 1982 as a start date. Back then, Baby Boomers, the same average age as the Millennials are now, were working hard, and beginning to save and spend money. As they rolled through their earning, spending, and saving years, they had a dramatic impact on the markets they touched, including real estate, investments, and typical consumer goods. Boomers helped create the most robust and longest bull market in U.S. history. It was not an accident. Why? They were an enormous population group that acted very predictably, there were just more of them than past generations.

Fast forward to today, Millennials and Gen-Z are slightly bigger in size than the Boomers and are back-to-back generations. The read-through: if you enjoyed what Boomers did to the economy, you will likely really enjoy what the combo of Millennials and Gen-Z should do to it for the next 30 years. Keep in mind that each generation thinks and acts differently but make no mistake, they start working, saving, and spending as soon as they can. As an allocator of client capital, it’s hard to ignore this important driver of our economy inside an investment portfolio given its size and scope.

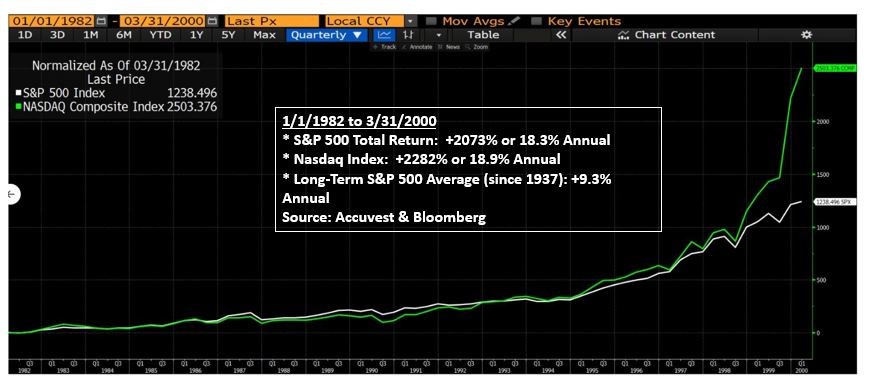

1982- March 2000 Secular Bull Market: It was the best of times.

The baby boomer led secular bull market returned about double the long-term average in stocks. Coincidence? I don’t think so.

There’s always going to be corrections along the way but please do not lose sight of the long-term opportunity of investing in the consumer spending theme, particularly when favorable demographics are present. What do you think will happen to spending beneficiaries (most relevant brands) when two demographic groups, larger in size than Baby Boomers, roll through a lifetime of spending in succession? I’m going to guess this back-to-back phenomenon plus the $30 trillion to $40 trillion in wealth that’s trickling down to younger people from older generations will create a secular bull market similar in size and scope. That is not a Disney ride you want to miss.

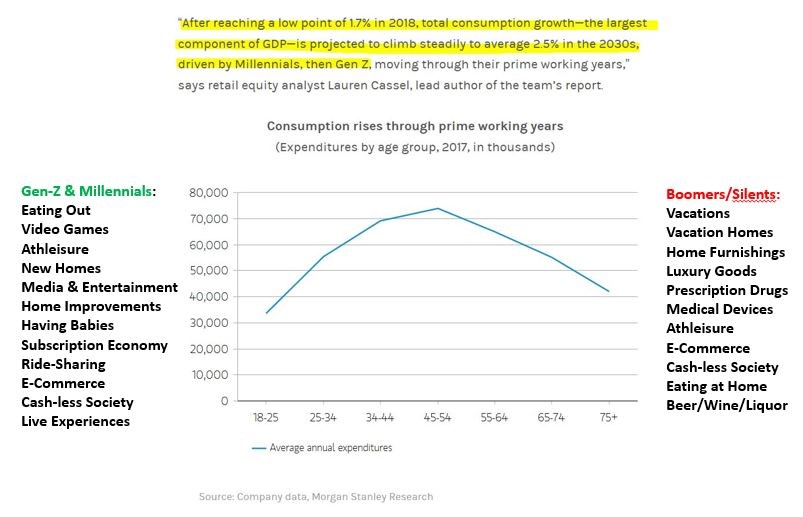

Let’s see if we can identify where the big secular winners will come from. As you can see from the Morgan Stanley graph below, consumption spending rises in a predictable fashion until our early 50’s when it peaks and begins to slow. Spending patterns are different across the demographic groups but if you identify how each group likes to spend and then identify which brands are the most relevant, you can gain some significant portfolio advantages. I’ve added some of the important consumption categories that each demographic tends to be focused on.

Brands that are Resonating Today

Since the largest opportunity comes from identifying the big trends driving Millennials and Gen-Z consumption, let’s talk about some key spending categories & brands that appear to be well positioned so long as they remain relevant.

Eating out:

- Chipotle, Shake Shack and McDonald’s continues to surprise people attractive store growth, same store sales growth, and/or higher profitability from utilizing technology in stores.

Video games:

Gamers are very fickle and the industry has gone through some growing pains but do not under-estimate youth cultures love for the gaming and e-sports phenomenon. Entire arenas are being built around the world to serve this fast-growing theme.

- Tencent, Nintendo, Sony, EA Sports, Take-Two Interactive

Athleisure:

- LuluLemon continues to impress.

- Nike and Adidas are well positioned in this important but fiercely competitive market.

Media & Entertainment:

- Netflix changed the game but now has significant competition. There’s room for everyone but these brands seem best positioned:

- Disney, Roku, Comcast (yes people still have cable), Spotify (music).

Home Improvements:

Make no mistake, the future for U.S. housing looks very bright from a demographic perspective. Here’s who we think will benefit most:

- Home Depot, Lowes (turnaround story), Sherwin Williams (paint & coatings), Lennar & DR Horton (builders of affordable housing in strong markets).

Brick-n-mortar retail and E-Commerce:

This is a category that I will spend more time on next week but here’s what our work shows from a brand relevancy perspective. Don’t get sucked into the “retail is dead” narrative, it’s hog-wash.

- Brick-n-mortar retail: People of all ages still like to go out and congregate in popular places. The winners in physical retail will be the brands that build experiential, interesting, and differentiated physical retail stores. Yes, that requires an investment and great planning but the rewards for getting it right will be enormous. These brands are currently resonating well: Walmart, Target, RH, Five Below, TJX, Ross Stores, Nordstrom, Nike, Adidas, LuluLemon, Canada Goose, Vans (VF Corp), Best Buy, T-Mobile, Ulta Beauty, Sephora (LVMH owner), Costco, Hasbro in other retailers. There are others but you get the point.

- E-Commerce is where the growth will continue, and it’s now driven by physical brands building enormous e-commerce businesses. The businesses that start with the customer and work their way back will continue to survive and thrive. Here’s some of the brands we think are particularly well positioned: RH.com, Etsy, Shopify (powers many brands’ online efforts), Nike, Adidas, LuluLemon, Estee Lauder, Booking.com (travel).

The cash-less society:

Between the hassle of frequent trips to the ATM with high bank fee’s, the ease of using a credit card with rewards points, and increasingly the convenience of scanning a QR code with our mobile phones, the use of physical cash is in significant decline. The addressable market opportunity is enormous around the globe but here’s a handful of great brands winning big: Visa, Mastercard, American Express, Square, Paypal, Alibaba, and Tencent.

DISCLOSURE:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors, companies or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts.