In the spirit of the holiday season, I would like everyone to repeat this stat a few times out loud: “Estimated holiday sales for 2019 are expected to be roughly $143 billion,” according to Adobe Analytics. Typically, holiday shopping begins in early November and runs through Christmas day; that’s a month and a half roughly with $140 billion plus in sales.

From an investment perspective, there is money going into asset classes that don’t have a $140 billion market opportunity for an entire year and yet the average investor’s portfolio is woefully underweight the consumer spending mega-trend. Just something to think about as you allocate your portfolio holdings for 2020.

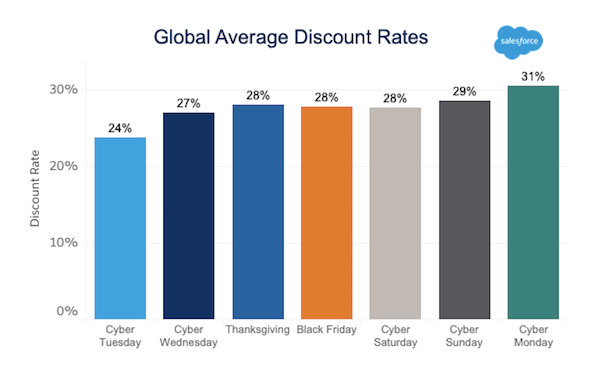

No matter the holiday shopping period, the one thing that’s consistent is increased sales. Cyber Monday delivered with the best deals this year, as indicated in the chart below.

Holiday Sales:

- Malls continue to struggle because most do not offer an attractive customer experience.

- Cyber Saturday-Monday & e-commerce continues to be the growth engine for retail spending.

- Black Friday & physical retail is not dead, it’s in transition.

The Mall is not what it used to be!

There are malls around the country that are thriving (Class A malls have doubled in value since 2008 and are valued at 2x that of Class B, C, D malls via Green Street Advisors) but the older the mall, the less interesting it is to today’s consumer. It’s really that simple. Every asset needs a facelift and a re-fresh over time. The malls that get it and also re-fresh their brand roster win, the laggards that keep irrelevant brands and avoid the mall facelift will continue to struggle and eventually go away. There is also another problem that still lingers: The U.S. still has too much retail space. We have more than five times the retail space than the UK and more than 2x that of all of Europe. Developers over-built from the mid 1990’s to the mid 200’s just as the economy was peaking. We should continue to see retail bankruptcies high for the foreseeable future which makes assessing “brand relevancy” imperative. This is the reason I created our Brand Relevancy Scoring System this year. This quant/qual system helps me see which brands are highly relevant and which are losing luster with consumers.

Cyber Saturday-Monday continues to be what consumers prefer

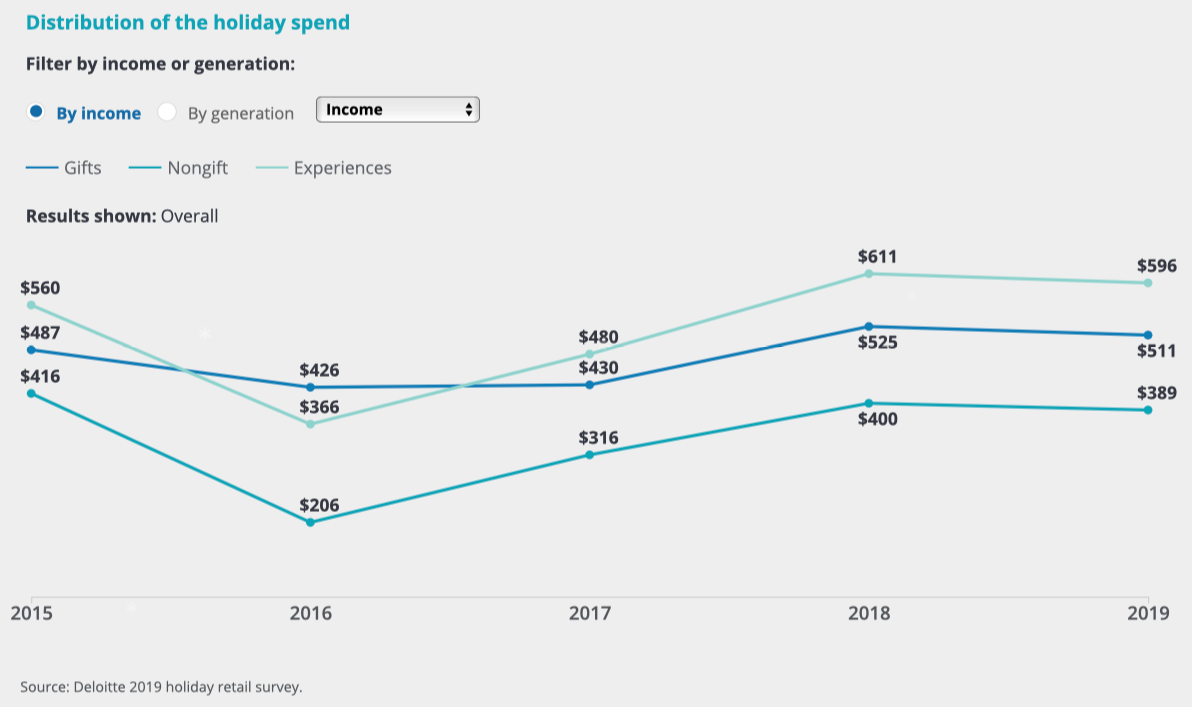

With our phones in hand, we read millions of product reviews, spent millions of hours on social websites getting product recommendations & reviews and shopped until we dropped. Deloitte recently released their holiday sales estimates and projects the average spending for the holidays per household to be $1,500 with 75% of total shoppers to spend as much or more as last year. The spending was evenly split between physical retail and e-commerce. Experiences over gifts remains the preference of consumers per the image below.

Cyber sales continue to rise

Just a reminder: Global E-Commerce is expected to be $4 trillion over the next 12 months and this is just the beginning (Deloitte projects >$20 trillion over the next 10 years) as global consumers continue to opt for convenience shopping online. Adobe Analytics projects Cyber sales hit roughly $9.4 billion between Saturday and Monday last week. Late night shoppers spent roughly $2.9 billion between 10:00 p.m. and 2:00 a.m., that’s commitment. So far, over $80 billion has been spent online since early November. Average purchase was +6% year over year. For retailers with >$1 billion in annual sales, the average days sales rose 540% year-over-year (YOY). For retailers with less than $50 million in sales, the average days sales rose 337% YOY. The most popular items bought online were: items for the home, fashion, toys, games like Monopoly and video games, health and wellness consumer tech (wearable fitness) and personal care items like cosmetics. The Brands that benefitted most: Amazon, Shopify, Best Buy, Target, to name a few. Other big winners: credit card brands Visa, Mastercard, American Express, Paypal and Square. As the price of things slightly rise over time as they mostly have, these card companies process higher transaction volumes making them wonderful inflation beneficiaries because they get paid on a percent of the total transaction price. Flat volume with a slight increase in prices equal higher transaction revenue.

Fun fact: Shopify is an e-commerce platform that enables any brand and retailer, large or small, to build a complete online and digital presence. They have >1 million retailers using the platform worldwide and in aggregate, Shopify is the third largest U.S. retailer behind Amazon and Walmart. Adobe projects the Shopify platform had 6million consumers buying from its global merchants which was +49% YOY. Total sales from its merchants over the week rose to $1.5 billion. I love Shopify and they are one of only a few brands that are competing well with Amazon. Everything they create is to help customers serve clients better. For a full write-up on Shopify, here’s a link: https://www.globalbrandsmatter.com/shopify-shop

Black Friday & physical retail:

Artificial intelligence behind the scenes continues to power the growth of e-commerce via logistics and delivery innovation.

Adobe Analytics tracks 4500 retail websites with 55 million SKU’s across 80 of the top 100 retailers. That is powerful data on sales, consumer behavior and retail trends. Black Friday sales are projected to be strong at $7.4 billion +20% YOY but still lower than e-commerce sales. The average purchase rose 6% YOY to roughly $168. The winners again were brands selling toys, video’s, video games, hardware associated to video games, apparel and consumer electronics. The physical stores that benefitted most are projected to be: Target, Walmart, Best Buy, Ulta Salon, Sephora, Lulu Lemon, Nordstrom, Dicks Sporting Goods, Gamestop, Apple, Van’s, to name a few. E-commerce on Black Friday again dominated sales over physical retail however.

The Bottom Line on Holiday Shopping

Let’s face it, holiday shopping is incredibly consistent and continues to highlight a healthy consumer economy here in the U.S. That said, e-commerce continues to experience the best growth with no evidence that will change anytime soon. Irrelevant brands will disappear over time which is why we track brand relevancy. In addition, physical malls that upgrade the experience and tenants according to brand relevancy will survive and thrive. The bottom line is that investing in global consumption offers a sound core allocation for investors.

DISCLOSURE:

This information was produced by and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.