Bailouts are the root cause of the dysfunction of capitalism and the demise of free markets.

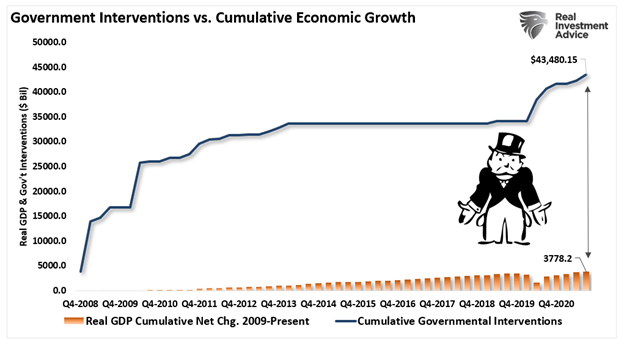

Over the last decade, the rise of wealth inequality and the failure of markets to function in a “fair manner” is apparent. We can directly attribute it to the influence of Central Banks and Governments.

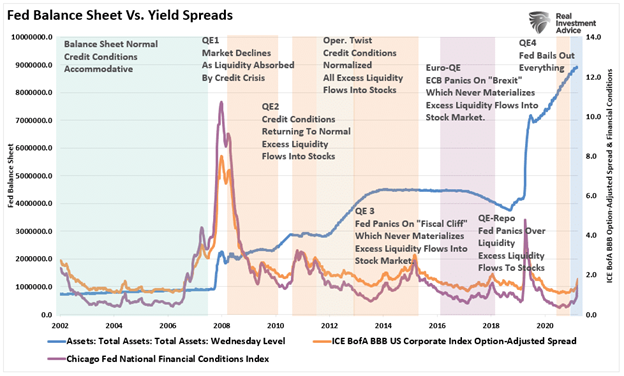

We talk much about the bailouts and stimulus programs related to the economic shutdown and pandemic. However, the bailouts began back in 2008 when the Federal Reserve intervened with the insolvency of Bear Stearns.

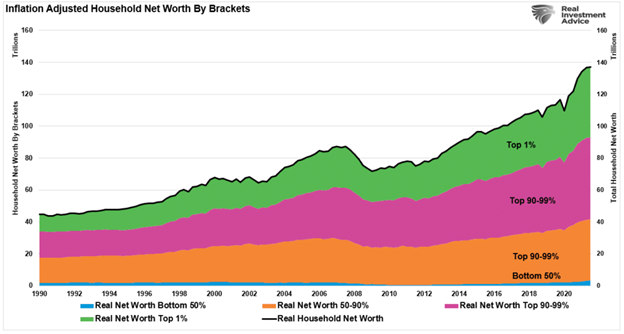

While these massive infusions kept the economy “afloat,” the realization of inequities between the financial system and everyone else led to a significant increase in social unrest. As shown by household net worth, such was the inevitable outcome as the wealth gap between the top 10% and the bottom 90% reached the tipping point.

Capitalism does not distribute wealth “evenly.” However, it historically provided “equal opportunity” for all to participate.

However, following the “financial crisis,” the evolution of “bailouts” perverted the capitalist system by eliminating the “Darwinistic” nature that made it function properly.

“Modern society looks increasingly to government for protection from major crises. Whether recessions, public-health disasters or, as today, a painful combination of both. Such rescues have their place. Few would deny that the Covid-19 pandemic called for dramatic intervention. But there is a downside to this reflex to intervene, which has become more automatic over the past four decades. Our growing intolerance for economic risk and loss is undermining the natural resilience of capitalism and now threatens its very survival.” – Ruchir Sharma

We can trace the problem directly to “SIFI’s.”

The Problem With SIFI’s

The 2008 “financial crisis” was the eventual result of allowing financial companies to take on too much leverage, debt, and risk. When interest rates rose and the economy slowed, defaults rose, leading to a tipping point where major financial institutions faced insolvency.

However, instead of allowing these financial institutions to go through the bankruptcy process (which is the very foundation of capitalism), the Federal Reserve, and Government, decided to spend billions of taxpayer dollars to “bailout” these institutions. Regulators felt that financial institutions were too deeply ingrained in the economy’s functioning. Or, as they put it: “Too big to fail.”

Such marked the rise of the “SIFI.”

“The 2010 Dodd-Frank Act established the Financial Stability Oversight Council (FSOC), giving it the authority to label banks and other financial institutions as SIFIs. The goal was to prevent a repeat of the 2008 financial crisis, which saw largely unregulated institutions such as American International Group Inc. require large taxpayer-funded bailouts.

Reasoning that financial contagion could originate in unexpected places, legislators created the FSOC to examine companies according to the risk posed by their size, financial position, business models, and interconnectedness to other areas of the economy.

The SIFI label imposes extra regulatory requirements and increased scrutiny. These include strict oversight by the Federal Reserve (Fed), higher capital requirements, periodic stress tests, and the need to produce ‘living wills’—plans to wind up operations without triggering a financial crisis or requiring a bailout.” – Investopedia

The Need For Recessions

While it was seemingly a good idea at the time, instead of diversifying the financial system, it concentrated it. Before 2008, the 5-major banks controlled about 40% of the banking sector. However, that swelled to nearly 60% following the financial crisis.

“Capitalism” should perform its “Darwinistic” process of eliminating the weak and letting the strong survive. However, regulators “rewarded” bad behavior instead.

Such was a point made in “Recessions Are A Good Thing.” To wit:

“Just as poor forest management leads to more wildfires, not allowing ‘creative destruction’ to occur in the economy leads to a financial system that is more prone to crises.

Given the structural fragility of the global economic and financial system, policymakers remain trapped in the process of trying to prevent recessions from occurring due to the extreme debt levels. Unfortunately, such one-sided thinking ultimately leads to skewed preferences and policymaking.

As such, the “boom and bust” cycles will continue to occur more frequently at the cost of increasing debt, more money printing, and increasing financial market instability.”

The problem now is that regulators, the Fed, and the Government believe they must avoid “recessions” at all costs.

The Rise Of Moral Hazard

Following the “financial crisis,” the Federal Reserve engaged in endless rounds of “monetary interventions” to keep the economy from recession. As we noted previously, this ongoing “support” for financial markets created a “moral hazard.”

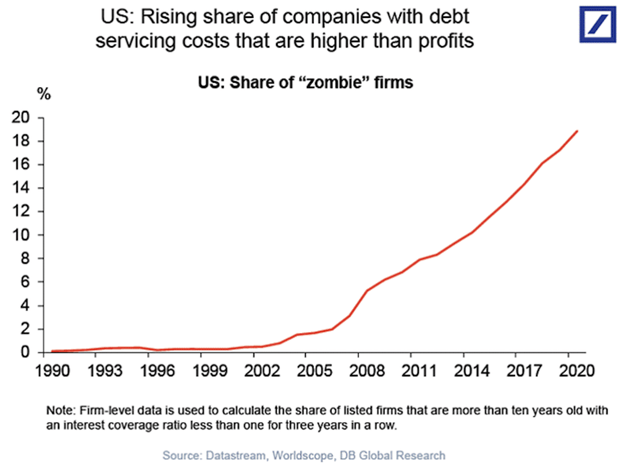

“This is a dangerous form of denial. A growing body of research shows that constant government stimulus has been a major contributor to many of modern capitalism’s most glaring ills. Easy money fuels the rise of giant firms and, along with crisis bailouts, keeps alive heavily indebted “zombie” firms at the expense of startups, which typically drive innovation. All of this leads to low productivity—the prime contributor to the slowdown in economic growth and a shrinking of the pie for everyone.” – Sharma

What exactly is the definition of “moral hazard?”

Noun – ECONOMICSThe lack of incentive to guard against risk where one is protected from its consequences, e.g., by insurance.

As Sharma notes, zombie companies depend on a speculative investment climate for bond issuance for their survival.

Everyone Gets A Bailout

In 2020, the Fed once again came to the rescue. Following the economic shutdown, the Fed “bailed out” companies to avoid failure. These were no longer “financial institutions” getting bailed out either, but companies like Boeing (BA) and Carnival Cruise Lines (CCL). These companies spent years using their capital and debt to execute “share buybacks” to enrich insiders. However, they ran to the Government for a bailout when they needed cash to survive.

Not only did banks and corporations get bailed out, but so did households. To keep individuals from defaulting on debt, direct checks and moratoriums on rent payments got implemented. The bailout of “everyone” was complete.

The problem with bailouts is that it destroys capitalism’s very basis, which is the “creation of opportunity.”

If capitalism were allowed to function, the weak players would fail. Stronger market players would acquire failed company assets. Bond-holders would receive some compensation for their debt holdings. Shareholders, who accepted the most risk, would get wiped out. Opportunities would then arise from the “void” created, and new players would have the chance to step in.

Furthermore, assuming capitalism was allowed to function, investors would require appropriate compensation for the risk when loaning money to companies. Such would provide higher returns to credit-related investors rather than the current state of abnormally low yields for junk-rated debt.

However, such has not been the case.

In the subsequent “bust,” we will bail out the “bad actors” once again. Such will suppress the opportunity created through “creative destruction.”

Here We Go Again

Not surprisingly, given the Fed created a “no-lose” environment for speculators and investors, the recent collapse in oil and Nickle has led to demands for more bailouts.

“The FT reported that Europe’s largest energy traders have joined the insolvent bank in calling on governments and central banks to provide “emergency” assistance to avert a cash crunch as sharp price moves triggered by the Ukraine crisis strain commodity markets.

The FT writes that in a letter it had seen, the European Federation of Energy Traders, a trade body that counts BP, Shell, and commodity traders Vitol and the margin-call stricken Trafigura as members, said the industry needed “time-limited emergency liquidity support to ensure that wholesale gas and power markets continued to function”. – Zerohedge

So, let me ask you a simple question.

“Whose fault is it that trades placed didn’t go the way you expected.”

Is that the bank’s fault? The Government’s fault? Or, is it the trader’s fault, and the firm, that made the bets in the first place.

If these firms have to meet “margin calls,” they might go into insolvency. At that point, one of several things would happen.

- Other traders would profit from the unwinding of the firms losing trades.

- Another firm would acquire the customers and orders of the failing firm.

- The firm would default to its lenders (who also took risks) and reorganize itself.

- Lenders become insolvent for taking on too much risk. They reorganize or become acquired by another firm.

- One, or all, of the associated firms, fail or get acquired or replaced by new firms.

Money does not get destroyed. It only changes hands from the weak to the strong.

Conclusion

“At the same time, easy money has juiced up the value of stocks, bonds and other financial assets, which benefits mainly the rich, inflaming social resentment over growing inequalities in income and wealth. It should not be surprising that millennials and Gen Z are growing disillusioned with this distorted form of capitalism and say that they prefer socialism. The irony is that the rising culture of government dependence is, in fact, a form of socialism—for the rich and powerful.” – Sharma

By not allowing the capitalistic process to operate, we only damage the long-term financial stability of the economy. The ongoing bailouts have destroyed the “free markets,” gave rise to wealth concentration, and promoted social unrest and socialistic demands.

There is no “pain-free” escape from the “debt hole” we have dug ourselves.

The continuous bailouts continue to distort the market’s price signals, making the markets less efficient in allocating capital. Such has led to the rising number of “zombies” and monopolies, widening wealth inequality, and lower productivity and growth.

The deformation of capitalism will be an economic plague that continues to lead to further dysfunction alienating younger generations. Social unrest and revolt will be the eventual result.

We can make choices today, which will be unpopular. Individuals will have to endure the short-term “pain.” However, it will be well worth the more robust economy tomorrow.

Or, you can wait until our creditors make those choices for us all at once.