Explore Catalyst Funds | Explore Rational Funds

Most investors intuitively understand the benefits of diversification, but due to a lack of familiarity and perceived complexity with other asset classes, many rely solely on stocks and bonds. As we’ve seen during recent market downturns, these two asset classes don’t always move independently, potentially undermining their ability to provide truly diversified returns.

In our recent report The Guide to Building a Risk Balanced Portfolio for Volatile Markets, we:

-

Introduce the liquid alternatives landscape

-

Explain how allocations to alts could have prevented downturns in past markets for some investors

-

Help investors understand how to diversify their portfolio using data-driven, time-tested approaches.

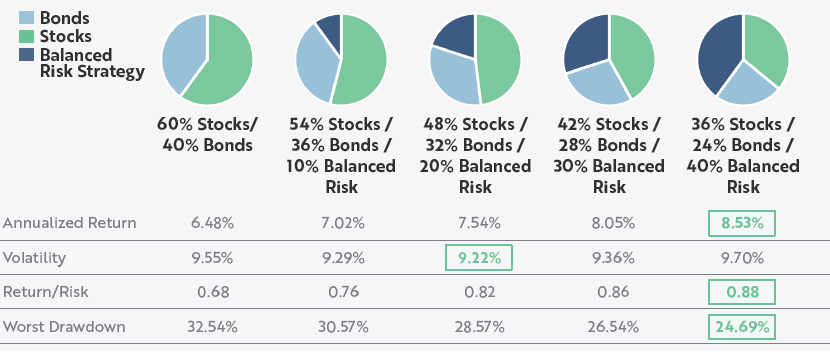

How Adding a Balanced Risk Strategy (Alternatives) Can Enhance a Portfolio

Data Source: Bloomberg LP and Catalyst Capital Advisors LLC. Based on monthly return data from 12/31/1999 to 12/31/2024. Stocks are represented by the S&P 500 TR Index; bonds are represented by the Bloomberg US Aggregate Bond Index; Balanced Risk Strategy is represented by 100% notional exposure to SG CTA Trend Index, 50% allocation to the S&P 500 and a 50% allocation to the Bloomberg US Short Treasury TR Index (to represent collateral for futures program). Rebalanced monthly. Past performance does not guarantee future results. See important disclosures at the end of this presentation, including with respect to the limitations inherent to hypothetical performance comparisons.

Data Source: Bloomberg LP and Catalyst Capital Advisors LLC. Based on monthly return data from 12/31/1999 to 12/31/2024. Stocks are represented by the S&P 500 TR Index; bonds are represented by the Bloomberg US Aggregate Bond Index; Balanced Risk Strategy is represented by 100% notional exposure to SG CTA Trend Index, 50% allocation to the S&P 500 and a 50% allocation to the Bloomberg US Short Treasury TR Index (to represent collateral for futures program). Rebalanced monthly. Past performance does not guarantee future results. See important disclosures at the end of this presentation, including with respect to the limitations inherent to hypothetical performance comparisons.