Key Points

- Apple is the largest company in the world by market cap and global consumers love the brand.

- The Apple ecosystem is so large, new product introductions can generate massive revenue.

- AirPods continue to drive outsized revenue gains and have significant opportunity to grow.

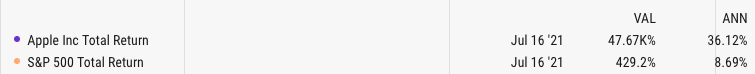

Source: Ycharts. Period assessed: the 20-year period of 7/19/2001 to 7/19/2021

Apple is the 800lb gorilla of Mega Brands

As a stock, Apple continues to be under-appreciated and under-owned by asset managers and individuals. It’s not a hyper growth stock that typical growth investors love to buy and it’s not a classic value stock that a deep value manager gets intrigued by. By every metric I can find, Apple’s stock is under-owned by investors, hedge funds and active mutual funds, yet it’s become the biggest stock on the planet and has compounded at roughly 36% a year for the last 20 years. That’s one of life’s biggest financial mysteries. As a comparison, the S&P 500 has compounded at roughly 8.7% per year over that same time period. I think it’s safe to say, the bulk of investors have not enjoyed the massive run Apple stock has had over the last few decades. When a business dominates the market it operates in, is heavily under-owned and continues to roll-out new, exciting and mass-market products, you have a continued opportunity to own a stock that’s not a crowded trade by any stretch. FYI, there aren’t many of these situations these days in my opinion.

As an investor dedicated to the global consumption theme, identifying Mega Brands is what drives our investment process. When you reach Mega Brand status, becoming a member of the $trillion club is typically an inevitability. As a reminder, here are the characteristics of companies that have the ability to join the $trillion club:

- Highly recognizable and relevant brand that consumers love.

- Global opportunities to sell their products and services on a recurring basis.

- Appeal to as many age cohorts as possible – kids to older adults is ideal.

- Produces products & services that are needed and loved in our everyday lives.

- Visionary management teams that are exceptional capital allocators.

The five key characteristics of Mega Brands above is an over-simplification but if you use this checklist to assess the companies you own, you will quickly realize the number of companies that meet all these criteria is quite small. Apple and a few other key Mega Brands have created an economic moat and recurring revenue flywheel few other companies will ever match. Because of that, Apple is likely the most important Consumer Staple every created.

Leading brands that dominate their categories should trade at a premium valuation. Hint: it does not trade at the premium valuation that’s warranted given its dominance in key consumption markets.

The Apple Eco-system is Large and Growing

If I told you a company worth over $2 trillion in market cap was still growing at scale you would probably laugh at me but it’s true. Apple, with the largest market cap on the planet is still able to grow revenues and free cash flow at a meaningful clip. When your quarterly revenue is roughly $90 billion, you have a significant opportunity to drive a meaningful wedge between you and your competitors. Look around your house, how many Apple products do you own and how loyal have you been over the years. In my house, we own two iPads, two iPhones, 2 MacBooks, one iMac, two sets of AirPods, we watch AppleTV, pay for iCloud, and all the accessories that we have to buy to use these great products. I know of no other companies in history that have been able to control my household wallet’s attention for as long as Apple has. Even as I write this blog, I can’t help but wonder if I own enough Apple myself and it’s a top position. Here’s just a sample of the most popular Apple products. Which ones do you own?

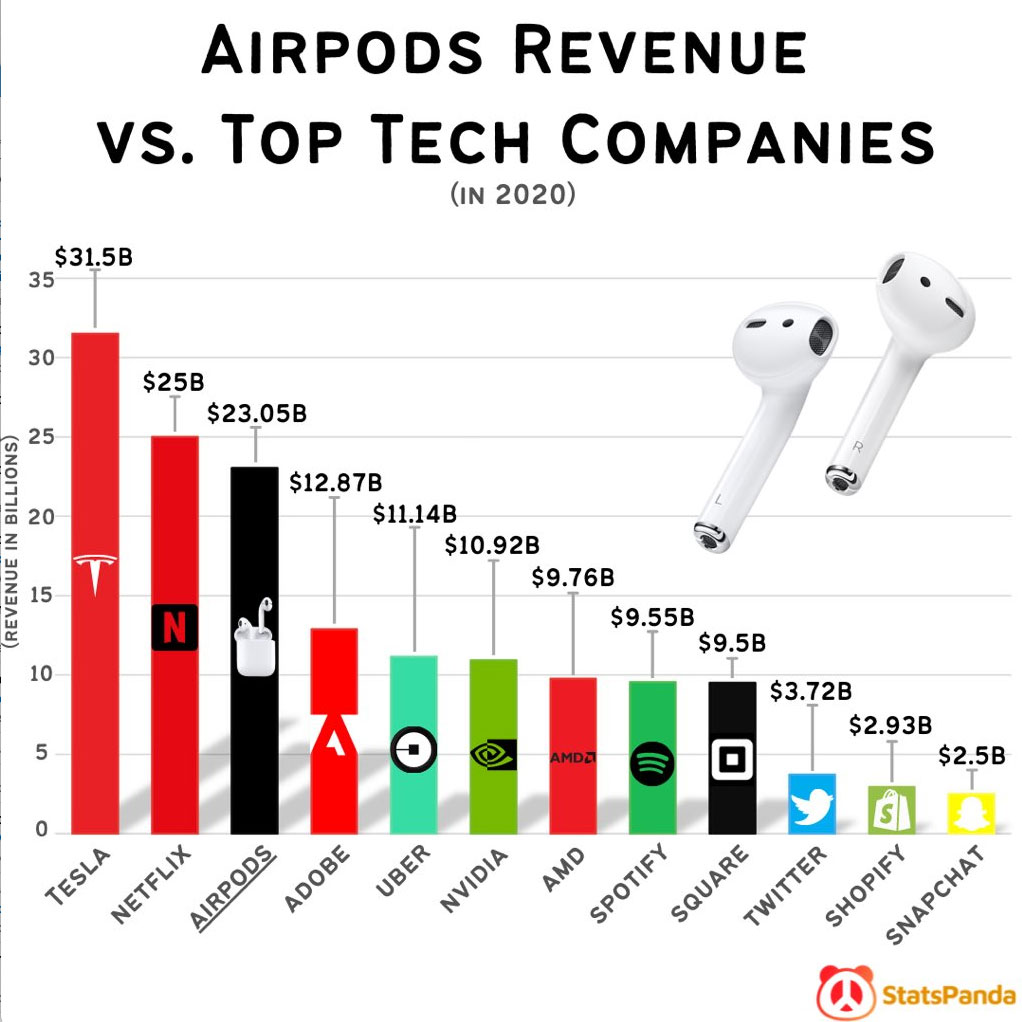

AirPods: A Massive Product Success

Everywhere I turn, I hear Apple has lost its innovation edge. When someone tells you that, run don’t walk away. The facts show a different story. Let’s use the Apple AirPods as an example. To date, Apple has sold over 100 million AirPods since the September 2016 launch. The revenue that’s been generated from this one product is already larger than the entire yearly revenue from many popular companies. Just sit on that for a minute. AirPods have generated more revenue for Apple than Netflix generated in all of 2021. Wireless earphones are not even a new innovation, they have been around for years. Apple just makes a better product and has the largest installed base to sell to. Between the sexy design, the eco-system loyalty, and the functionality built into the AirPods, this product has been a massive global success. With strong acoustic quality and one-touch functionality that’s integrated with Siri (Apples automated assistant), AirPods have become one of my most-used consumer electronic products.

I rarely leave home without them and use them daily for business and recreation. With just 100 million sold, there’s so much more opportunity for additional sales.

With over 1 billion iPhones active today, the opportunity for cross-selling other products and services is enormous as you can see from the above AirPods example. If Apple is the wheel, then each additional product are the spokes of the wheel. When all Apple products work together in harmony, they reinforce the power of the overall eco-system. And with a 92% loyalty & repeat purchase rate, Apple has the pricing power to charge a premium for its products. The eco-system is so vast and interconnected that once you enter the Apple hotel, you rarely leave. Is there any wonder Apple has a $2 trillion market cap?

AirTags: The next new thing for Apple?

Apple new AirTag’s offer consumers an easy way to keep track of their valuables. Because we all have lots of valuable items, the potential for Apple to sell multiple AirTag’s to each consumer is high. You can attach one to your keys, your kids school backpack or belt-buckle, put one in your mountain bike bag and even attach one to your dog’s collar. The potential is endless in my opinion and they are cheap enough at $29 each to be a very nice future revenue opportunity for Apple. Innovation doesn’t have to look like a space-craft when there’s high brand love.

Summary:

- Apple is the largest company in the world and it’s got more room to grow.

- Product innovation at Apple continues to deliver new, useful, and exciting products.

- AirPods as a single business line deliver more revenue than most other great companies.

Disclosure:

This information and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.