Leland Abrams, who serves as Chief Investment Officer for the investment manager Wynkoop LLC and a portfolio manager of a fixed income strategy at Catalyst, provides his analysis of the recent CPI data and its impact on future Fed policy below:

When looking at the markets on the day of the October CPI release (Nov. 14) vs. later in the week (Nov. 16), you’ll notice there’s been a big shift in thinking, with ZERO additional rate hikes priced in from the Federal Reserve, signaling their fight against inflation may be coming to an end. A June rate cut has actually been priced in, and there are signs that it’s inching even earlier.

Rate Hike Probability as of November 13, 2023

Source: Bloomberg

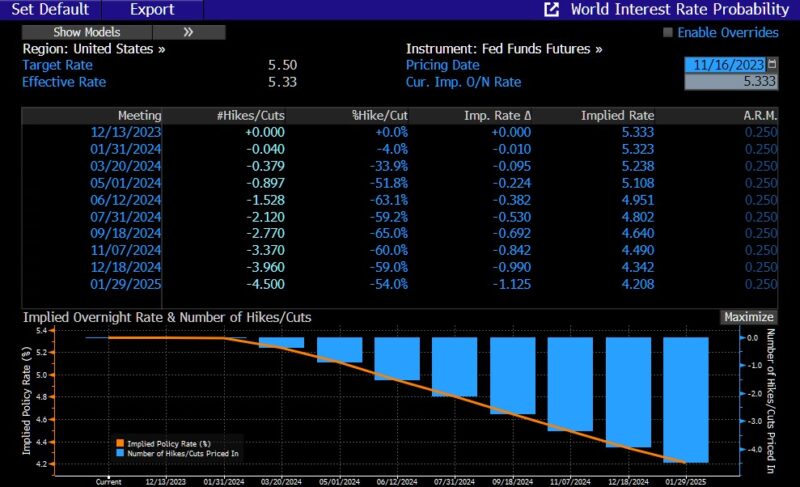

Rate Hike Probability as of November 16, 2023

Source: Bloomberg

As I foresaw in some prior pieces in 2023 regarding CPI, the housing data – which is one year old and makes up 40% of core inflation – is starting to roll. Now that this portion of the data is on a downward trajectory because of declining rents, the core should not see increases moving forward.

This thesis has also been discussed from Nick Timiraos of the Wall Street Journal, who is sometimes referred to as “the Fed Whisperer.”