Alternative Approach to Value Investing: Is it “Reflex” or “Novel”?

As the economy continues to recover with inflation increasing, many investors are starting to realize that the tech-fueled V-shaped recovery may have caused equity valuations to trade at a premium. This natural economic dynamic has not occurred in close to a decade, with growth stocks significantly outpacing their value counterparts. However, now may be the time for value.

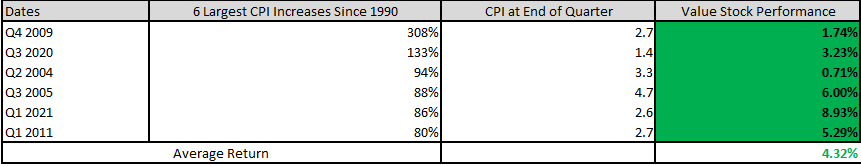

Historically, value stocks perform well during inflationary periods. Fundamentally, that makes sense as inflation creeps into the picture, investors, (like individual consumers), look for investments (or products) that display a low correlation to inflationary pressures. Whether that is a psychological expectation compared to other options (similar to relativity theory), an instance of rational opportunity cost calculations, or simple logic the same case holds, value stocks outperform growth stocks during times of inflation as described in COVID-19 Steps Down as the Market’s Biggest Domestic Threat: So What’s Next?. As seen below, the six largest consumer price index (CPI) percent increases (when the consumer price index was greater than 1) all coincided with positive returns from value stocks illustrated by an average quarterly return of 4.32%.

Value Stocks Perform Well During Inflationary Environments

Source: Catalyst Capital Advisors LLC 06/22/2021

Source: Catalyst Capital Advisors LLC 06/22/2021

As described in The “Great Rotation”: Is It Time For Value?, we discussed the rationale behind the aggressive shift to value stocks. More specifically, we discussed the unconventional interpretation of the current thematic environment. The unique characteristics of “the tragedy of the innovator,” which encompasses the idea that investors invested excessive amounts of capital in a short amount of time in disruptor companies, high growth companies, and speculative technologies fueled by a COVID-19 induced societal fast-forwarding, all created a situation where investor projections overshot their developmental infrastructures. Thus, this dynamic causes imbalance between expected returns and actual returns.

Some may ask, isn’t growth investing supposed to be based on grandiose projections?

In short, it is not an exact science. Many investors believe that growth stocks are the only way to capitalize on innovation, but that is not always the case, as this interpretation results from repetition, misinformation, and expectations. In many regards, there are numerous parallels to scientific findings that are viewed as a fact today when in actuality, it is more of a concrete assumption. For instance, Sherrington’s reflexology of the nervous system, figuratively and literally, is a tremendous scientific example to make parallel comparisons. Sometimes determinate calculus can illustrate the inevitable decision, reaction, or reflex of an investor on a particular economic situation, but other times determinate calculations are incomplete in determining an investor decision. Let me explain. Sherrington’s reflexology and the afferent arc are a “scientific truth” today, as taught in medical textbooks. However, many scientists in history, such as Graham Brown, Nikolai Bernstein, Paul Weiss, and Von Holtz, to name a few, challenged Sherrington’s sensory-to-motor linkage creating pockets “doubt”. The scientific “doubt” on behavioral determinism put forth by those contrarian scientists is comparable to the “doubt” that mathematics and technological advancements’ incorporation into a company’s balance sheet caste on the definition of Growth vs. Value investing. Growth continues to expound on the debated truth that innovation delivers long-term appreciation compared to value. Though this statement is true if the company declared a growth company actually follow-throughs on its projections (eliminating a “tragedy of the innovator” situation), this is not the only way to capitalize on technological advancements and R&D. Like Sherrington’s reflexology model, the concrete definition of growth investing only looks at the situation with one perspective without conceptualizing the “doubt” that modern advances have created in regard to the “true” intrinsic value calculations of equities. Therefore, let us uncover the true meaning of value investing.

Most importantly, we must highlight that value investing does not just mean investing in relatively cheap companies compared to their peer group using P/B, P/E, etc. That also would only be looking at the situation one-dimensionally. Instead, there are multiple ways to illustrate value stocks and the value investing approach.

To clarify, my definition of value stocks resides under two main categories:

- Per share Value (Thematic Value)

- Invested Capital Value

“Per-share value” or “thematic value” stocks are the traditional definitions of a value stock. A “thematic value” stock is an equity with a per-share price low relative to the company’s financial performance as measured by the company’s revenues, dividends, yield, earnings, and profit margins. Some of the critical characteristics of a “thematic value” stock are a lower than peer P/E ratio, the per-share price below peers, lower volatility than the broader stock market, and a higher probability of dividend payouts to stockholders. Collectively, these value stocks consist of established blue-chip companies with proven histories of financial performance geared to long-term investors who have the time to experience the appreciation.

On the other hand, a lesser-known type of value stocks, regularly confused with growth stocks, are the “invested capital value” stocks. An “invested capital value” stock can be either a “thematic value” stock or any other stock with an attractive “return margin” or “asset margin on invested capital. This is the percent return of R&D investment or intangible assets compared to the company’s cash from operations or current assets. This alternative way of uncovering “hidden” value stocks exploits conservative accounting biases and improper accounting documentation of intangible assets and forward-looking returns from R&D investments. Some may ask, well, that seems like a growth stock. That is why it is “hidden.” These types of value stocks, on the surface, seem like a growth stock, but fundamentally it is quite the opposite. This newly defined value stock is mispriced based on all cash flows’ “true” intrinsic value. These stocks, when properly accounting for R&D investments and intangible assets concerning fundamental financial performance, may display stocks that appear to be growth-oriented though have a per-share price (or are trading at a price) relatively low compared to the company’s “true” financial performance: thus, a value stock with growth-oriented “characteristics.” These stocks are often falsely interpreted as pure growth, overpriced, or poised for a pullback. Unfortunately, these “invested capital value” stocks fall victim to illegitimacy discounts and behavioral expectations that drive prices below their peer group’s performance despite attractive price per share value, dollar-for-dollar investment returns, robust financials, and “return margins”/”asset margins.”

In summary, two of the most important metrics to calculate the “true” instinct value of a company are the cash from operation and invested capital. Though debated, the basis of a good company can be argued to be the return on invested capital or success of their R&D investments as this may project the manageable growth of a company without falling victim to the disproportion between projections and developments (as described above) and the market share capture of competitors. Therefore, using a contemporary analysis, “invested capital value” stocks can be categorized into the value investing classification as the company has a future value that is unaccounted for through conservative accounting bias and the inconsistency of capitalizing and expensing these types of “assets.” On-going in-house research has started to conclude that specific ratios using cash from operations and invested capital accompanied with other behavioral investing techniques (insider buying) can uncover hidden value stocks that display growth-like returns.

Therefore, investors should conceptualize the case for unconventional value investing during the current macro environment. Inflation, the “Great Rotation,” a COVID-19 economic recovery, contemporary definitions of value stocks, and accounting limitations all create a unique opportunity for value investors. Despite the recent decade of value stock underperformance, value investing may be returning, but not by “reflex” rather with a new flavor. Thus, value stock in a growth wrapper may be the sweet spot to capitalize on technological advancements/innovation and the thematic outperformance of value investing during times of inflation.