Summer Surge

After a challenging July that saw investors sell off high-flying technology stocks, buyers returned to the market in August, bidding up risk assets across the board. Buoyed by a slew of tepid economic data, expectations for the Federal Reserve’s September interest rate cut rose to near certainty. This served as a catalyst for equities and bonds alike.

The month kicked off with the July jobs report, which came in at 114,000, significantly below expectations of 185,000 jobs, and a June report that saw 179,000 jobs added to the economy. The weak jobs number increased the unemployment rate to 4.3%, the highest level since October 2021.

The July Consumer Price Index (CPI) report confirmed perceptions of a cooling economy as inflation slowed to 2.9%, the lowest level since March 2021. The Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures Price Index (CPE), met expectations for an annual increase of 2.5% for the 12-month period ending in July. Core CPE, which excludes volatile food and energy prices, came in at 2.6% for the 12-month period, below expectations of 2.7%.

The bond market welcomed the progress on the inflation front, pushing the yield on the benchmark 10-year U.S. Treasury down from 4.0% at the end of July to 3.9% on the last trading day before Labor Day weekend (bond prices move inversely to yields).

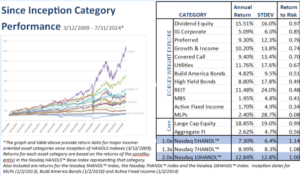

A rebound in technology stocks drove the Core Large Cap Equity category to a 1.6% gain in August. Meanwhile, the Core Fixed Income category gained 1.5% as bond prices benefitted from lower yields.

For the Nasdaq Dorsey Wright Explore portion of HANDLS Indexes, interest-rate-sensitive categories remained the big beneficiaries of declining interest rates. REITS and Utilities saw gains of 5.6% and 4.8%, respectively, for August. After a disastrous 2023 that saw significant losses, Utilities are now the top-performing category on a year-to-date basis with a return of 22.1%. As in July, MLPs were once again the worst performer, gaining 0.5% in August, but remain up 18.3% for the year.

HANDLS indexes delivered positive returns across the board in August:

- Nasdaq 5HANDL™ Index: 2.1%

- Nasdaq 7HANDL™ Index: 2.6% (1.3x leveraged)

- Nasdaq 10HANDL™ Index: 3.8% (2.0x leveraged)

Disclosure: Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved

Important Disclosure. HANDLS Indexes receives compensation in connection with licensing its indices to third parties. Any returns or performance provided within are for illustrative purposes only and do not demonstrate actual performance. Past performance is not a guarantee of future investment results. It is not possible to invest directly in an index. Exposure to an asset class is available through investable instruments based on an index. HANDLS Indexes does not sponsor, endorse, sell, promote or manage any investment fund or other vehicle that is offered by third parties and that seeks to provide an investment return based on the returns of any index. There is no assurance that investment products based on an index will accurately track index performance or provide positive investment returns. HANDLS Indexes is not an investment advisor, and HANDLS Indexes makes no representation regarding the advisability of investing in any such investment fund or other vehicle. A decision to invest in any such investment fund or other vehicle should not be made in reliance on any of the statements set forth in this document. Prospective investors are advised to make an investment in any such fund or other vehicle only after carefully considering the risks associated with investing in such funds, as detailed in an offering memorandum or similar document that is prepared by or on behalf of the issuer of the investment fund or other vehicle. Inclusion of a security within an index is not a recommendation by Indexes to buy, sell, or hold such security, nor is it considered to be investment advice. The information contained herein is intended for personal use only and should not be relied upon as the basis for the execution of a security trade. Investors are advised to consult with their broker or other financial representative to verify pricing information for any securities referenced herein. Neither Indexes nor any of its direct or indirect third-party data suppliers or their affiliates shall have any liability for the accuracy or completeness of the information contained herein, nor for any lost profits, indirect, special or consequential damages. Either Indexes or its direct or indirect third-party data suppliers or their affiliates have exclusive proprietary rights in any information contained herein. The information contained herein may not be used for any unauthorized purpose or redistributed without prior written approval from HANDLS Indexes. Copyright © 2024 by HANDLS Indexes. All rights reserved.