April Showers:

April extended the patterns of March with robust job growth and modestly higher-than-expected inflation, yet the outcomes for income investors were far less favorable. While March signaled gains, April proved challenging, culminating in widespread losses.

The month began on a positive note with the U.S. Bureau of Labor Statistics (BLS) announcing a substantial addition of 303,000 nonfarm jobs in March, surpassing the anticipated 200,000. This surge dropped the unemployment rate to 3.8%. However, accompanying inflation data from the BLS tempered this good news. The Consumer Price Index (CPI) for March indicated a 0.4% increase, with a year-over-year rise of 3.5%, both figures exceeding expectations by 0.1%. Even the Core CPI, which strips out volatile food and energy costs, nudged past forecasts, adding to the inflationary concerns.

Despite the economic slowdown, most companies in the S&P 500 reported positive first-quarter earnings. Over 75% of these companies exceeded earnings expectations. However, Starbucks was a notable exception, significantly missing on revenue and earnings, hinting at reduced discretionary spending among consumers.

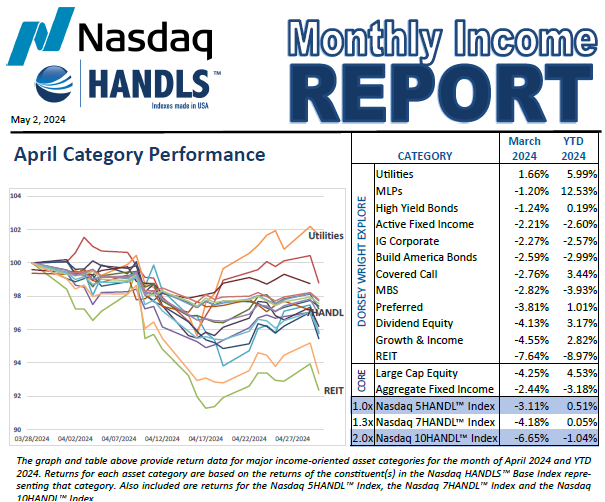

With no immediate relief from interest rates in sight, April saw a broad sell-off. The Core Large Cap Equity category dipped by 4.3%, with technology stocks particularly underperforming. Core Fixed Income assets also declined by 2.4%, driven by inflation-driven interest rate hikes.

Utilities stood out as the sole income-oriented category within the Nasdaq Dorsey Wright Explore portion of HANDLS Indexes to post gains, climbing 1.7% and bringing its year-to-date return to 6.0%. Conversely, REITs faced severe setbacks due to rising rates, plunging 7.6% in April alone, marking them as the poorest performers of the year with a -9.0% return.

The broader indices also reflected this downturn:

- Nasdaq 5HANDL™ Index: -3.1% for April

- Nasdaq 7 HANDL™ Index: -4.2% (1.3x leveraged)

- Nasdaq 10 HANDL™ Index: -6.7% (2.0x leveraged)

April’s market dynamics underscore a challenging landscape for investors, as inflation concerns and interest rate adjustments continue to dictate market movements.

April brought to light fears of stagflation, as the U.S. Department of Commerce reported a first-quarter GDP growth of only 1.6%—well below the projected 2.4%. Additionally, the personal consumption expenditures index (PCE), a key inflation gauge for the Federal Reserve, also reported higher-than-expected figures.

Disclosure: Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved

Important Disclosure. HANDLS Indexes receives compensation in connection with licensing its indices to third parties. Any returns or performance provided within are for illustrative purposes only and do not demonstrate actual performance. Past performance is not a guarantee of future investment results. It is not possible to invest directly in an index. Exposure to an asset class is available through investable instruments based on an index. HANDLS Indexes does not sponsor, endorse, sell, promote or manage any investment fund or other vehicle that is offered by third parties and that seeks to provide an investment return based on the returns of any index. There is no assurance that investment products based on an index will accurately track index performance or provide positive investment returns.

HANDLS Indexes is not an investment advisor, and HANDLS Indexes makes no representation regarding the advisability of investing in any such investment fund or other vehicle. A decision to invest in any such investment fund or other vehicle should not be made in reliance on any of the statements set forth in this document. Prospective investors are advised to make an investment in any such fund or other vehicle only after carefully considering the risks associated with investing in such funds, as detailed in an offering memorandum or similar document that is prepared by or on behalf of the issuer of the investment fund or other vehicle. Inclusion of a security within an index is not a recommendation by Indexes to buy, sell, or hold such security, nor is it considered to be investment advice. The information contained herein is intended for personal use only and should not be relied upon as the basis for the execution of a security trade. Investors are advised to consult with their broker or other financial representative to verify pricing information for any securities referenced herein. Neither Indexes nor any of its direct or indirect third-party data suppliers or their affiliates shall have any liability for the accuracy or completeness of the information contained herein, nor for any lost profits, indirect, special or consequential damages. Either Indexes or its direct or indirect third-party data suppliers or their affiliates have exclusive proprietary rights in any information contained herein. The information contained herein may not be used for any unauthorized purpose or redistributed without prior written approval from HANDLS Indexes. Copyright © 2024 by HANDLS Indexes. All rights reserved.