Key Summary:

- A basket of leading consumer-focused stocks has a significant long-term track record.

- When leaders lag for a trailing 3-year period, a mean reversion opportunity is presented.

- In the past, periods of 3-year underperformance were followed by outperformance.

Very Important thesis: If equities generate roughly 8-10% a year over time, leading brands serving the dominant driver of the economy, in theory, should compound at 13%+ over time. We have significant proof on this topic below. For a variety of reasons, the last few years has been difficult for the average stock. Betting against consumption-focused stocks after a below-average 3 years has been a poor investment decision. History is very clear on this topic.

Everyone Needs Exposure to Consumer Stocks.

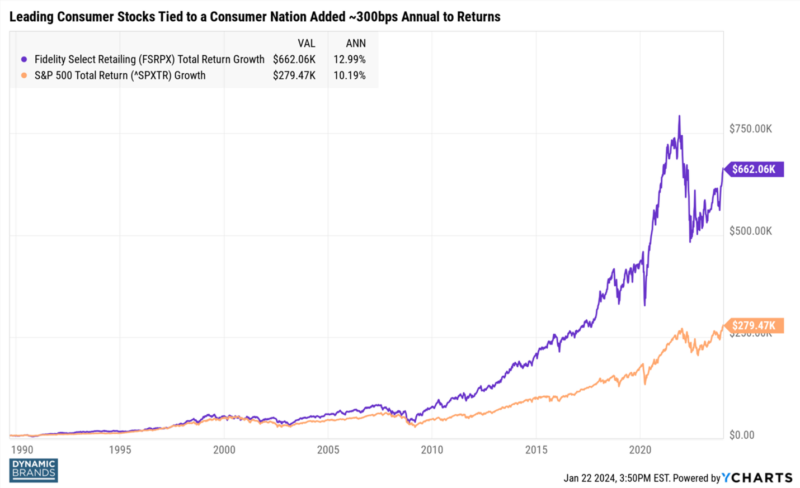

Everyone knows consumer spending drives the economy here and abroad. The thematic is a $50+ trillion annual market opportunity. Our team spends all our time identifying important spending categories and the most relevant brands within each category. In theory, a group of leading companies serving a very large and growing market should also be a solid investment opportunity. Testing this theory using a look-back of the actual performance of a basket of leading Consumer Discretionary brands offers some proof to this thesis. The image below shows the real-time performance of an active strategy dedicated to the Consumer Discretionary sector and is being used as the proxy for consumer spending investments. The graph illustrates a 38-year history (12/16/1985 to 12/31/2023) of having dedicated and highly concentrated, exposure to the retail sector. FYI, our approach to investing in the consumption theme is more broad-based and more “lifetime spending focused”, making it an ideal “core” versus satellite investment. Not surprisingly, the correlation between Dynamic Brands and the pure U.S. retail stock basket is quite high and utilizing both strategies in a portfolio has merit. To put the worthiness of having some dedication to the theme into terms we can all appreciate, let’s do it using a growth of $10,000 approach. Putting $10,000 into the retail proxy strategy on 12/16/1985 yielded a total return of ~$662K versus the same $10k investment into the S&P 500 return yielding ~$279k for an added benefit to investors of roughly $383,000. Letting time and compounding, and hopefully adding during the dips that always come, offered a wonderful boost to an investor’s retirement nest egg! Clearly holding a dedicated allocation to the consumer adds a lot of value to a portfolio.

Here’s Where it Gets Interesting. The Time to Buy is Now.

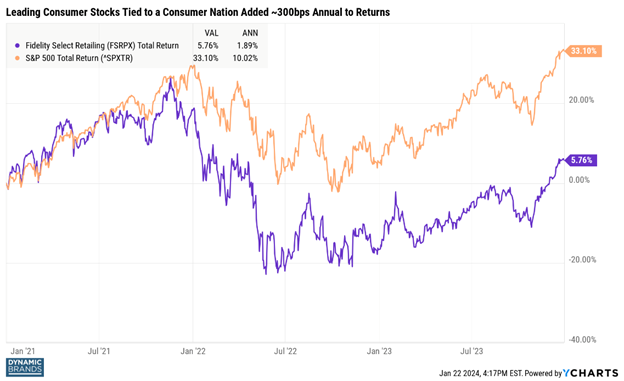

As investors, we know the equity markets don’t always go straight up. There’s short-term, catalyst-driven volatility, random corrections, recessions, and even pandemics that happen along the way. We also know, buying low and buying right, are key attributes of generating solid returns over time. Thus, adding to these positions when the basket of stocks is lagging over shorter periods of time is a commonsense approach. That’s where we are in 2024. Because of high inflation, steep interest rate moves, and the distortions that were created in the consumer sector because of the pandemic, consumer stocks have experienced one of those laggard periods. The good news: all these factors have been normalizing. This is the catalyst that should help the forward returns of consumer stocks to normalize as well. The graph below shows the latest 3-year period for consumer stocks, which is in sharp contrast to above average longer term returns for the sector. Investors now have an opportunity to either initiate a core position to the theme or add to their holdings while the returns have experienced a rare underperformance period.

Underperformance Tends to Be Followed by Outperformance.

Mean reversion is a wonderfully predictable theme. When an asset generally performs well and has offered excess returns over long periods of time, the asset gets very exciting as a recovery opportunity as mean reversion takes hold. It’s our view that the stellar 2023 returns were just the beginning. With wages strong, unemployment low and stable, inflation trending back to more normal levels, the Fed being less interested in holding back the economy, and consumer sentiment getting better, spending trends and consumer stocks are destined to get back to more normal times. Bonus: because of the difficult operating environment, leading brands have gotten leaner, and their operating metrics have re-set higher in many cases. The stocks of the best brands simply do not yet fully reflect the better operating environment ahead. To illustrate the mean reversion opportunity, I looked back at the history of our proxy retail stock strategy to see if there were other 3-year sub-par return periods.

Indeed, there was. Retail stocks annualized at +1.2% (similar to the last 3 years) between 2001-2003 and +0.75% between 2007-2009. What did the forward returns look like? Obviously, this is just an illustration, and the future doesn’t have to look like the past, but we know it rhymes.

Strong Returns Were Generated Across Consumer Sectors.

2004-2006:

The forward 3-year period for the consumer & retail basket annualized at +12.74% versus the S&P 500 Index at +10.45% for ~229bps of annualized outperformance. The returns would have been even better if you added to your position after the initial 3-year lagging period.

2010-2012:

The forward 3-year period for the consumer & retail basket annualized at +18.2% versus the S&P 500 Index at +10.8% for ~740bps of annualized outperformance. Imagine what the return would have been if the investor bought more of a great asset on sale and let the compounding effect work for them.

BRANDS MATTER.

Disclosure: The above data is for illustrative purposes only. The retail fund used in this illustration is simply being used as a proxy for the merits of the theme and to highlight the potential opportunity for investors. This fund is highly concentrated in a few mega cap brands and can be very volatile but has shown merit for investors. The Dynamic Brands fund and it’s track record are highly correlated to the retail fund making this analysis pertinent and relevant. Not every great brand is always a great investment but over time, the leading brands with high brand relevancy have generated outsized returns for investors. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.