Key Summary:

- Generally, the consumer has been resilient, is still spending, and favoring deals.

- Consumer sentiment has further room to recover, which should drive stable spending.

- Attractive wages and growth, job opportunities and better sentiment is expected.

Important thesis: If equities generate roughly 8-10% a year over time, the leaders of industry should, in theory, compound at 13%+ over time. We have significant proof on this topic where top brands are concerned. For a variety of reasons, the last few years has been difficult for the average stock. Betting against consumption-focused stocks after a poor two-year period has been a poor investment decision. We see massive opportunity across the consumption landscape as great companies play catch-up to reach more typical annualized return metrics.

2024: The State of the Consumer

As we begin 2024, the state of the consumer is a great place to start with these notes. As dedicated consumer spending-focused investors, the state of the consumer is an important variable to understand. Spending is in every consumer’s DNA, so we have an important advantage when we understand the state of the consumer. With that in mind, I thought we could speed-date through a handful of important charts from Goldman Sachs Research where consumer data is concerned. Spoiler alert: there’s a wonderful rate of change opportunity looking forward.

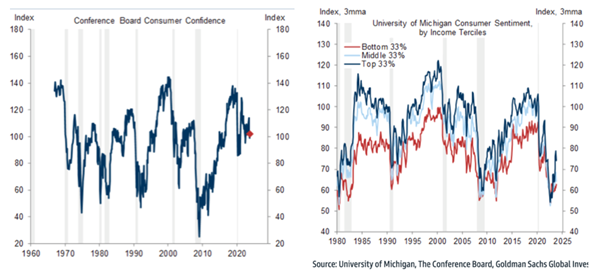

Consumer Confidence:

Confidence is key to consumer behavior. For the last 2 years, consumer spending has stayed relatively strong, but the spending was not broad based, and it was “save money” and/or “I just have to have this product or service” focused. The charts below highlight, consumer confidence still has a long way to go to improve back to normal levels. As that occurs, consumer spending will accelerate as it always does. For lower income consumers, sentiment is as bad as it ever gets. Even top earners have sentiment that can and should vastly improve.

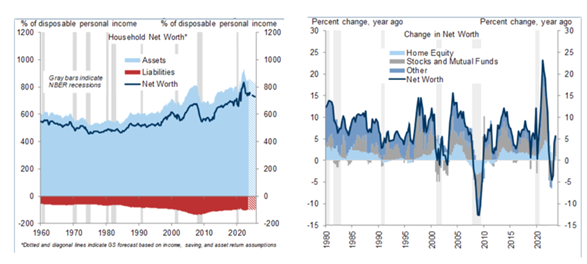

Wealth Effect:

Home prices have remained generally stable. Stocks and bonds have largely recovered from 2022’s drubbing, and overall net worth has risen back to “normal” levels that tend to correspond to higher consumer sentiment. Liabilities are still generally stable as assets remain high. The wealth effect is a tailwind for the first time in a few years.

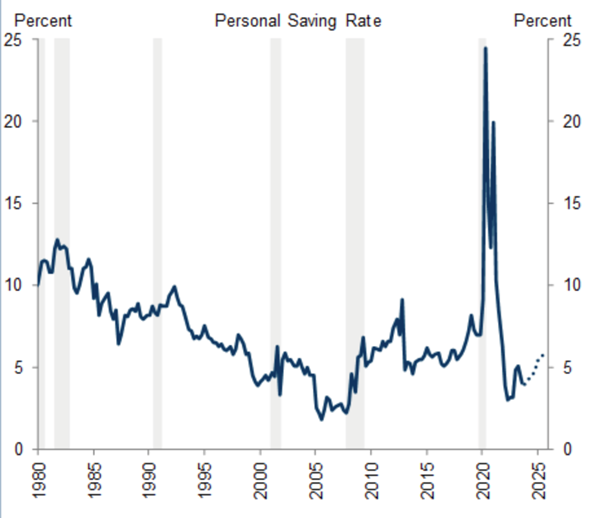

Savings:

The savings rate went parabolic in 2020, fell dramatically & then reverted to more normal levels in 2022. We are now beginning to build savings again. Consumers, generally, are in recovery mode after a wild 3 years.

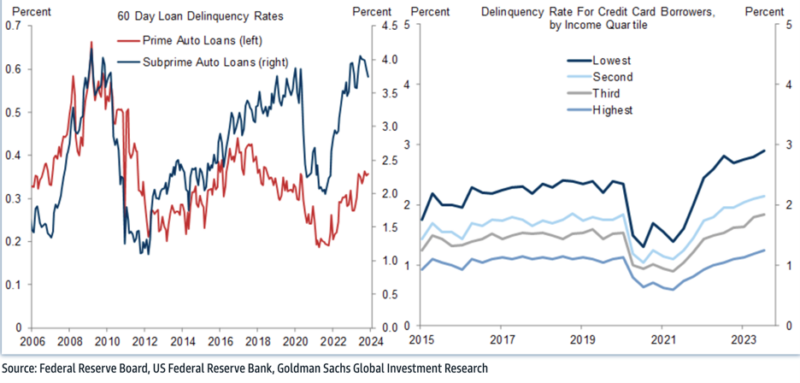

Delinquency Rates:

There’s been a lot of chatter about consumer credit issues building into 2024 (autos and credit cards). The below data shows that’s partially true and not unexpected given the pressure the average consumer has been under for the last few years. Widen the lens a bit, and one realizes, generally, the data is rising off a very low base and within normal ranges. With the prices of certain products/services likely to stay elevated for longer, it would not be surprising to see a further rise in delinquencies in the lower income cohort. This is a key reason part of our investment portfolio is catered to the theme of “trade-down” purchases.

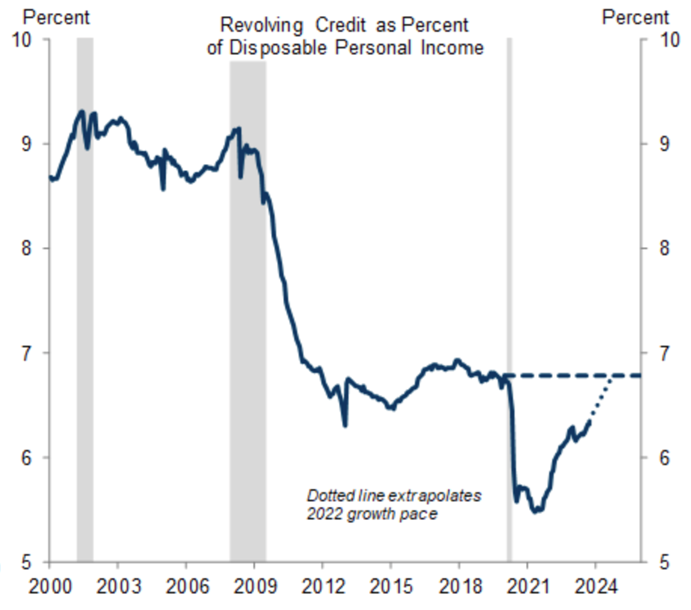

Revolving Credit as a percent of Disposable Income:

Again, over the last 2 years, consumers have been taking on revolving credit, likely to help navigate higher prices. But widen the lens, and you see just how low, versus history, the use of revolving sources of credit really is. Remember, after 2008/2009, consumers experienced a massive de-leveraging that has helped them be much more financially healthy ever since. We are simply getting back to the normal levels since 2012.

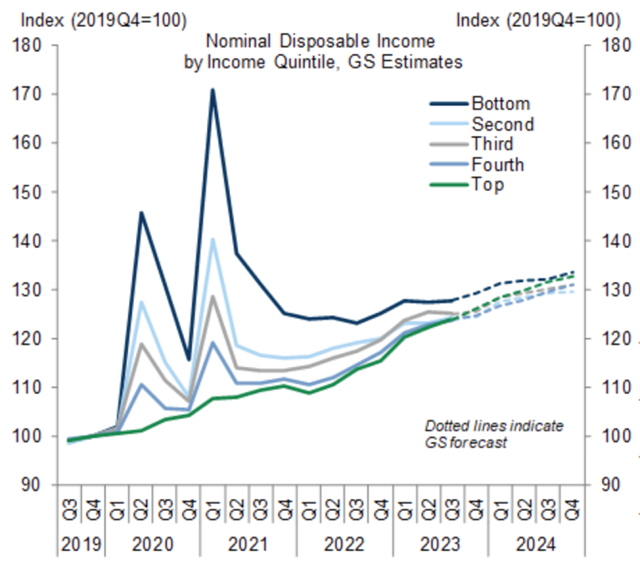

Income & Wages:

Wage growth has continued to be strong. This feeds into disposable income which feeds into consumer spending growth, which ultimately feeds into corporate earnings. Nothing bad to see here.

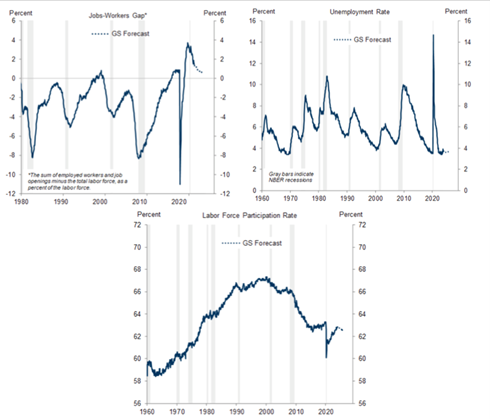

Employment, Worker Shortages, Labor Participation:

I have talked about the skilled labor shortages many times, this will likely continue to keep wages higher and job availability attractive. There’s also a shortage of workers in unskilled labor and within the trades. This likely keeps this portion of the inflation data elevated for longer. People making more money generally corresponds well with spending more money.

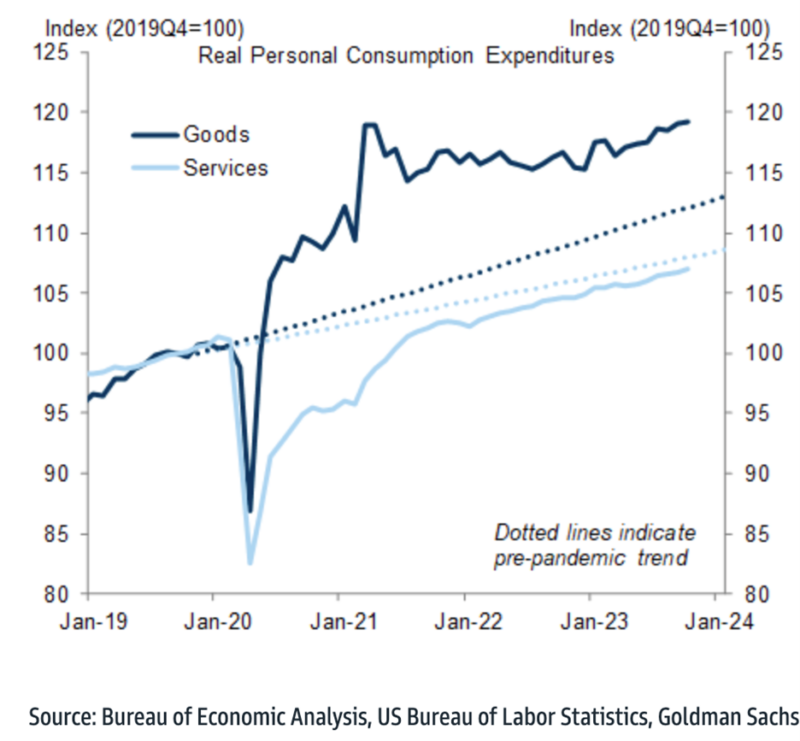

Goods Versus Services in Personal Consumption:

Generally speaking, our team favors the service economy more than the goods economy today. As the chart below shows, consumer spending on services is still trading below the long-term trend while good spending is still elevated.

Disclosure: The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.