Key Summary:

- Uncertainty drives market volatility.

- Volatility can create wonderful trading gains.

- Active trading can add significant value to long-term, buy-hold portfolios.

Important thesis: Buying leading companies operating in vital consumer spending industries is a timeless investment approach. Being opportunistic and buying these great assets when the market puts them on sale (like today) allows your recovery time to shorten. Making volatility your friend not your enemy, can add even more value to your long-term retirement nest-egg.

Our Topic Today: Managing Volatility in a Portfolio.

I speak to a lot of advisors on a weekly basis. For the bulk of the last year and a half, our conversations tended to go like this (sound familiar?):

- “What’s your view of equities today?” Answer: cautious at best.

- “What has you worried?” So many things: Interest rates, the Fed, $30T in debt, politicians, corporate earnings, the consumer, inflation, an imminent recession to name a few.

- “How have you expressed your cautious views in client portfolio’s?” Holding some cash, adding to bonds, private credit and other alternatives, being defensive in equities.

- “Yes, there’s clearly a lot to worry about. What happens to markets when there’s high uncertainty?” They get more volatile.

- “What tends to be an opportunity when asset prices are volatile?” Cash? I don’t know.

Answer: Active trading.

- “Do you do any trading around the core portfolio when the opportunities exist?” Definitely not.

- “Should you have some exposure to strategies that have active trading as a core part of the investment process?”

- “Definitely but does anyone trade anymore? I thought everyone was buy-hold?”

Answer: Let’s talk about the benefits of a Dynamic approach to managing equities.

Intuitively, we all know paying too much attention to the media and acting on what they are recommending tends to add very little value to portfolios. Unfortunately, our clients get bombarded daily with nothing but scary, bearish narratives. They make us glued to the screen so the media company can monetize our fear. When they worry, they force us to hold less exposure than we might otherwise want as contrarians.

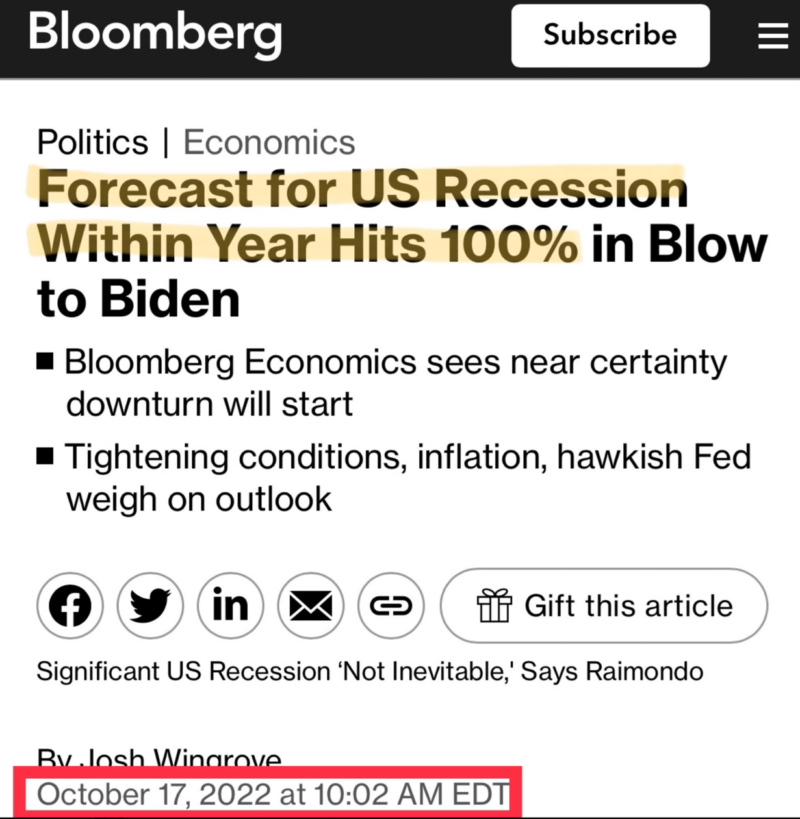

Case in point: last October. Virtually every asset class struggled mightily in 2022 as the Fed hiked rates aggressively and inflation ran at 50-year highs. In October, as markets were incredibly oversold, more and more investors couldn’t take the drawdowns any longer and decided to raise more cash. I traded stocks for a living for 7 years and one of my rules was: “if markets are in a bear phase and you just can’t take it anymore, wait 3 days.” Why? Because with an alarming track record, when I finally was ready to capitulate and go to cash, the selling was typically done and being a more aggressive buyer was the proper, money-making decision. Here’s a great Bloomberg headline literally at the October lows last year. Lots of people felt the same way and that emotion was absolutely a terrible decision for your portfolio.

Volatility is the friend of long-term portfolios.

Reality: very few advisors have any exposure to strategies that are designed to take advantage of short-term volatility swings. That forces portfolios to be anchored to the buy-hold-hope mentality. Over the long-term, that approach has worked well as equities tended to be positive on a calendar year basis 80% of the time and are up roughly 8-10% a year over time. But in shorter periods of time, bouts of volatility can deliver client heartburn and divert their attention away from the long-term goals.

- 1: don’t let daily market VOL change how you feel daily, it’s just noise.

- 2: be willing to take advantage of daily volatility buy building bigger positions for the long-term.

- 3: if you are unwilling or not capable of taking advantage of short-term VOL, hire a few managers who have a successful history of benefitting during these periods.

Bottom Line:

Investors should expect to see continued bouts of volatility across equities, fixed income, commodities, and currencies. The more uncertainty we have, the more frequent the volatility spasms will be. Don’t be afraid of the VOL, embrace it by implementing some strategies that love operating in a higher VOL regime. Our team can help.

Disclosure: The above report is a hypothetical illustration of the benefits of using a 3-pronged approach to portfolio management. The data is for illustrative purposes only and hindsight is a key driver of the analysis. The illustration is simply meant to highlight the potential value of building a consumption focused core portfolio using leading companies (brands) as the proxy investment for the consumption theme. This information was produced by Accuvest and the opinions expressed are those of the author as of the date of writing and are subject to change. Any research is based on the author’s proprietary research and analysis of global markets and investing. The information and/or analysis presented have been compiled or arrived at from sources believed to be reliable, however the author does not make any representation as their accuracy or completeness and does not accept liability for any loss arising from the use hereof. Some internally generated information may be considered theoretical in nature and is subject to inherent limitations associated therein. There are no material changes to the conditions, objectives or investment strategies of the model portfolios for the period portrayed. Any sectors or allocations referenced may or may not be represented in portfolios managed by the author, and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that any investments in sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. The use of tools cannot guarantee performance. The charts depicted within this presentation are for illustrative purposes only and are not indicative of future performance. Past performance is no guarantee of future results.